Investor Jeremy Grantham who has been warning of a 'superbubble' says it is yet to pop despite turbulence in the stock market this year.

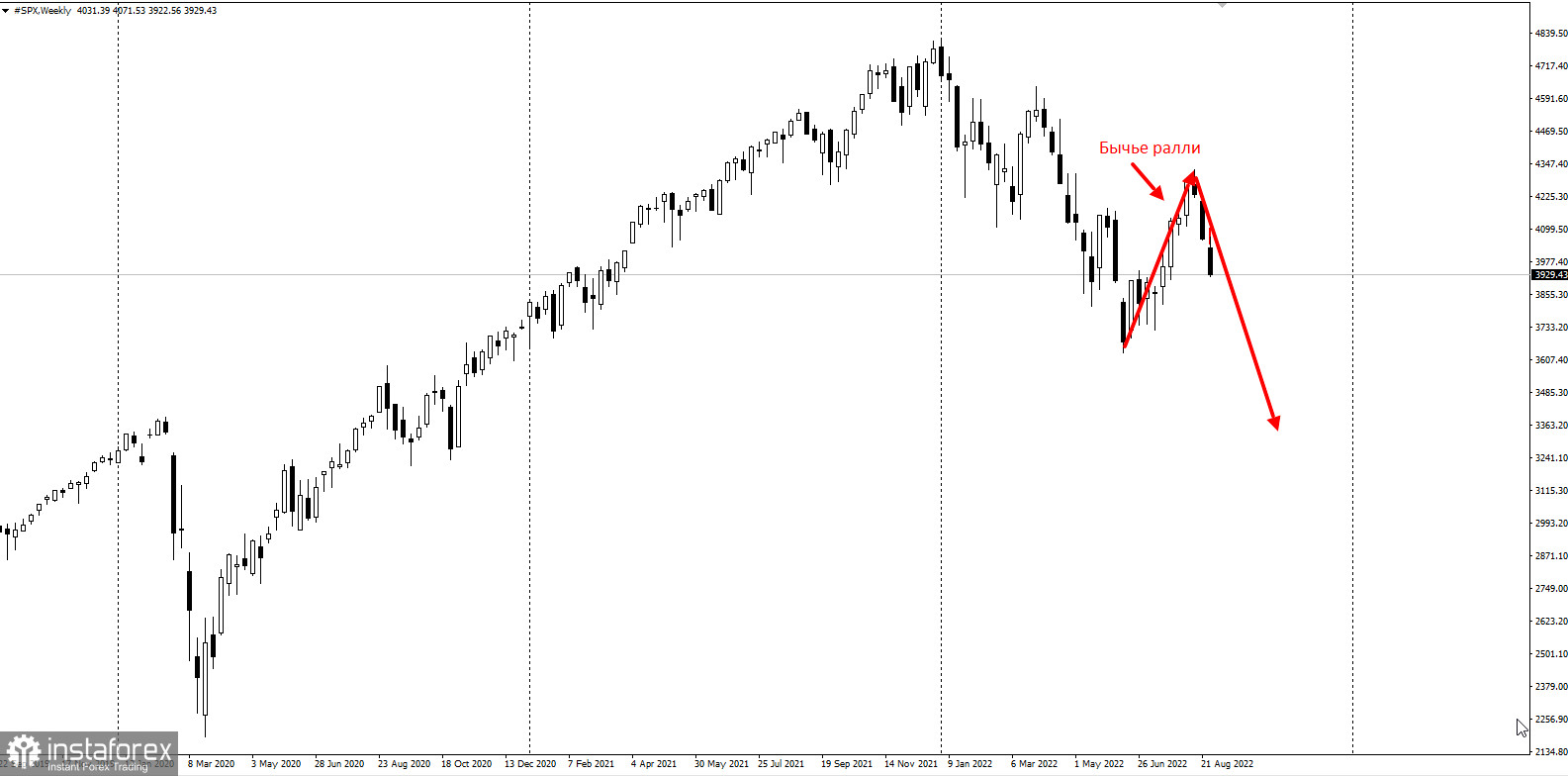

The co-founder of Boston Asset manager GMO said on Wednesday in a research note that growth in the US stock market from mid-June to mid-August is in line with a rally in a bear market, which usually takes place after a sharp fall. The 83-year-old investor reckons that "the current superbubble features an unprecedentedly dangerous mix of cross-asset overvaluation [...], commodity shock, and Fed hawkishness."

At the beginning of the year, Grantham predicted that underlying stocks would collapse by nearly 50%. The S&P 500 fell by 25% from its January peak in June. The index soared in the following two months. Nevertheless, US stocks have now been bearish for the fourth straight session. Well-known strategists, like Mike Wilson for Morgan Stanley, warn investors that the market is yet to bottom.

"You had a typical bear market rally the other day and people were saying, 'Oh, it's a new bull market," Grantham said in the research note. "That is nonsense."

"First, the bubble forms; second, a setback occurs, as it just did in the first half of this year, when some wrinkle in the economic or political environment causes investors to realize that perfection will, after all, not last forever, and valuations take a half-step back. Then there is what we have just seen—the bear market rally. Fourth and finally, fundamentals deteriorate and the market declines to a low."

Grantham is known for having predicted Japan's asset price bubble in the 1980s, the dot-com bubble, and the US housing bubble that came before the 2008 financial crisis. Some of his other bearish warnings have been wrong, or at least premature.

He mentioned some other short-term issues, such as the impact of the Russia-Ukraine conflict on food and energy crises in Europe, monetary tightening, and China's ongoing Covid woes. He also pinpointed how rising inflation was driving the stock market down in the first half of the year, and elaborated on how falling corporate profit margins would lead to new losses.

"My bet is that we're going to have a fairly tough time of it economically and financially before this is washed through the system," Grantham said. "What I don't know is: Does that get out of hand like it did in the '30s, is it pretty well contained as it was in 2000, or is it somewhere in the middle?"