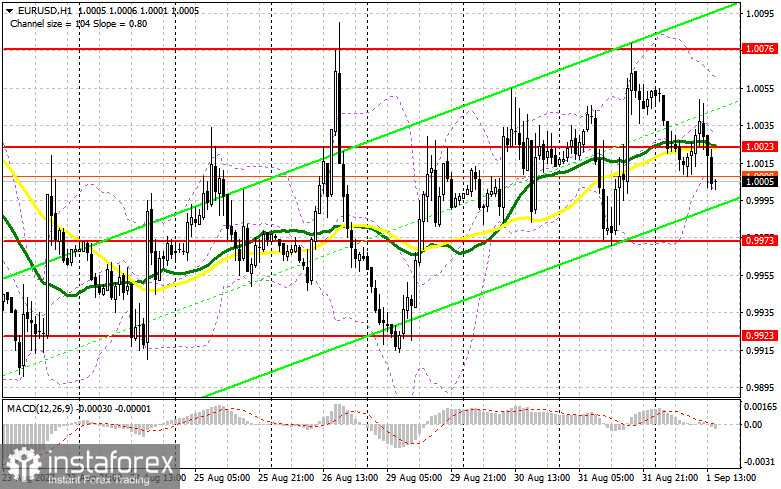

In the morning article, I highlighted the level of 1.0030 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. A breakout and a downward test of 1.0030 gave an excellent buy signal in the continuation of the bullish trend. However, it was undermined by the weak Manufacturing PMI data. So, I had to close Stop Loss orders. After a small jump up by 10 pips, the pressure on the pair returned. For the afternoon, the technical outlook has changed slightly.

What is needed to open long positions on EUR/USD

The US is going to unveil the ISM manufacturing PMI Index and the weekly initial jobless claims report today. If the Manufacturing PMI Index drops, it may adversely affect the US dollar. The euro, on the contrary, will recover. If the figure turns out to be better than economists' forecasts, the pair could decline to the nearest support level of 0.9973. I recommend making decisions on entering the market with this level in focus. A false breakout of this level will provide a good buy signal. The pair is likely to grow to the weekly high of 1.0076. A breakout and a downward test of this level will force bears to close their Stop Loss orders. Traders will be more willing to buy the pair above the parity level. If so, a correction to 1.0127 may occur. A more distant target will be the resistance level of 1.0155 where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 0.9973 in the afternoon, the pressure on the pair will escalate. The pair is moving near the upper border of the ascending corridor formed on August 23. It would be wise to open long positions if a false breakout near the low of 0.9923 takes place. You can buy EUR/USD immediately at a bounce from 0.9861 or a low of 0.9819 near the parity level, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

The main task of bears today is to protect the nearest resistance level of 1.0023. The pair managed to consolidate above this level for a short period of time in the morning. The speech of Fed policymaker Raphael Bostic may impact the trajectory of the pair. He is expected to express hawkish comments like his colleagues, backing further monetary tightening. It may help sellers and the US dollar to end the upward correction of EUR/USD that has been unfolding for some. The optimal scenario for opening short positions will be a false breakout of the resistance level of 1.0023. It could generate a sell signal, pushing the euro down to 0.9973. A breakout below this level may occur if the US economic reports are positive. An upward test of this level similar to one that occurred yesterday will give an additional sell signal. The pair is likely to decrease to 0.9923 where I recommend locking in profits. A more distant target will be the 0.9861 level. If EUR/USD rises in the afternoon and bears show no energy at 1.0023, bulls could regain the upper hand. In this case, it is better to postpone short positions to 1.0076 but only if a false breakout of this level occurs. You can sell EUR/USD immediately at a bounce from a high of 1.0127 or 1.0155, keeping in mind a downward intraday correction of 30-35 pips.

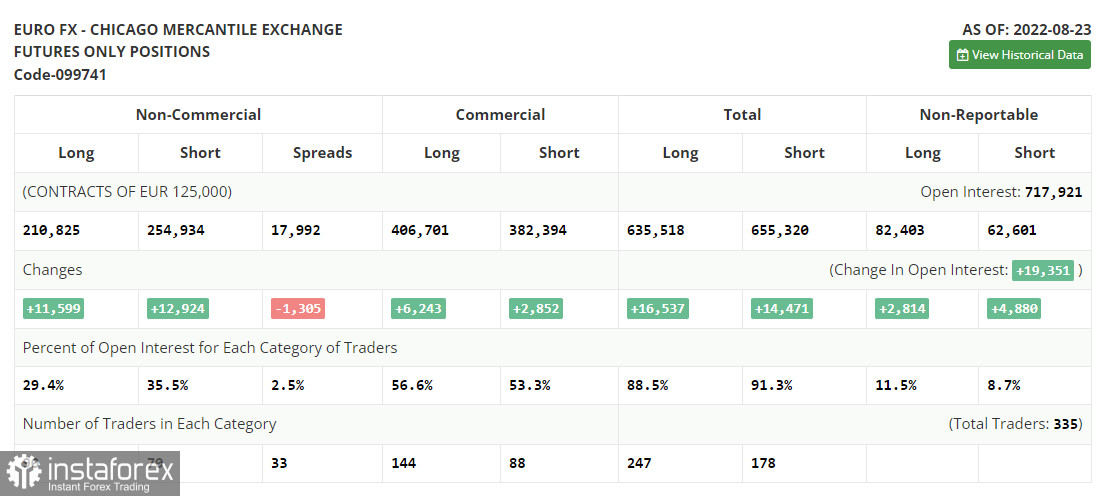

COT report

The COT report (Commitment of Traders) for August 23 logged a sharp increase in both short and long positions. It indicates a high risk appetite among traders, especially after the price approached the parity level. Jerome Powell's speech at the Jackson Hole Symposium led to a surge in volatility and facilitated a short-term rally of the US dollar. However, large retail traders try to prevent the pair from decreasing below the parity level. They begin to enter the market each time the pair start declining. Jerome Powell said that the Fed's main priority is to curb inflation. He also hinted at another sharp rate hike at the September meeting. Investors have priced it in already. So, it did not lead to a drastic drop in the euro versus the US dollar. This week, the Nonfarm Payrolls report is due. The Fed is sure to take notice of this report as it may impact the regulator's monetary policy decision. A strong labor market will keep boosting inflation, which may force the watchdog to raise interest rates further. The COT report revealed that the number of long non-commercial positions increased by 11,599 to 210,825, while the number of short non-commercial positions jumped by 12,924 to 254,934. At the end of the week, the total non-commercial net position remained negative and decreased to -44,109 against -42,784, signaling pressure on the euro and a further fall in the trading instrument. The weekly closing price declined to 0.9978 against 1.0191.

Signals of technical indicators

Moving averages

EUR/USD is trading near 30- and 50-period moving averages, signaling market uncertainty.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD goes down, the indicator's lower border at 0.9999 will serve as support. Otherwise, if the currency pair jumpes, the upper border at1.0053 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.