Stability is a sign of class. Bitcoin fans are optimistic about its fluctuations around the 20,000 mark, sincerely hoping that the token has finally found the bottom. The flow of negative information from the cryptocurrency market has significantly decreased, and you will not find news about the collapse of stablecoins like TerraUSD during the day with fire. Tabloids write about new ETFs, about futures for cryptocurrencies denominated in euros. On the contrary, pessimists scare September, which is traditionally difficult for BTCUSD, and are wondering if the asset, which previously fluctuated in the range of 800% per year, has lost its attractiveness due to a decrease in volatility.

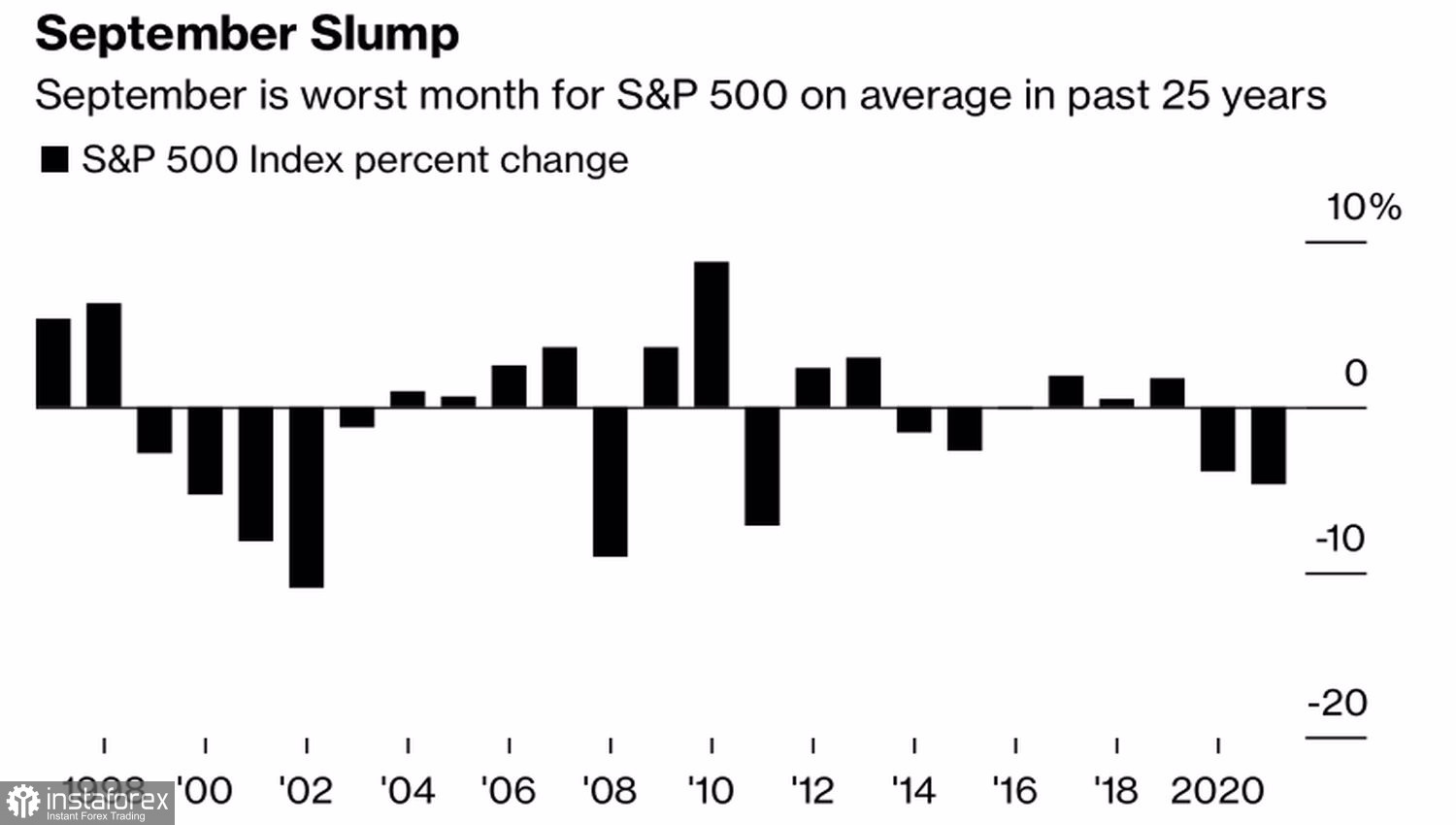

Indeed, bitcoin's propensity for a narrow trading range suggests that the crypto winter has flown into a sleepy summer, which may be followed by a harsh autumn. From 2017 to 2021, the token closed September in the red zone with an average loss of 8.5%. A fundamentally important role in this process was played by the fact that this month is the worst month of the year for the US stock indices. Even though the S&P 500 had its crazy crashes in October in 1929, 1987, and 2008, the beginning of autumn was more often unprofitable for US stocks than its middle.

Dynamics of the S&P 500 in September

Seasonal weakness may be due to the revision of portfolios by managers after leaving vacations, profit-taking by investment funds on the eve of the end of the financial year, the formation of budgets for the next year with arguments about whether it is worth tightening belts. Nevertheless, the fact remains that September is not the best time to buy stocks, which may cause bitcoin to suffer.

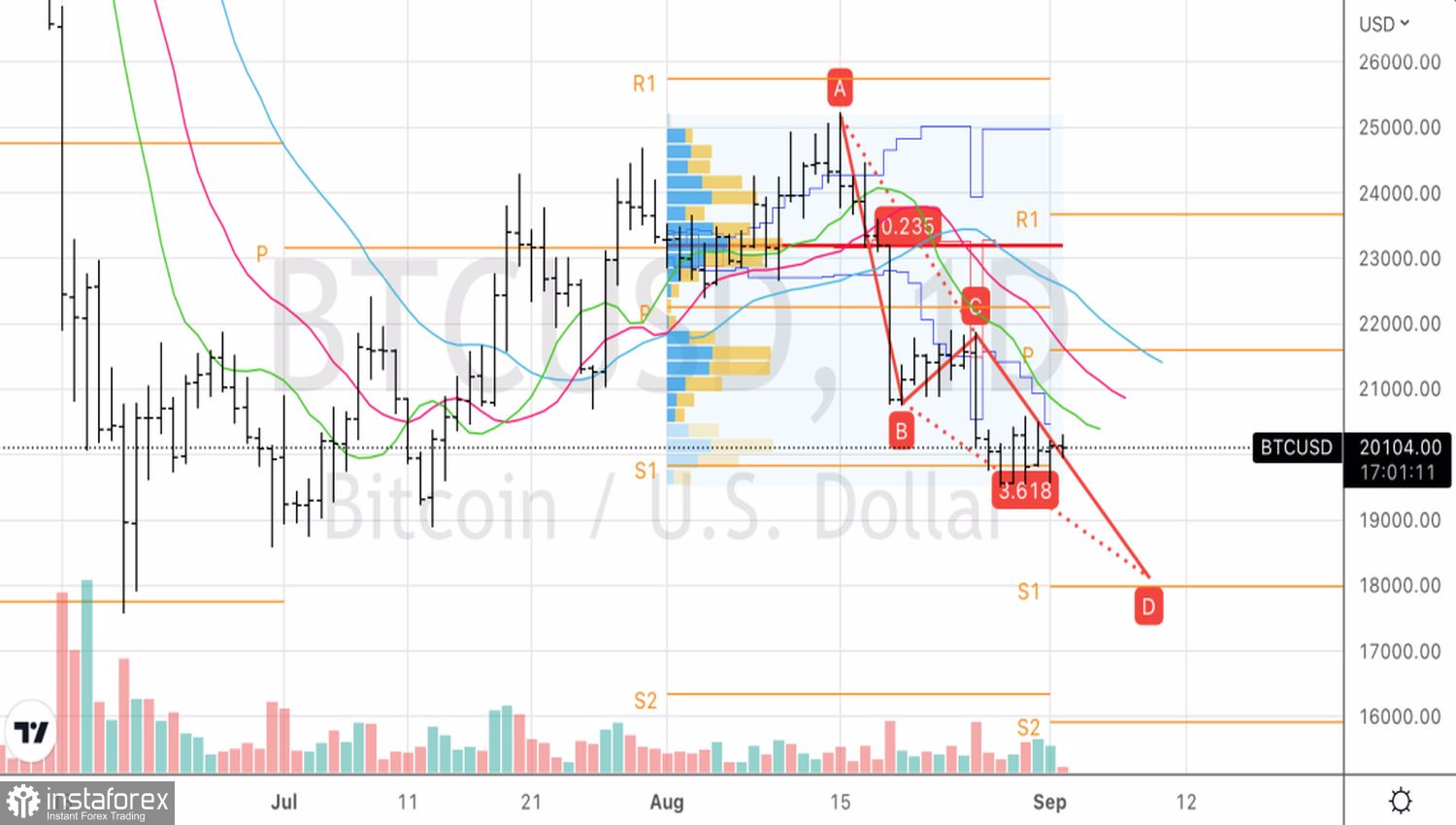

However, judging by the dynamics of recent days, the path of the leader of the cryptocurrency sector has become different from the road followed by American stock indices. In particular, while the BTCUSD quotes stabilized near the 20,000 mark, the S&P 500 fell for five out of six trading days. In my opinion, the reason for everything is the fact that the stock market was wishful thinking: it sincerely counted on the Fed's "dovish" shift in the form of a reduction in the federal funds rate in 2023 and is now paying for its own illusions. The rise of the broad stock index by 17% from the levels of the June bottom was due to the influx of hot money, but they were less willing to enter the cryptocurrency market, so the BTCUSD sales turned out to be smaller.

After Federal Reserve Chairman Jerome Powell's speech at Jackson Hole, the stock market is back on the ground. It has sobered up and is trying to figure things out with a clear head. The U.S. jobs report could give it and bitcoin clues as to where to go next. If the figures turn out to be close to the forecast, this will increase the likelihood of a 75 bps increase in the federal funds rate in September and support the US dollar. Bad news for BTCUSD.

Technically, on the daily chart of bitcoin, there is another accumulation within the Ross Hook pattern. A break of support at 19,800 will allow increasing the shorts formed from the level of 24,000.