Futures on US stock indices were trading mixed in Friday's premarket trading. The US government bond yields declined ahead of the Nonfarm Payrolls report. If the figure is upbeat, it may increase expectations of another sharp rate hike. The Dow Jones futures rose by 0.1% and the S&P 500 futures climbed by 0.2%. The NASDAQ futures remained unchanged compared to the close of the session.

The Nonfarm Payrolls report is expected to show a significant rise in new jobs, signaling the resilience of the economy after yesterday's mixed data on the Manufacturing PMI Index. Traders are now widely discussing the possibility of another aggressive rate hike by 75 basis points. If this scenario comes true, the stock market may sink even more. However, some analysts believe that high interest rates have adversely affected the prospects of the US labor market. It could force the Fed to revise its hawkish stance. It will be extremely bullish for stocks.

As for the energy market, the shares of EU energy companies have shown the best performance amid growing oil prices. Russia looks set to resume gas supplies through its key pipeline to Europe, a relief for investors as fears about more halts this autumn persist.

Lululemon Athletica Inc. stock jumped in the premarket after raising its full-year outlook, giving a boost to European peers JD Sports Fashion Plc, Puma SE, and Adidas AG. However, traders remain cautious. They are also exiting global stock funds at a fast pace, with the fourth-largest weekly outflows of the year in the week through Aug. 31, according to BofA citing EPFR Global data. Apparently, optimism is waning as inflation keeps soaring and the Fed sticks to a hawkish stance. Besides, the economy is likely to slide into recession. Analysts assume that there will no positive shifts in the next few months.

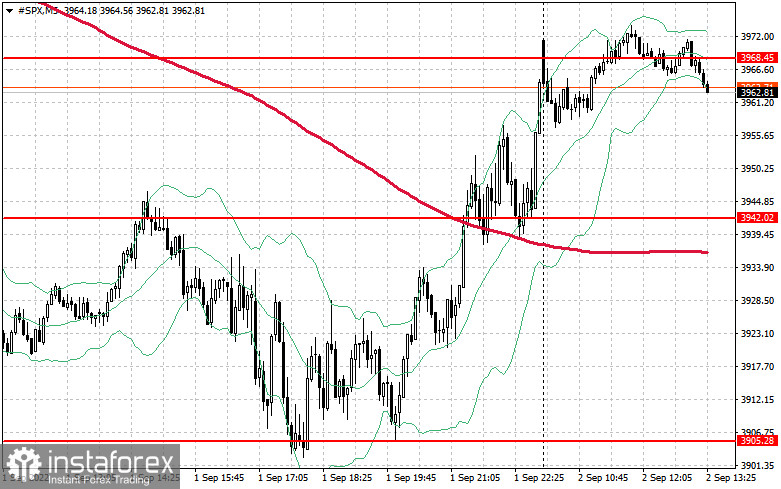

As for the technical outlook of the S&P500, there is a small chance of an upward correction if the index breaks through the level of $3,968. If NFP data is upbeat, one should pay attention to this level. A breakout of this level will signal a further rise. If it sinks, the index may return to monthly lows and resume a downward movement. In case of a breakout of $3,942, the trading instrument will slide to a low of $3,905. If so, the index could decrease to $3,870 where bears could lose their grip. The index is likely to regain momentum only if it reaches the resistance level of $3,968. After that, it may recover to $4,003. A more distant target will be the $4,038 level with the prospect of a rise to $ 4,064. At this level. large sellers will return to the market again. At least there will be those who want to close their long positions.