EUR/USD

Higher time frames

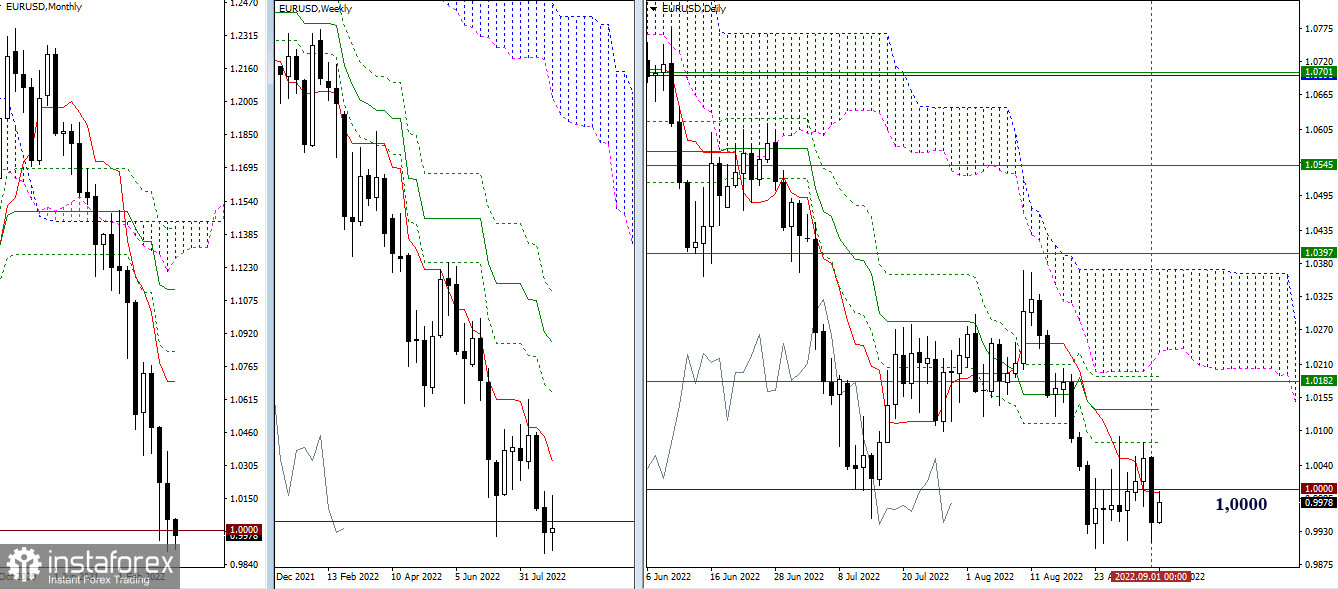

Yesterday, bears had the leading position in the market. However, they remained within the consolidation zone with the key point found at the psychological level of 1.0000 and the daily short-term trend at 0.9995. So, the main nearest targets stayed the same. Bears faced an obstacle at the lowest extremum point (0.9901) of the current correction. Meanwhile, buyers still need to overcome the resistance of the daily Ichimoku Cross pattern (1.0080 – 1.0135 – 1.0190) and the weekly short-term trend at 1.0182.

H1 - H4

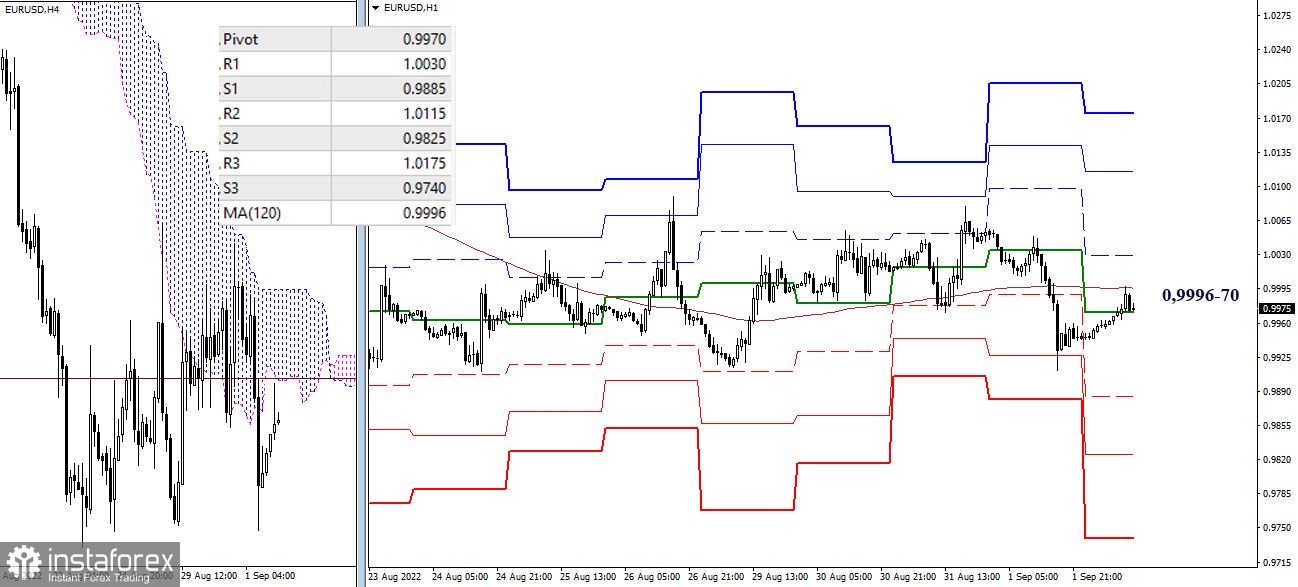

Currently, we can observe the formation of an upside correction on lower time frames. The pair is testing the key levels accumulated in the 0.9996-70 area (the central pivot point + weekly long-term trend). Consolidation above these levels may favor bullish activity. The next upward targets on the intraday chart are the standard resistance pivot levels of 1.0030 – 1.0115 – 1.0175. In case the current correction is over and the fall continues, the downside targets are seen at 0.9885 – 0.9825 – 0.9740 (standard support pivot levels).

***

GBP/USD

Higher time frames

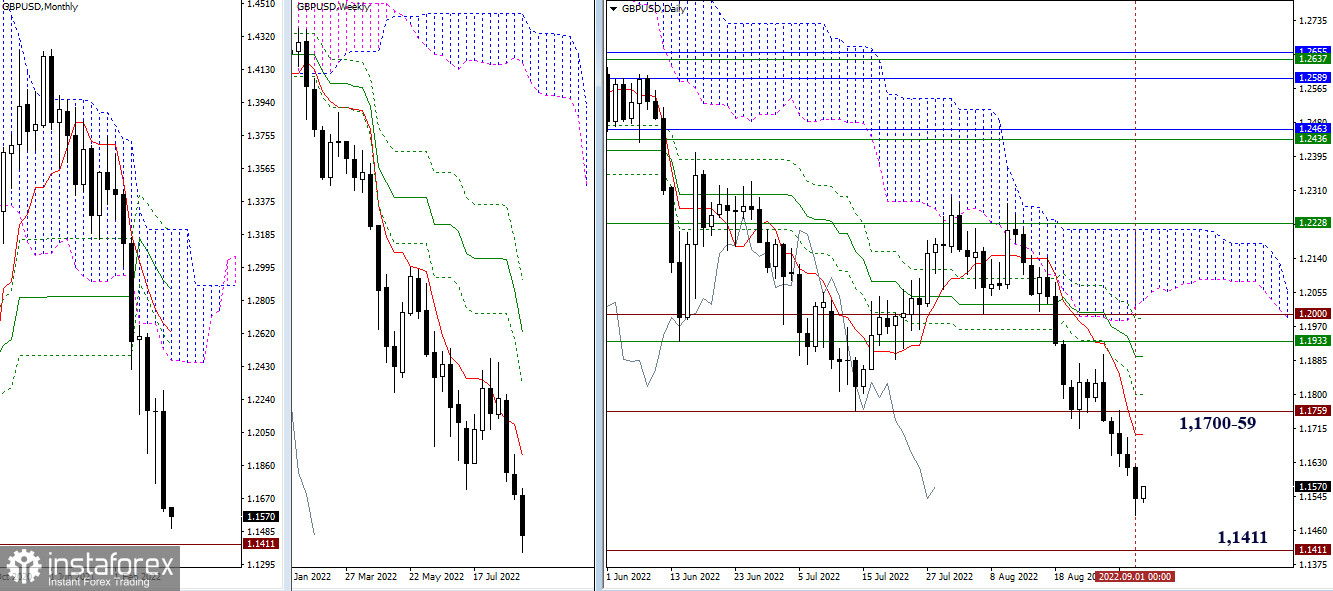

Yesterday, sellers continued to develop a downtrend. Their main target for now remains the level of 1.1411 (the low of 2020). If the market sentiment starts to change, bulls will focus on the nearest resistance levels found at 1.1700 (daily short-term trend) and 1.1759 (historical level).

H1 - H4

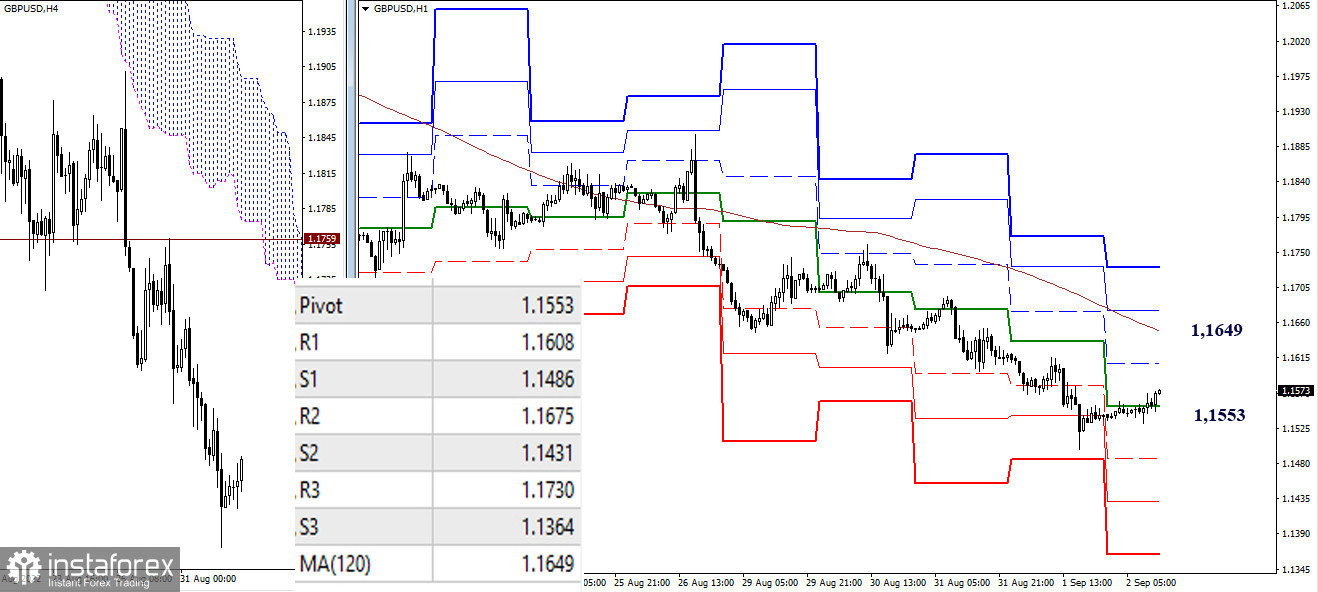

On lower time frames, bears prevail and maintain the downward movement. However, the pair is going through a correction at the moment and is testing the central daily pivot level of 1.1553. The next key target within the correction will be the weekly long-term trend at 1.1649. The level of 1.1608 (R1) may act as an interim resistance level along the way. When ending correction at 1.1498, bears will focus on the standard support pivot levels of 1.1486 – 1.1431 – 1.1364.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)