Long-term perspective.

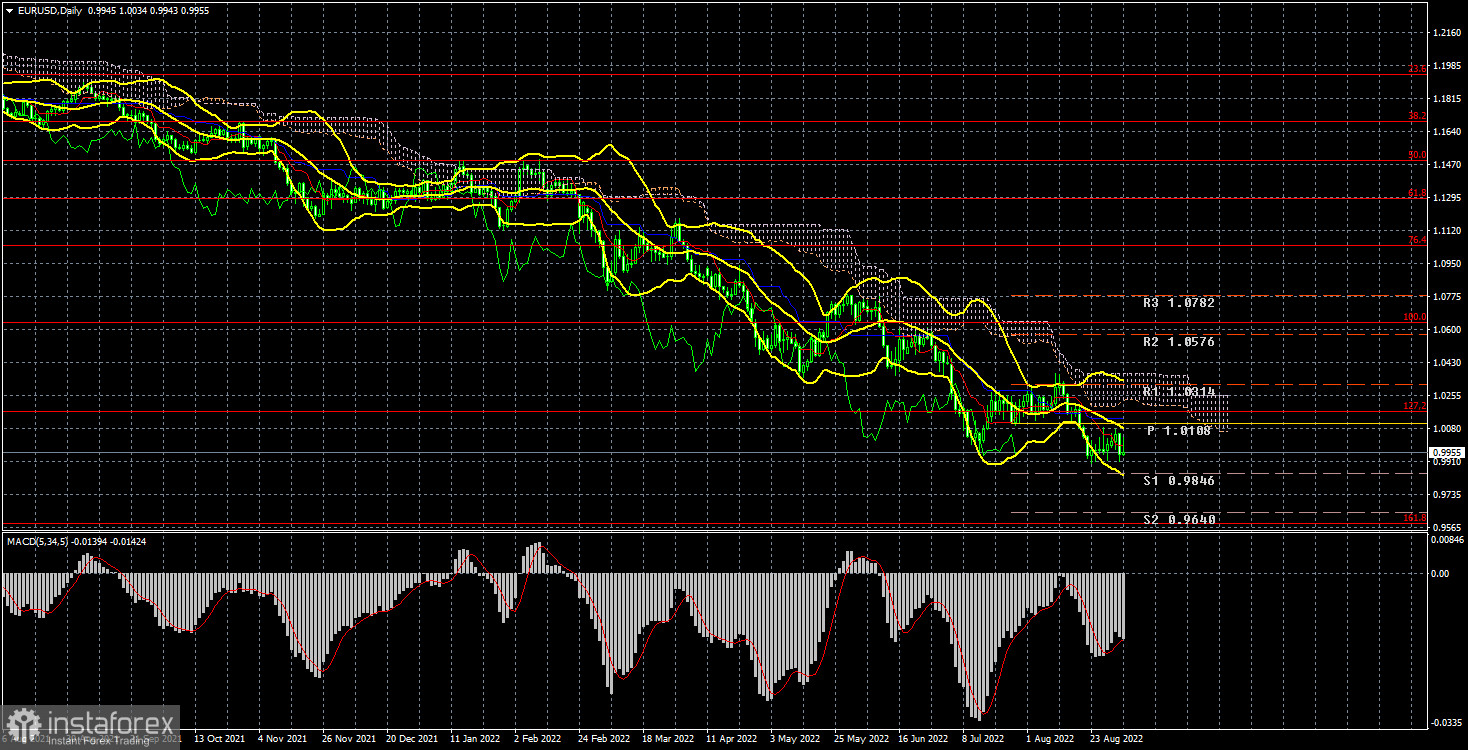

The EUR/USD currency pair has lost about 20 points during the current week. Again, it seems to be a little, but the euro currency is falling weekly. Corrections are still "festive" because they have the same frequency as holidays. This week there was only one disastrous day for the euro – Thursday. What exactly happened on this day? There was not a single reason for such a collapse. Analyzing the lower TF (4-hour and hourly), we said that the pair now found itself inside a fairly wide side channel of 0.9900-1.0080. In principle, it remained in it after the end of the trading week. Thus, we state that the pair is in a wide flat or "swing." And it is right around its 20-year low. From our point of view, this is proof that the downward trend has not been completed, which means that the fall of the European currency will resume. Analyzing the technical picture of the 24-hour timeframe, we can say that the trend is downward since the price is located below all the lines of the Ichimoku indicator. The last correction ended without even reaching the Ichimoku cloud, which is located not far from the price.

Nevertheless, buyers were again allowed to ensure they would not buy the euro currency now. And we have already talked about the reasons for this attitude to the euro a thousand times, and it does not change. Geopolitics remains complicated. Many military experts expect a new round of escalation in the conflict in Ukraine in the autumn and winter of 2022. The "gas war" between the Russian Federation and the EU is gaining momentum. Yesterday, it became known that gas transportation via the Nord Stream has been stopped indefinitely. The ECB is still characterized by its passivity on the issue of monetary policy. The Fed, on the contrary, is ready to continue raising the rate and has expanded the QT program to $95 billion per month since September 1. Thus, there are still many more reasons to buy the US dollar now.

COT analysis.

The COT reports on the euro currency in the last few months reflect what is happening in the euro/dollar pair. For most of 2022, they showed a frank "bullish" mood of professional players, but at the same time, the European currency was steadily falling. At the moment, the situation is different, but it is not in favor of the euro currency. If earlier the mood was "bullish" and the euro was falling, now the mood is "bearish," and the euro is also falling. Therefore, so far, we do not see any reason for the growth of the euro because the absolute majority of factors remain against it. During the reporting week, the number of buy contracts from the "Non-commercial" group decreased by 8.5 thousand, and the number of shorts – by 5 thousand. Accordingly, the net position decreased by about 3.5 thousand contracts. This is not much, but an increase in the "bearish" mood among the major players. After several weeks of weak growth, the decline in this indicator resumed. From our point of view, this fact very eloquently indicates that, at this time, even professional traders still do not believe in the euro currency. The number of buy contracts is lower than sell contracts for non-commercial traders by 47 thousand. Therefore, we can state that not only the demand for the US dollar remains high, but also the demand for the euro is quite low. The fact that major players are not in a hurry to buy euros may lead to a new, even greater drop. Over the past six months or a year, the euro currency has not been able to show even a tangible correction, let alone something more.

Analysis of fundamental events.

There were few macroeconomic statistics in the European Union this week. We can only highlight the inflation report for August, which (here's a surprise!) showed acceleration again, this time to 9.1%. The unemployment rate did not change and amounted to 6.6%, and the index of business activity in the production sector fell to 49.6 (below the critical mark of 50.0). As you can see, the statistics did not give reasons for buying euros, which did not happen. However, we have already said that macroeconomics has only a local impact on market sentiment. Thus, it is unlikely to expect a trend change based on one or two not the most important reports from the European Union. There were also several important events in the States this week, but they did not have a particularly strong impact on the movement of the euro/dollar pair. Global fundamental and geopolitical factors remain the basis.

Trading plan for the week of September 5 – 9:

1) On the 24-hour timeframe, the pair continues to move south. Almost all factors still speak in favor of the long-term growth of the US dollar, and the situation has not changed for a very long time. Traders failed to overcome the Ichimoku cloud, so the upward movement and purchases of the euro currency are still irrelevant. To do this, you must wait for consolidation above the Senkou Span B line and only consider long positions.

2) The sales of the euro/dollar pair are still more relevant now. The price has overcome the critical line, so we expect the fall to continue with a target of 0.9582 (161.8% Fibonacci). In the future, if the fundamental background continues to remain the same as it is now and geopolitics deteriorates, the euro currency may fall even lower.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.