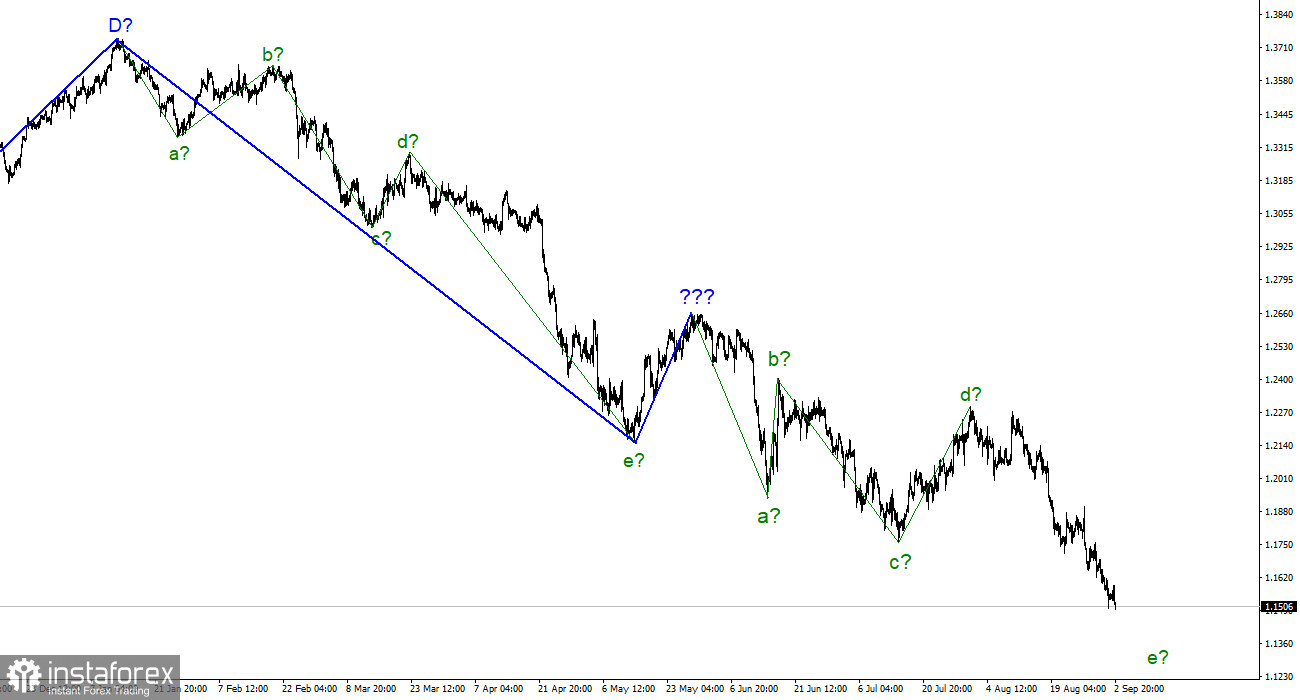

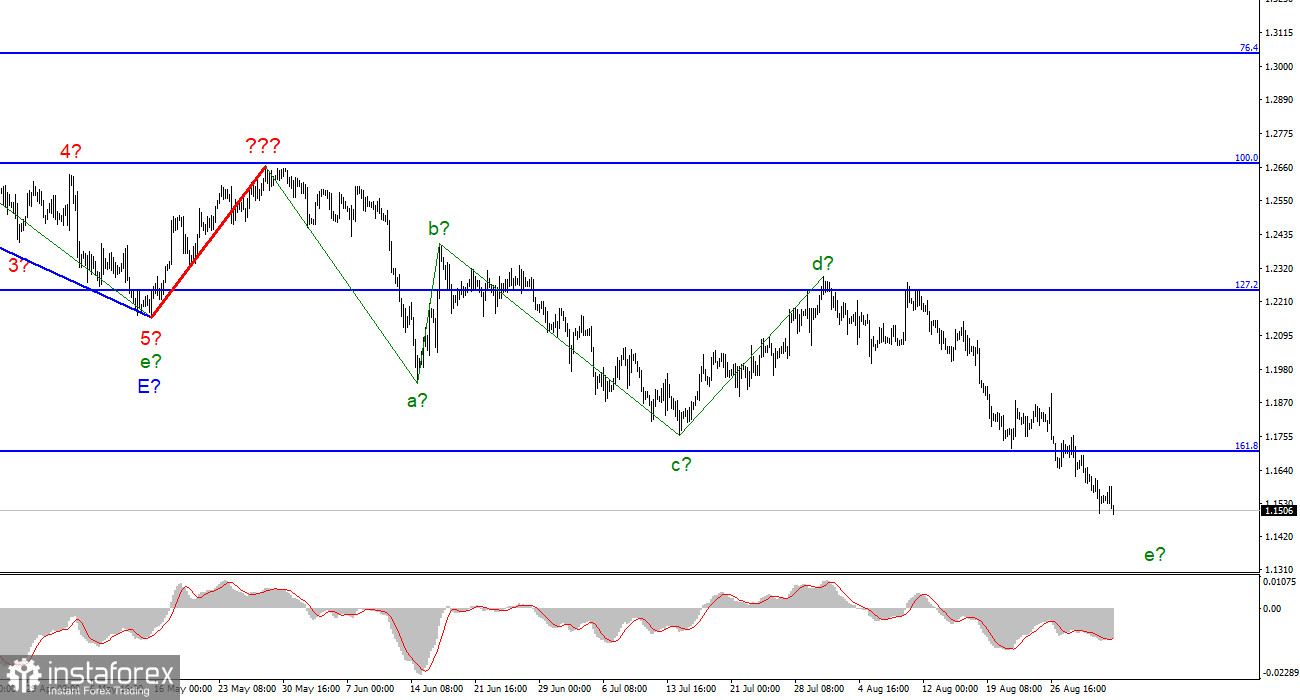

For the pound/dollar instrument, the wave marking at the moment looks quite complicated but does not require any clarifications. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. At the moment, we have completed waves a, b, c and d, so we can assume that the instrument continues to build wave e. If this assumption is correct, then the decline in quotations may continue in the near future. However, I remind you that if impulse structures can become more complicated and lengthen, then corrective ones are even more so. Given the news background and the fact that the Fed will not stop raising interest rates now, the entire downward trend section may take a much longer form. A successful attempt to break through the 1,1708 mark, which corresponds to 161.8% Fibonacci, indicates that the market is ready for new sales of the British. At the same time, the low of wave e is already much lower than the low of wave c, so wave e can end at any time.

The demand for the British continues to decline.

The exchange rate of the pound/dollar instrument decreased by 35 basis points on September 2. This happened thanks to American data on unemployment and the labor market, which can be interpreted as you like. The unemployment rate rose, which is bad, but the number of payrolls turned out to be higher than market expectations, which is good. As a result, the market decided that payrolls are still more important, and demand for the dollar has recovered. However, let's move away from the American economy and pay attention to the UK, where there were practically no important events this week. But this is only at first glance. On Friday, the vote for the future Prime Minister and leader of the Conservative Party in place of the retiring Boris Johnson officially ended. According to the BBC, Liz Truss, the current foreign minister, will win. The BBC notes that Truss enjoys the support of Conservatives across the UK.

In contrast, Rishi Sunak's support fell very much after he won all the preliminary rounds of the election. Recent opinion polls have shown that 60% to 70% of Conservatives will vote for Truss. At this time, almost no one doubts that Truss will win.

For the British, this news is interesting, but the market is not yet ready to trade with an eye on politics. The Briton is not in demand now for objective reasons, and the victory of the Tracks is not something positive for the UK economy. Truss's decisions in the near future will mean much more to the market. She has already announced that taxes in the UK can be reduced, which will cause a clear budget deficit, but at the same time ease the burden on the budgets of British citizens.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the instrument may not reach it. Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, and the same three waves are down after. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.