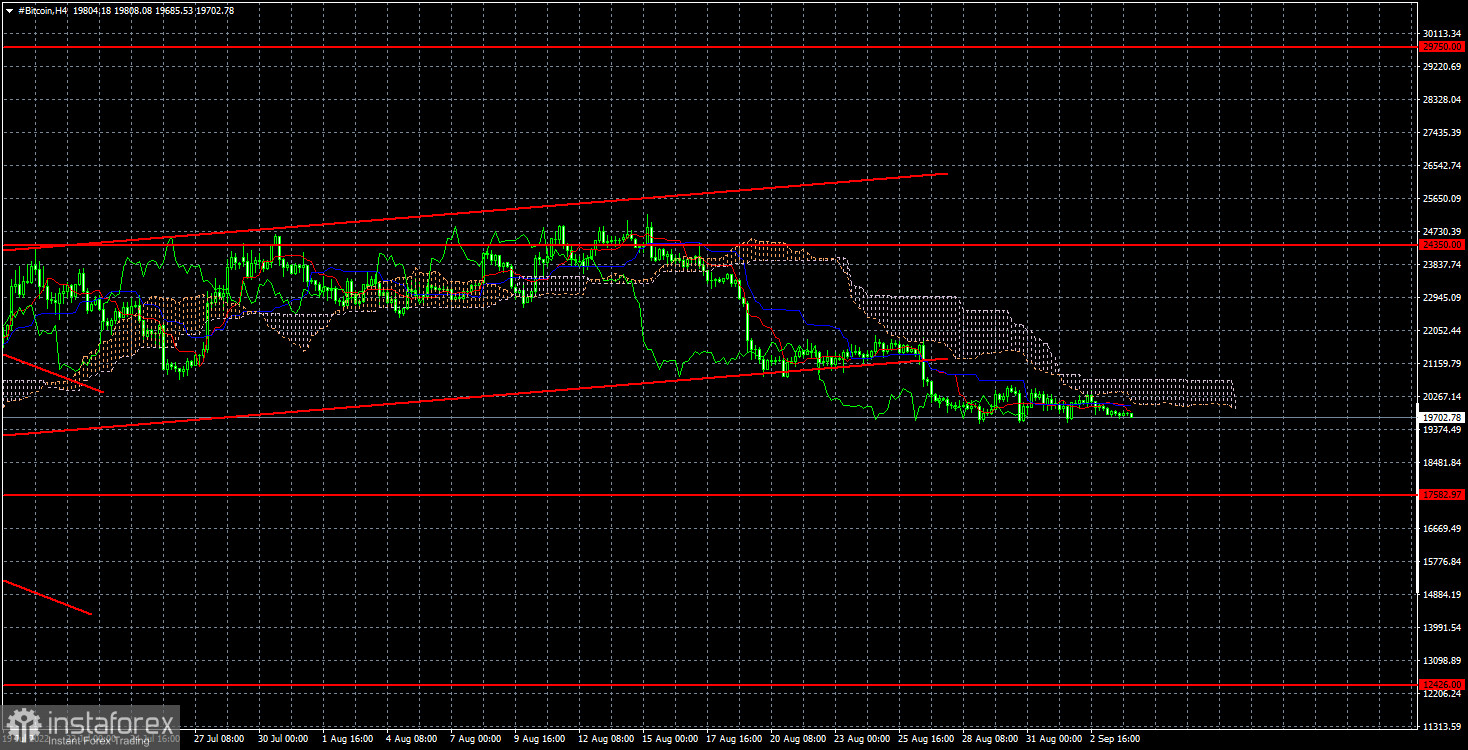

On the 4-hour TF, it is even better to see that the level of $ 24,350 bitcoin has not been able to overcome, and subsequently consolidated below the ascending channel. Thus, quite officially, the trend has changed to a downward one. So far, the downward movement is not strong, but this does not mean that bitcoin will not collapse tomorrow like a "stone". Recall that the times when the market was very actively working out various fundamental events have already sunk into oblivion. Now there are calm movements, which are occasionally replaced by large-scale sales, which cannot be associated with any specific events.

But the general fundamental background continues to play a huge role. Recall that the Fed continues to raise the key rate and in the last few weeks there was an opinion that the regulator would slowly abandon the aggressive attitude in monetary policy. However, last Friday, Fed Chairman Jerome Powell made it clear that the rate of rate growth may and will decrease (although it is not 100% yet), but the rate itself will rise for a long time, and the period during which it will be at a high level will be long. We can interpret all this as the continued aggressive attitude of the Fed. And the longer it stays that way, the more time bitcoin will have to continue its decline. Time is working against him now.

Bitcoin is one of the riskiest assets, and in times of tightening monetary policy, the demand for such assets is falling. That is why we are simultaneously observing a decline in the US stock market, which, undoubtedly, is not as risky as the cryptocurrency market. Therefore, it is bitcoin and its "brothers" that remain in the riskiest position. If earlier we were talking about a total increase in the Fed rate to 3.5%, now more and more members of the monetary committee are talking about 4–4.5%. The rate may continue to rise even in 2023, although Powell and the company hinted earlier that the regulator could slowly return the rate to a neutral value next year. As we can see, harsh reality makes its adjustments. Inflation in the US was stopped within one specific month, but this does not mean at all that it will continue to slow down at the current rate. There is not even confidence that the September report will show a slowdown. In any case, the rate should continue to be raised if the Fed intends to return the consumer price index to 2% and is not going to spend more than 5 years on it.

In the 4-hour timeframe, the quotes of "bitcoin" completed, apparently, an upward correction. We believe that the decline will now continue. The first target for sales is now the level of $ 17,582, which is the last local minimum of the cryptocurrency. Next, the common goal for the two timeframes is $12,426.