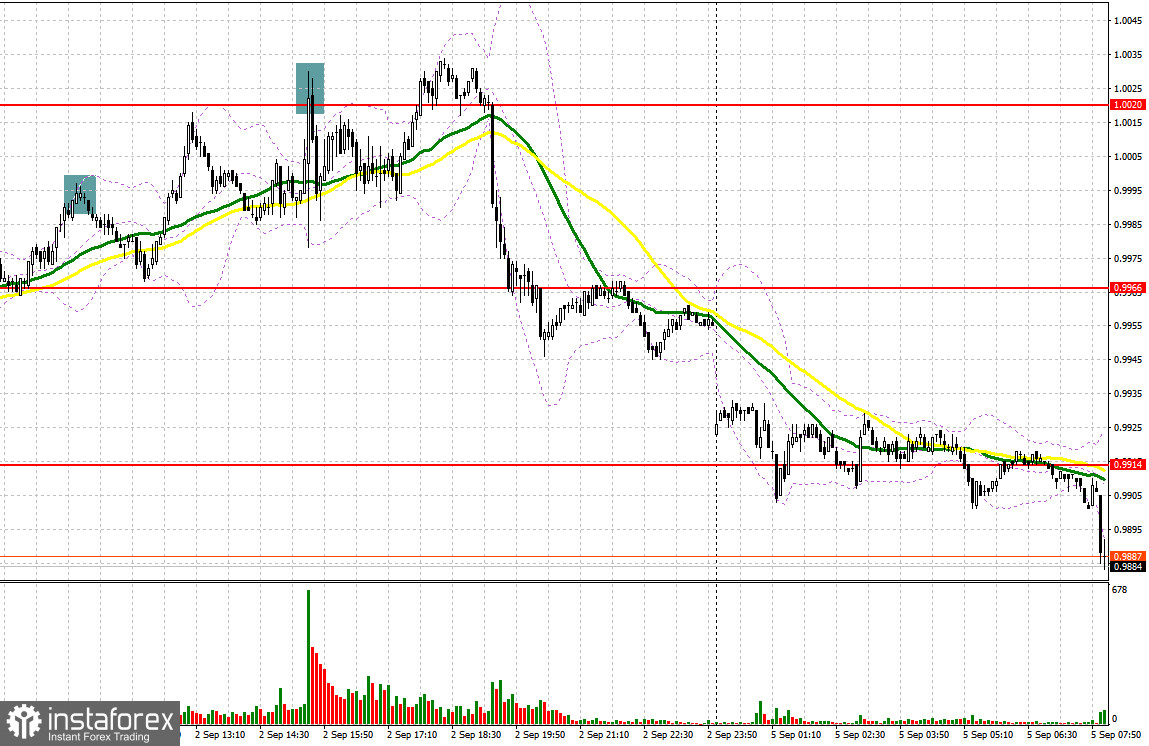

On Friday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier I asked you to pay attention to the level of 0.9993 to decide when to enter the market. A rise and a false breakout led to a perfect short signal. As a result, the pair declined by 25 pips. However, it failed to reach the nearest support level of 0.9949 since there was not enough weak data from the eurozone. Data on the US labor market turned out to be mixed. On the one hand, the unemployment rate surged, whereas the number of new jobs was ahead of projections. This caused market volatility and a false breakout of 1.0020. As a result, the euro/dollar pair tumbled by about 30 pips.

Conditions for opening long positions on EUR/USD:

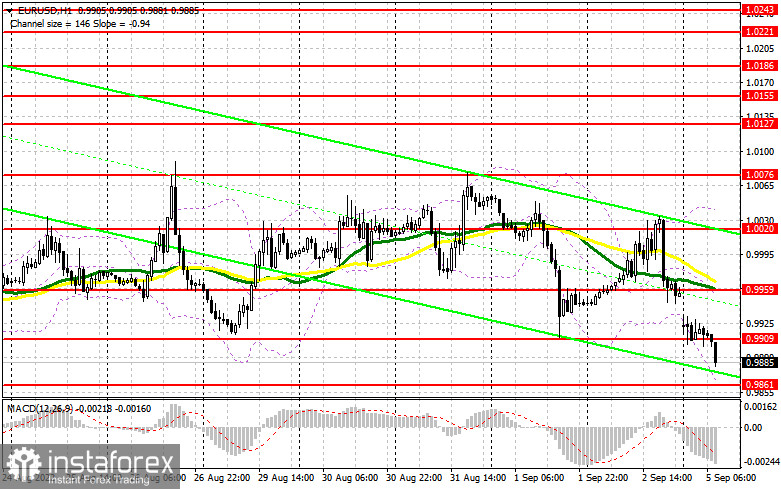

The euro began the trading week with a decline amid the events and protests that took place yesterday in Prague. That is why the pair has already reached a new yearly low. The price will hardly show an upward correction in the near future because of today's fundamental data from the eurozone. Germany, Italy, and the eurozone are going to disclose their services PMI reports. What is more, the eurozone will also publish the composite MPI data from Markit for August. The business activity is likely to go on falling. This is likely to exert pressure on the euro, thus causing a new drop. It will be wise to buy the euro near the support level of 0.9861. The pair may slump to this level in case of very weak data from the eurozone. A false breakout of 0.9861 will give a good long signal with the target at 0.9909. If the pair breaks and downwardly tests this level, this will affect bears' stop orders, thus encouraging buyers. Against the backdrop, the price may jump to 0.9959, where there are moving averages, which may cap the pair's upward potential. The next target is located at the resistance level of 1.0020, which is an upward limit of the wide downward channel. There, traders are better to lock in profits. If the euro/dollar pair declines and buyers fail to protect 0.9861, pressure on the pair will return. It will be wise to go long after a false breakout of the low of 0.9819. Traders may initiate buy orders just after a bounce off 0.9770 or even lower – from 0.9740, expecting a rise of 30-35 within the day.

Conditions for opening short positions on EUR/USD:

Bears are fully controlling the market, whereas all bulls' attempts to consolidate on the parity level were in vain. Today, sellers should primarily protect the nearest resistance level of 0.9909. The pair may climb to this level even before the publication of the eurozone PMI data. That is why a false breakout after the publication may lead to a perfect sell signal with the target at 0.9861. A breakout and settlement below this level as well as an upward test will give an additional sell signal, which may seriously affect buyers' stop orders. In the event of this, the price may tumble to 0.9770, where it is recommended to lock in profits. The next target is located at a low of 0.9740. If the euro/dollar pair increases during the European session amid strong data from the eurozone and bears fail to protect 0.9909, the overall situation will hardly change, but the price may launch an upward correction. If these predictions come true, traders should avoid selling the asset until it hits 0.9959 and forms a false breakout of this level. Traders may go short just after a rebound from the high of 1.0020 or even higher – from 1.0076, expecting a drop of 30-35 pips.

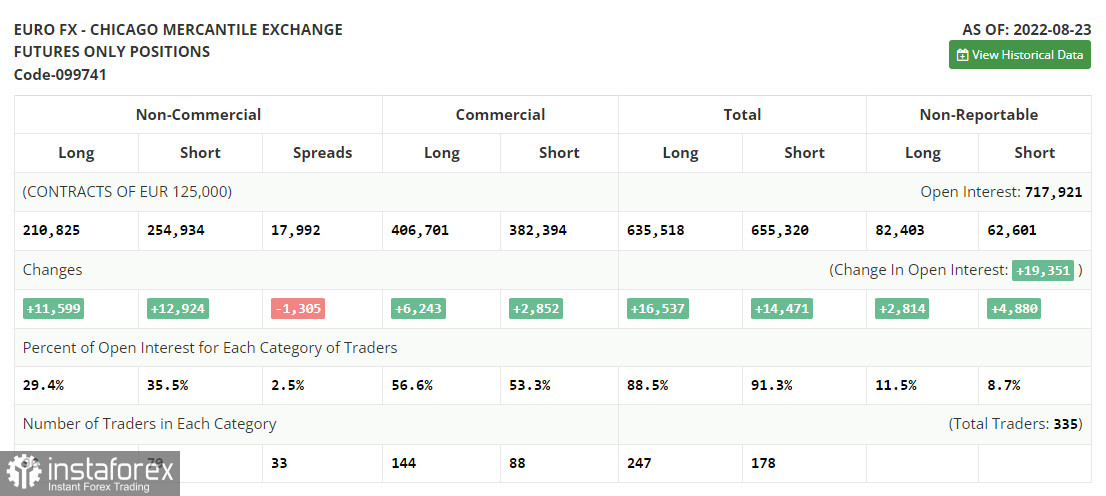

COT report

According to the COT report from August 23, the number of both long and short positions soared. This fact points to great interest among traders, especially after the euro dropped below the parity level. Fed Chair Jerome Powell's speech in Jackson Hole led to a surge in volatility and provided short-lived support for the US dollar. However, big traders prevent the pair from falling below the parity level and become more active every time it starts losing value. Jerome Powell said that the Fed would do its best to cap inflation. That is why the regulator is likely to keep the current pace of monetary policy tightening. Since traders priced in such an outcome before the symposium, the euro managed to stay intact. This week, traders should analyze the US labor market data that has a considerable influence on the Fed's plans. Thus, a strong labor market may contribute to high inflation, thus forcing the Fed to raise the benchmark rate even more. The COT report reads that the number of long non-commercial positions increased by 11,599 to 210,825, whereas the number of short non-commercial positions jumped by 12,924 to 254,934. At the end of the week, the total non-commercial net position remained negative and decreased to -44,109 against -42,784, which reflects pressure on the euro and a further fall in the trading instrument. The weekly closing price decreased to 0.9978 from 1.0191.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to the ongoing decline in the pair.

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair decreases, the support level will be located at the lower limit of the indicator near 0.9860. In case of a rise, the upper limit of the indicator located at 1.0030will act as resistance.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.