Trend analysis

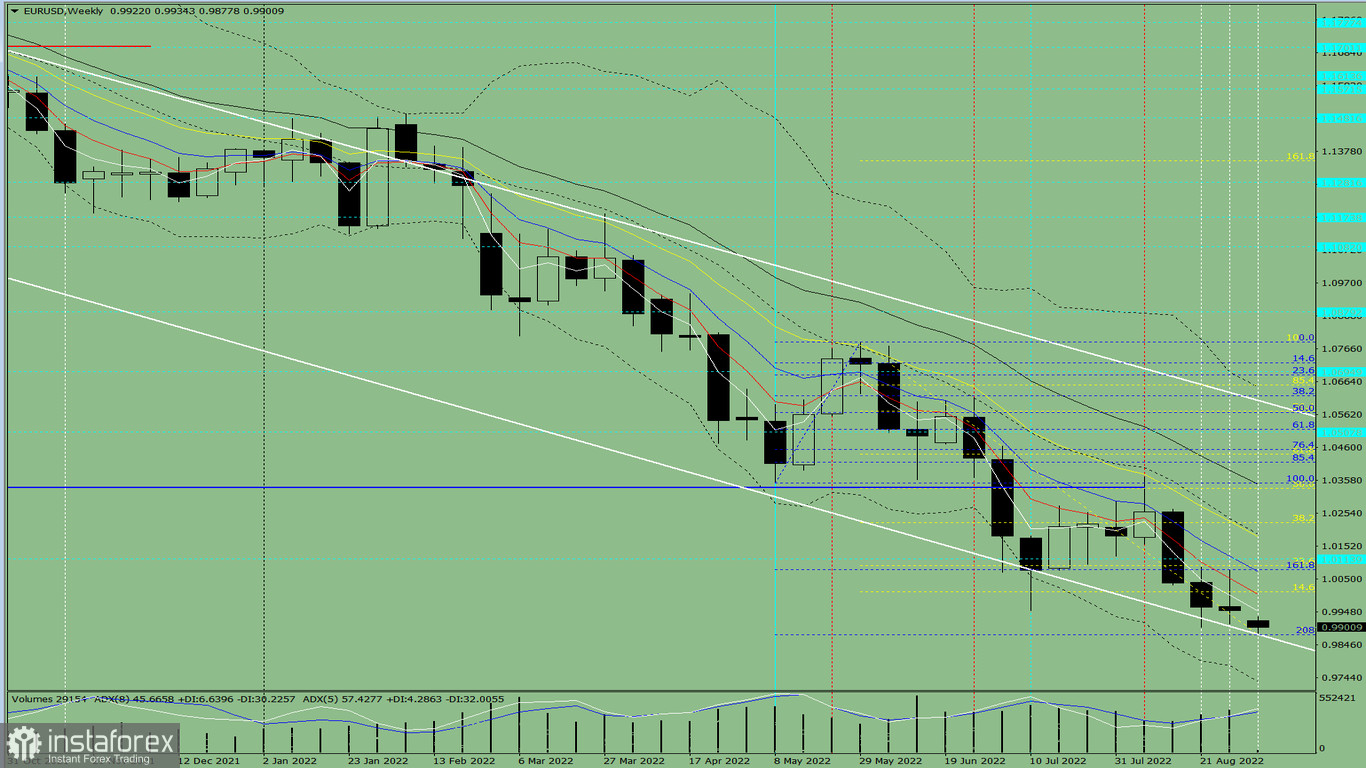

EUR/USD quotes will decrease this week, starting from 0.9900 (closing of the last weekly candle) to 0.9878, which is the support line of the downward channel (thick white line). Then, it will move to the 14.6% retracement level at 1.0009 (yellow dotted line) and to the 23.6% retracement level at 1.0091 (yellow dotted line).

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - uptrend

Fibonacci levels - uptrend

Volumes - uptrend

Candlestick analysis - uptrend

Trend analysis - uptrend

Bollinger bands - downtrend

Monthly chart - uptrend

All this points to an upward movement in EUR/USD.

Conclusion: The pair will have a bullish trend, with a first lower shadow on the weekly white candle (Monday - down) and a second upper shadow (Friday - down).

So during the week, euro will fall from 0.9900 (closing of the last weekly candle) to the support line at 0.9878 (thick white line), then go to the 14.6% retracement level at 1.0009 (yellow dotted line) and 23.6% retracement level at 1.0091 (yellow dotted line).

Alternatively, quotes could drop from 0.9900 (closing of the last weekly candle) to the lower border of the Bollinger band at 0.9730 (dashed black line), then go to the 14.6% retracement level at 1.0009 (yellow dotted line).