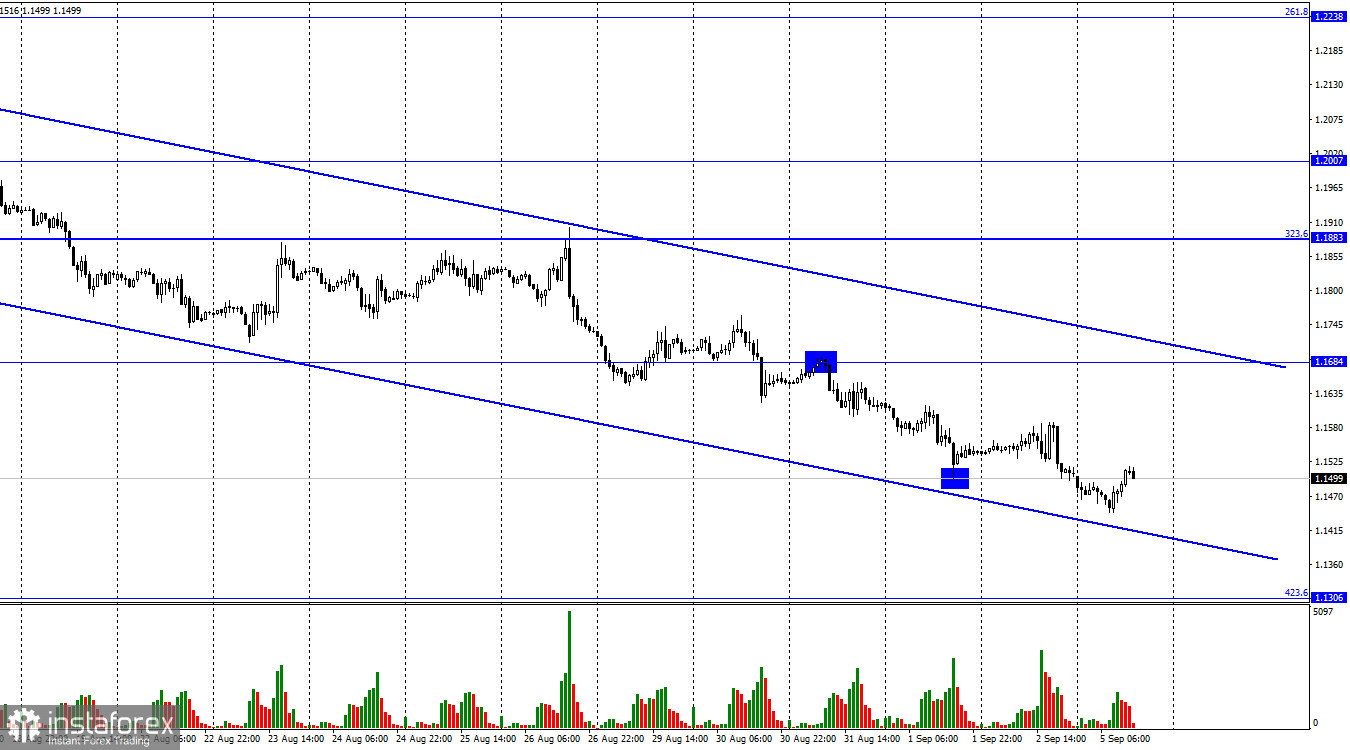

On the hourly chart, the GBP/USD pair continued to fall on Friday towards the correctional level of 423.6% - 1.1306. This level is below the 40-year low, and the descending channel continues to prove bearish sentiment in the market. Notably, the pound has not even tried to stop the ongoing decline in recent weeks. Bulls have not attempted to drag the price above the downtrend channel. What conclusion can we draw here if bulls continue to show weak activity in the market? On Friday, bears had reasons to buy the US dollar. On Monday, they had reasons to sell the British currency as the index of business activity in the service sector was 50.9 against expectations of 52.5. However, when there were no such reasons, traders continued to sell the pound anyway. It is not about weak statistics from the UK or strong statistics from the US. Most traders keep buying the US dollar and selling the British pound. Such a trend can last for quite a long time.

Currently, when the euro is trading near its 20-year lows and the pound is near its 40-year lows. It looks like both currencies will continue to depreciate. Today the UK will name a new prime minister as Boris Johnson will leave office soon. Certainly, the current fall of the British currency has nothing to do with this event as there is nothing negative about it. On the contrary, the new government may make changes in politics and the economy that will be good for the pound. The American and British economies may fall into recession in the coming quarters. Consequently, the information background for the pound and the US dollar is not too different now. Nevertheless, only one currency is growing in recent weeks and months. It seems that there is no sense to study economic reports now as they do not affect the traders' sentiment. We can count on the growth of the British currency only after the pair closes above the descending channel.

On the 4-hour chart, the pair fell to the level of 1.1496 and rebounded from it. Today there was a bullish divergence in the CCI indicator, which allows traders to expect a slight rise towards the Fibo level of 161.8%, 1.1709. However, if the price fixes below the level of 1.1496, it may continue to decline towards the Fibo level of 200.0% - 1.1111.

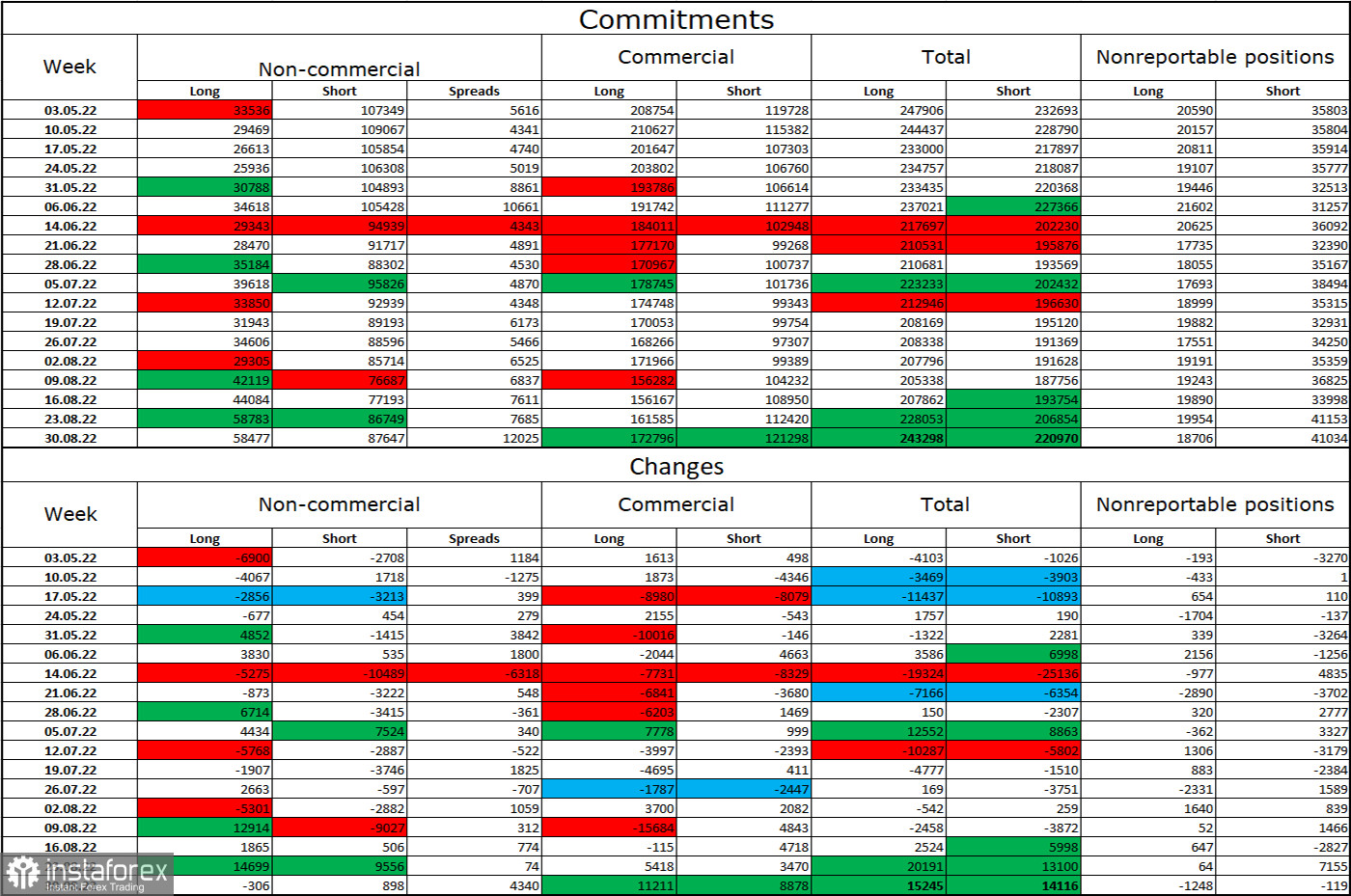

COT report:

Non-commercial traders became a bit more bearish this week. The number of long positions in the hands of speculators decreased by 306, and the number of short positions increased by 898. The sentiment of big players remained bearish, and the number of short positions still exceeds the number of longs, but much less than it was before. Large players continue to hold short positions on the pound for the most part, and their sentiment is gradually becoming less bearish. The pound resumed the fall, and the COT reports so far prove that the British pound is more likely to continue to fall than to start a full-fledged uptrend.

US and UK economic events:

UK - CIPS UK Services PMI (08:30 UTC)

UK - Composite PMI (08:30 UTC)

On Monday, the US economic calendar does not contain any important events. The reports scheduled in the UK have already been released. Thus, the information background is unlikely to influence the market today.

Forecast for GBP/USD and recommendations for traders:

It is better to sell the pound if the price closes below 1.1684 on the hourly chart. The target is located at 1.1496. This level has already been tested. New short positions on the pound are possible if the price closes below 1.1496 with the target at 1.1306. You may open long positions on the pound if the price fixes above the descending channel on the hourly chart with the target at 1.2007.