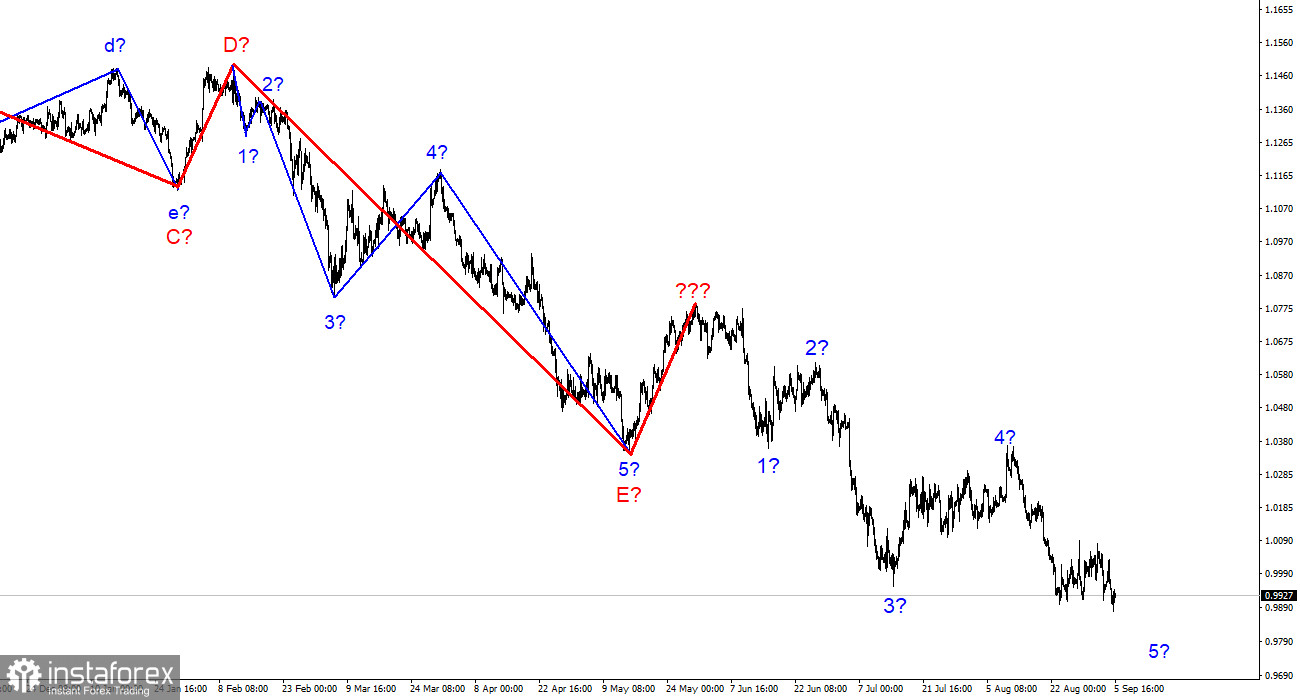

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments, although wave 4 turned out to be longer than I expected, and now the construction of wave 5 is also delayed. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. There are no grounds to assume the completion of the downward trend segment yet. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect that the decline in the quotes of the instrument will continue with the targets located below the 1.0000 mark within wave 5. Wave 5 can take almost any kind of length since wave 4 turned out to be much longer than wave 2 – the waves acquire a more extended form as the downward trend section is built. However, I note that the low of wave 5 is below the low of wave 3, so this wave can complete its construction at any time. And with it, the entire downward section of the trend.

An ECB rate hike may not help the euro.

The euro/dollar instrument fell by 20 basis points on Monday. Recently, the euro currency has been avoiding serious losses, but wave 5 has not yet been completed (if it had been, then the construction of an ascending wave would have begun). Thus, the decline in the quotes of the instrument may continue for some time. Earlier, I said that to ensure the integrity of the wave markup, it is necessary to reduce the demand for euros. Now there are no problems with this. American statistics continue to upset the market much less than the European one, although it is the American economy that is now showing concrete signs of a slowdown and recession. Let me remind you that in the US, two quarters have already closed in the red, and in the European Union, even for the third quarter of 2022, the GDP forecast is positive (the report will be released this week).

The recession in the American economy has already begun, and in the European economy it may only begin, and this will depend on the actions of the ECB and the ability to solve problems with gas imports in Brussels. It seems that it is the possible complete rupture of gas contracts in Russia that most worries the market. Now, more than ever before, there is a high probability of freezing not only the Nord Stream-2, but also the Nord Stream-1. In this case, there will be a serious gas shortage in the European Union, although many countries are struggling to fill their storage with this type of fuel on the eve of winter. That is, the energy crisis has not yet begun, there is still no recession, but demand for the euro continues to remain low due to market fears on both the first and second points. Against this background, I don't even want to think about the ECB, whose meeting will be held this week, and as a result of which the interest rate will rise by at least 50 basis points. Now I am not sure that even such a "hawkish" decision by the European regulator will be able to cause an increase in the value of the European currency.

.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you now to sell the instrument with targets located near the calculated mark of 0.9397, which equates to 423.6% Fibonacci, for each MACD signal "down", counting on the construction of wave 5. So far, I do not see a single signal that would indicate the completion of this wave.

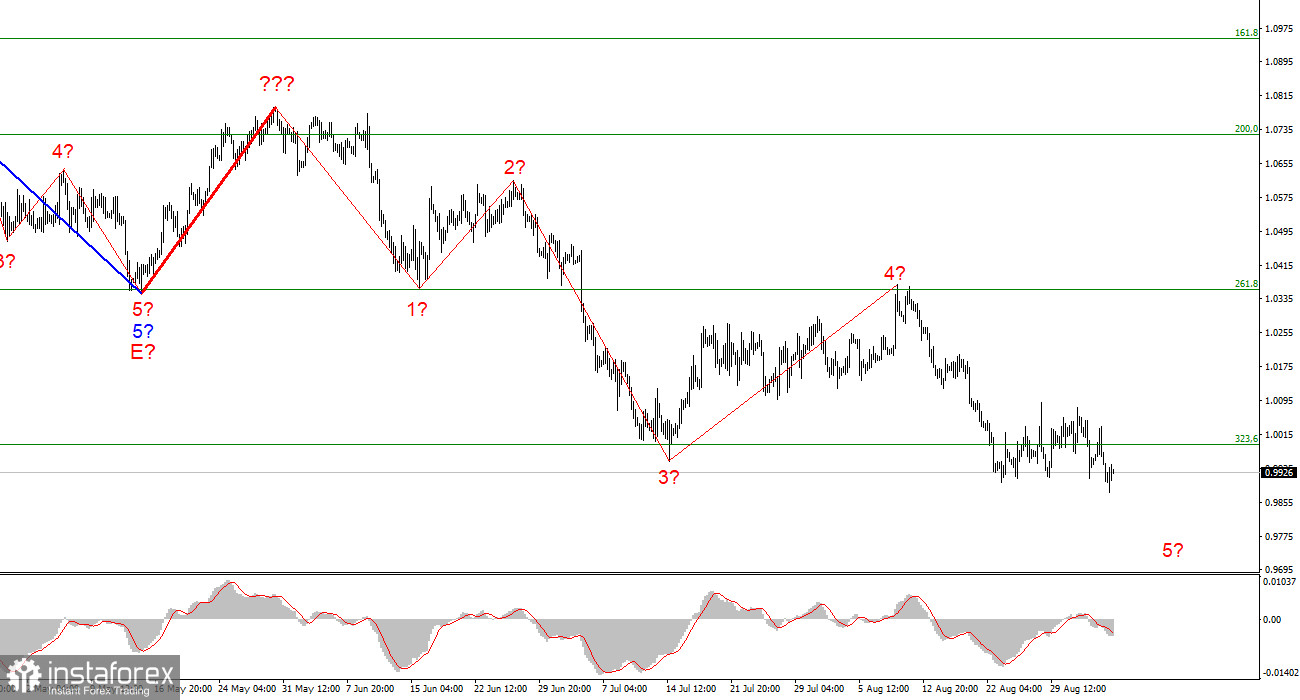

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any kind of length, so I think it's best now to isolate the three and five-wave standard structures from the overall picture and work on them.