EUR/USD

Big time frames

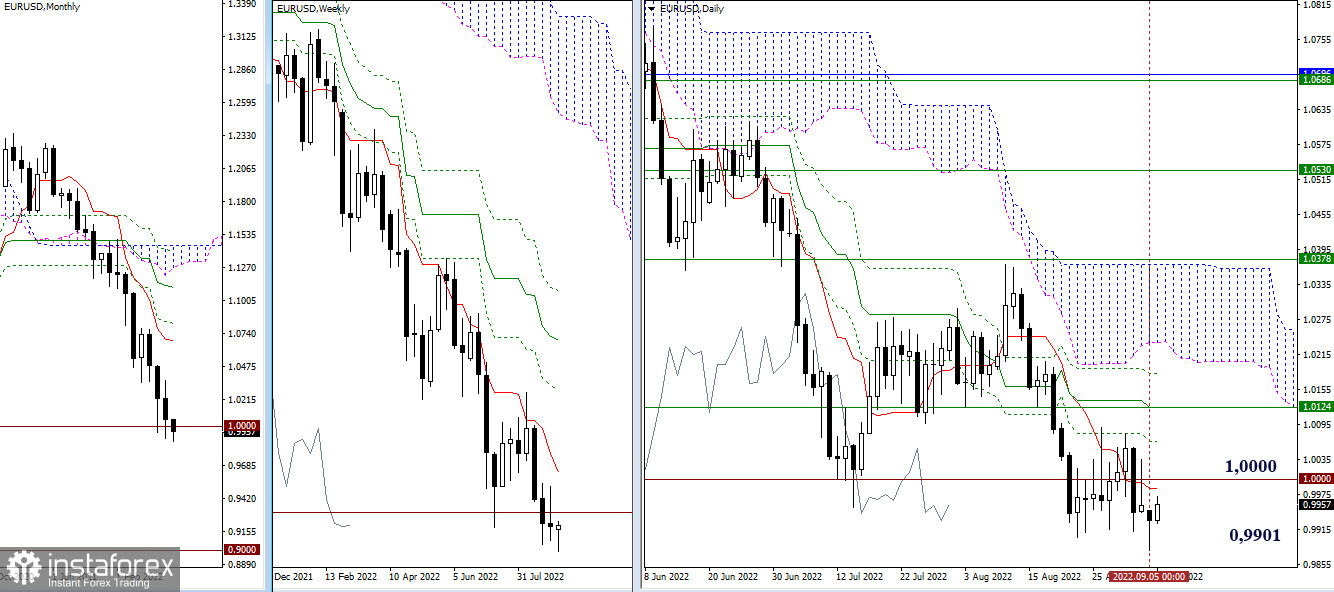

Reaching a new low of the current correction, the euro/dollar pair closed below the extreme of 0.9901, returning to the consolidation zone. Now, the bearish scenario is under question, whereas the bullish one neither has reasons to develop. The control levels are the same and a further movement of the pair highly depends on them. Thus, bears should break 0.9901 to revive the downtrend. Bulls should break the daily cross (1.0066 – 1.0124 – 1.0181) to receive support from the weekly short-term trend (1.0124).

H4 – H1

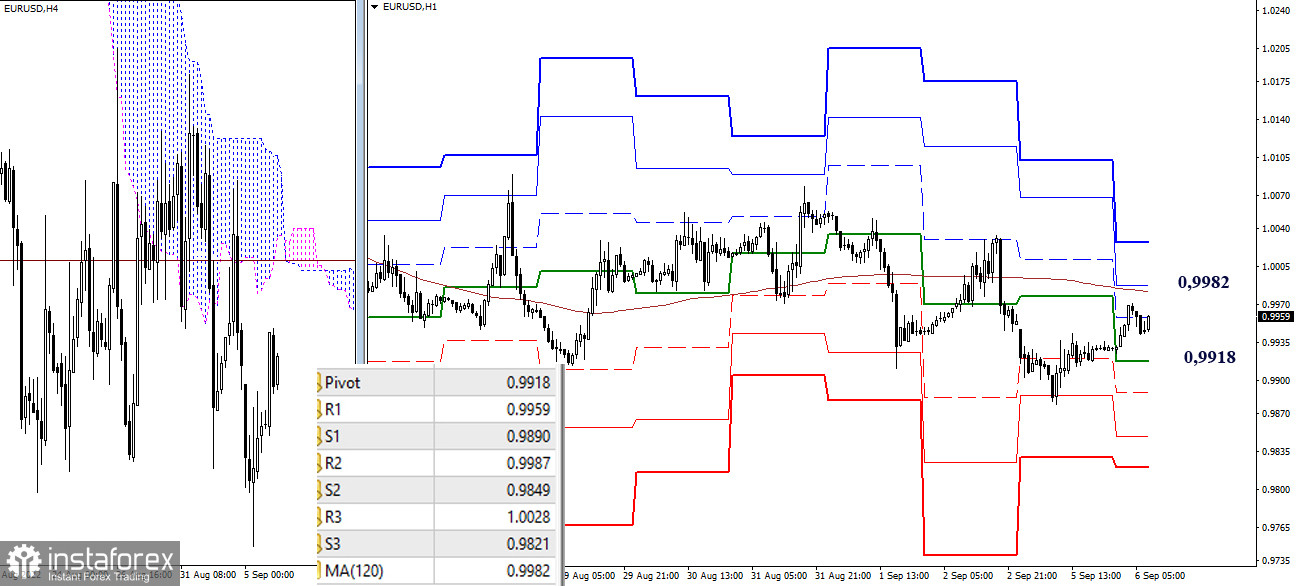

On smaller time frames, the euro/dollar pair is still in the zone of upward correction. Bulls managed to pass the main pivot point of 0.9918. That is why now they are focused on the resistance level of the weekly long-term trend (0.9982). If the price consolidates above this level, it may reverse, thus causing a change in the market sentiment to the bullish one. An additional target is located at 1.0028 (the final resistance of the pivot points). In case of bearish activity, the support levels will be located at 0.9918 – 0.9890 – 0.9849 – 0.9821.

***

GBP/USD

Big time frames

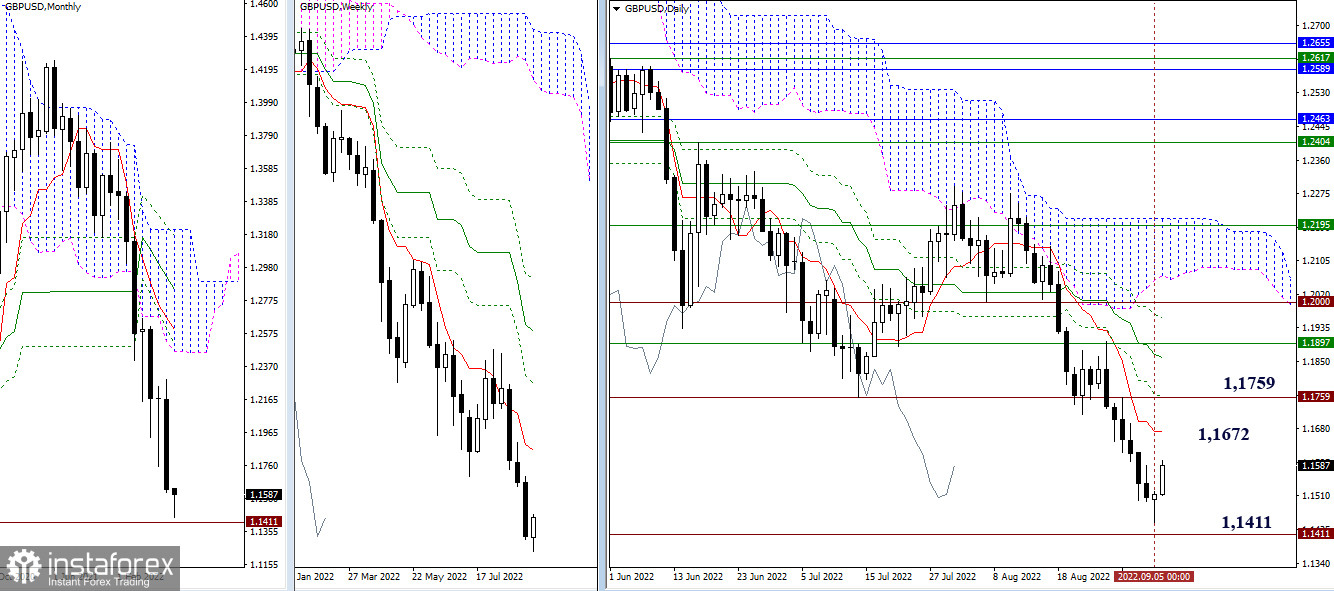

Yesterday, the price hit the support level of 1.1411 and began falling slower. Today, bulls are trying to regain control over the market and launch a fully-fledged correction. The nearest target is located at 1.1672. The next target is 1.1759 (daily Fibo Kijun + historical level).

H4 – H1

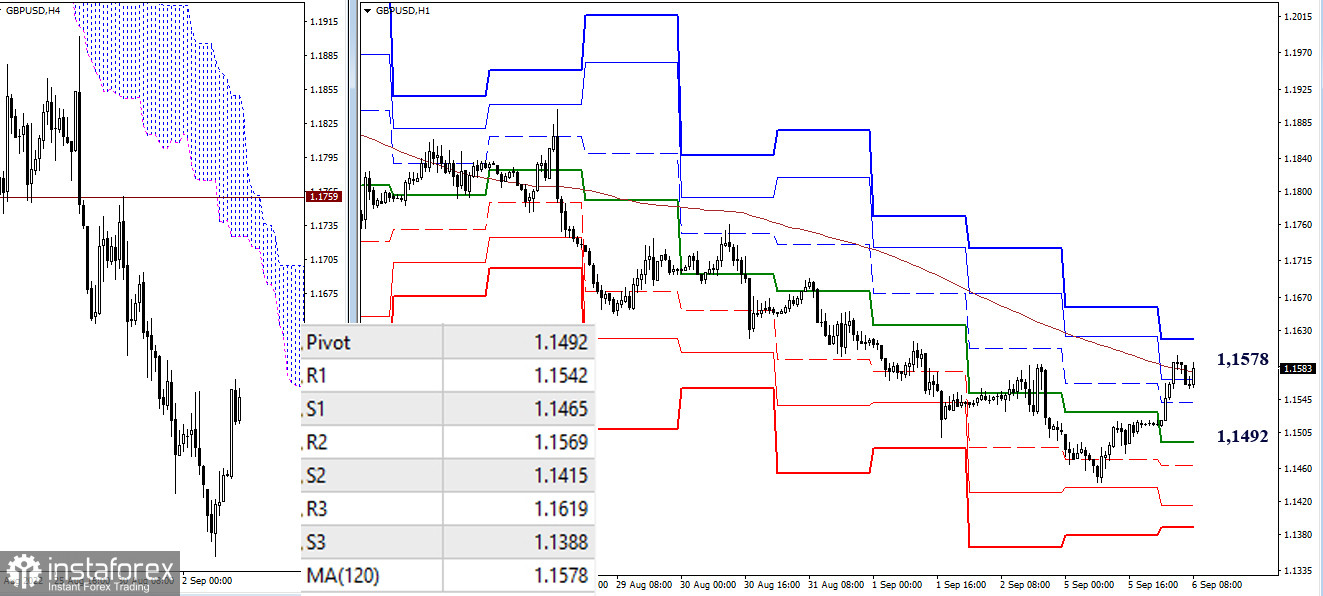

The upward correction spurred combat for the weekly resistance level of the long-term trend (1.1578). A breakout of the level and reversal of the pair may cause a change in the market sentiment. If the pair continues rising today, it may reach the R3 located at 1.1619. Then, it may climb to such levels as 1.1672 and 1.1759. If the market situation changes, bears may regain control over the market. The intraday support levels are located at 1.1492 – 1.1465 – 1.1415 – 1.1388.

***

The following tools were used for the technical analysis:

Big time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (classic) + Moving Average 120 (weekly long-term trend)