Market activity was noticeably lower than usual on Monday due to the holiday in the US. Local markets were closed and only electronic trading took place. Today, however, important economic data will be released, which fully reflect the negative situation in Europe.

According to the data presented, business activity in the service sector of Germany, the Euro area and the UK showed a decrease, with Germany and the eurozone's level below 50 points. This indicates lack of growth in the sector, which is important for the Western post-industrial economy. Attention was also drawn to the retail sales report in the Euro area, which declined 0.9% y/y and 0.3% m/m in July. The data prior to this was revised upwards to -1.0%.

In the wake of all these events, as well as the resumption of growth in oil prices in response to the unexpected decision of OPEC to slightly reduce the volume of production in order to keep prices near $100 per barrel, the European stock market lost all its positiveness and finished trading in different directions. The gloomy outlook for the European economy is back in the spotlight after the release of weak service PMI data. Additional negative was the decision to continue deliveries of natural gas to Europe only after the lifting of sanctions. This means that energy crisis can develop after the collapse of local industry, then proceed into a full-scale crisis with social consequences.

In terms of the forex market, nothing significant happened yesterday because of low trading volatility. The ICE dollar index, having tested the 110-point mark, failed to gain a foothold above, and is currently below this level. It is likely that players are anticipating the outcome of the ECB meeting this week, as well as the speeches of Christine Lagarde and Jerome Powell.

Today, the RBA raised its key interest rate by 0.50% to 2.35%, but did not cause any special movement in pairs with the Australian currency.

Ahead are reports on business activity in the construction sector of Germany and the UK, as well as the index of purchasing managers for the non-manufacturing sector of the US. The dynamics can set the tone for trading not only in the US, but also on other world trading floors. But there is a chance that the current situation is just the calm before the storm, which may arise after the ECB meeting and release of GDP data from a number of economically developed countries.

Forecasts for today:

EUR/USD

The pair is consolidating below 0.9975. A break of this level may lead to further growth towards 1.0050.

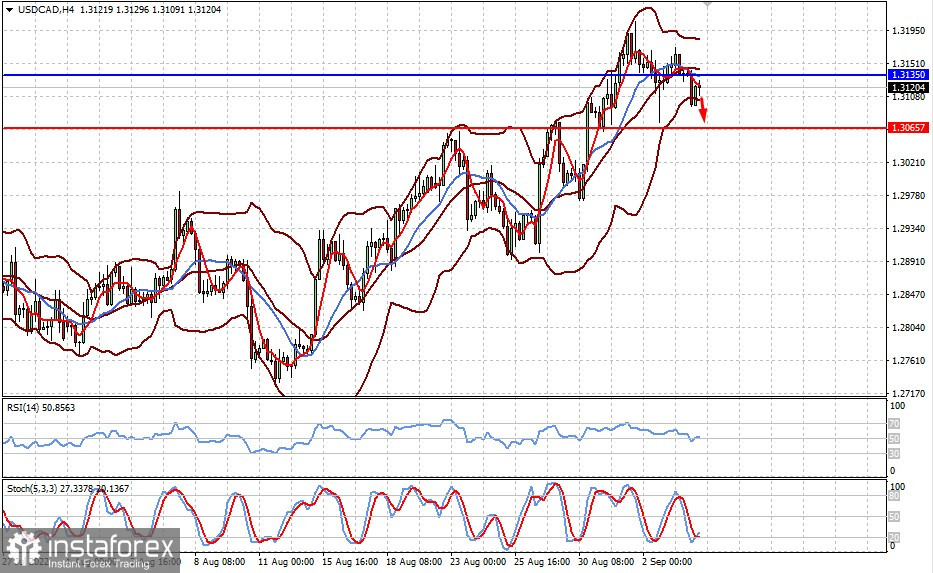

USD/CAD

The pair is trading below 1.3135. Continued growth in oil prices may put pressure on it, which will push the quote to 1.3065.