Even though the shock from the complete shutdown of the Nord Stream is gradually passing, shocking forecasts for the European economy and the functioning of the energy market in the euro area continue to put pressure on the euro. EURUSD's move towards parity ended in nothing, and the main currency pair again plunged into a wave of sales.

According to the EU, one of the measures to curb the rise in gas prices will be the suspension of energy trading on the stock exchanges. However, they themselves may stop if governments do not help companies contribute $1.5 trillion to maintain margin requirements. The lack of liquidity and its withdrawal from other transactions in order to comply with the rules of exchange trading is one side of the coin called the energy crisis.

The second and main one is the increase in heating bills. According to research by Goldman Sachs, electricity bills for European households will increase by €2 trillion by early 2023. At their peak, they will be equivalent to 15% of eurozone GDP. The bank believes that the market has underestimated and continues to underestimate the depth of the crisis and its impact on the economy. It will surpass the oil crisis of the 1970s in its scope.

The currency bloc is facing a deep recession, which, according to Governing Council member, Martins Kazaks, could reverse the ECB's rate hikes. The so-called dovish reversal puts further downward pressure on EURUSD and prevents bulls in the major currency pair from taking advantage of such bargaining chips as expectations of a 75 bps increase in borrowing costs in September and declining gas prices amid low pre-heating demand and fears of government and central bank intervention.

Dynamics of European gas prices

Trouble doesn't come alone. The euro is hit not only in Europe but also in North America, where, after rising at the end of the week, by September 2, US stock indices began another five-day sell-off. The market is revaluing the US employment report for August. It doesn't seem as bad as it used to. Indeed, employment continues to grow more rapidly than before the pandemic, as however, and the average wage. The Fed will have to continue the cycle of tightening monetary policy and keep the federal funds rate close to 4% for a very long time.

Thus, the further fate of EURUSD depends on the global appetite for risk and the extent of the recession in the eurozone economy. If it happens, of course. If not, the main currency pair will go into a correction. Although such a scenario now seems unlikely.

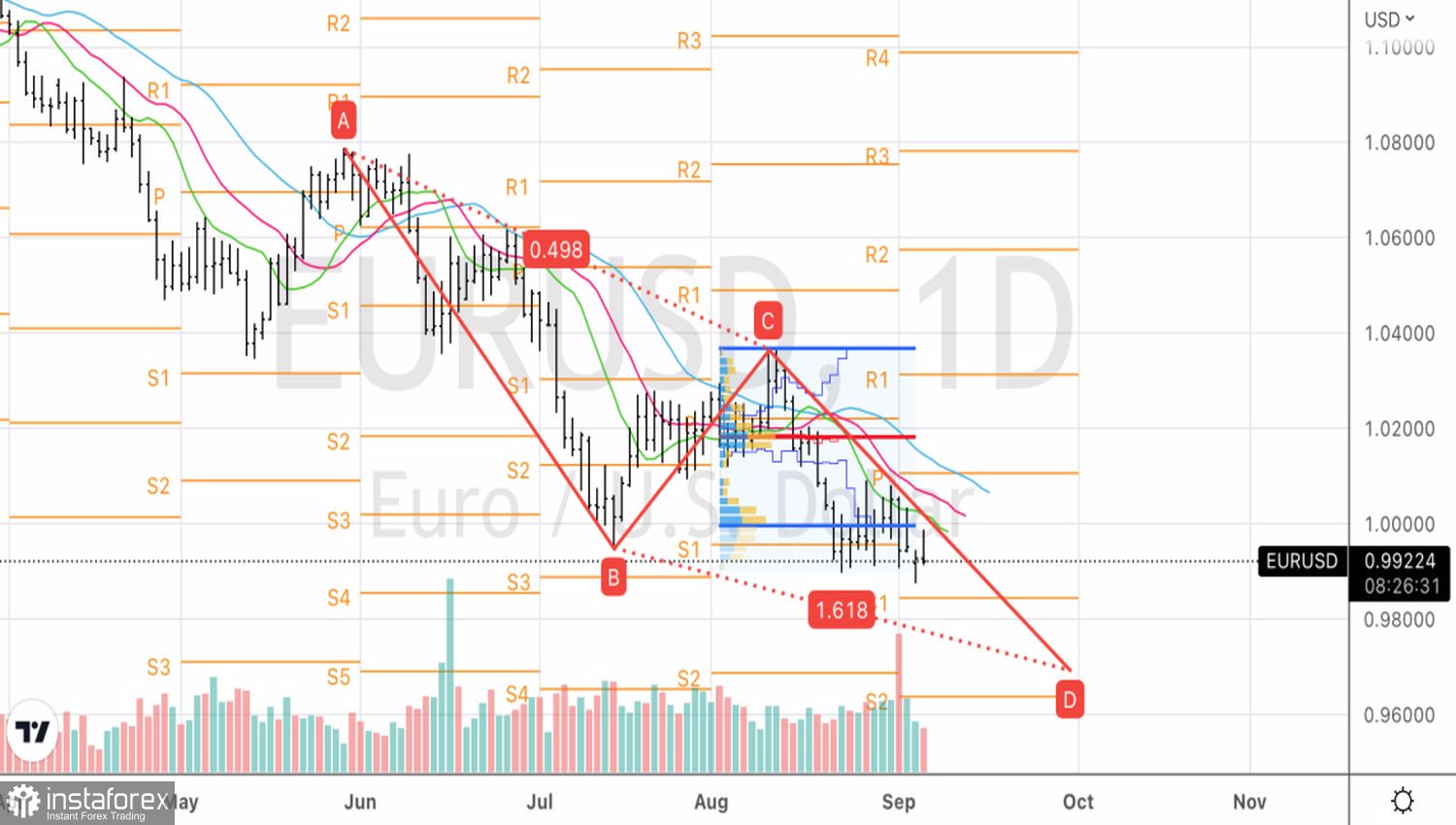

Technically, the idea of selling EURUSD on the rise while the pair is below parity wins back. The rebound from the pivot point at 0.998 allowed us to form shorts in the direction of the previously announced target at 161.8% according to the AB=CD pattern. We will increase them in case of a breakout of support at 0.9875 with a close below it.