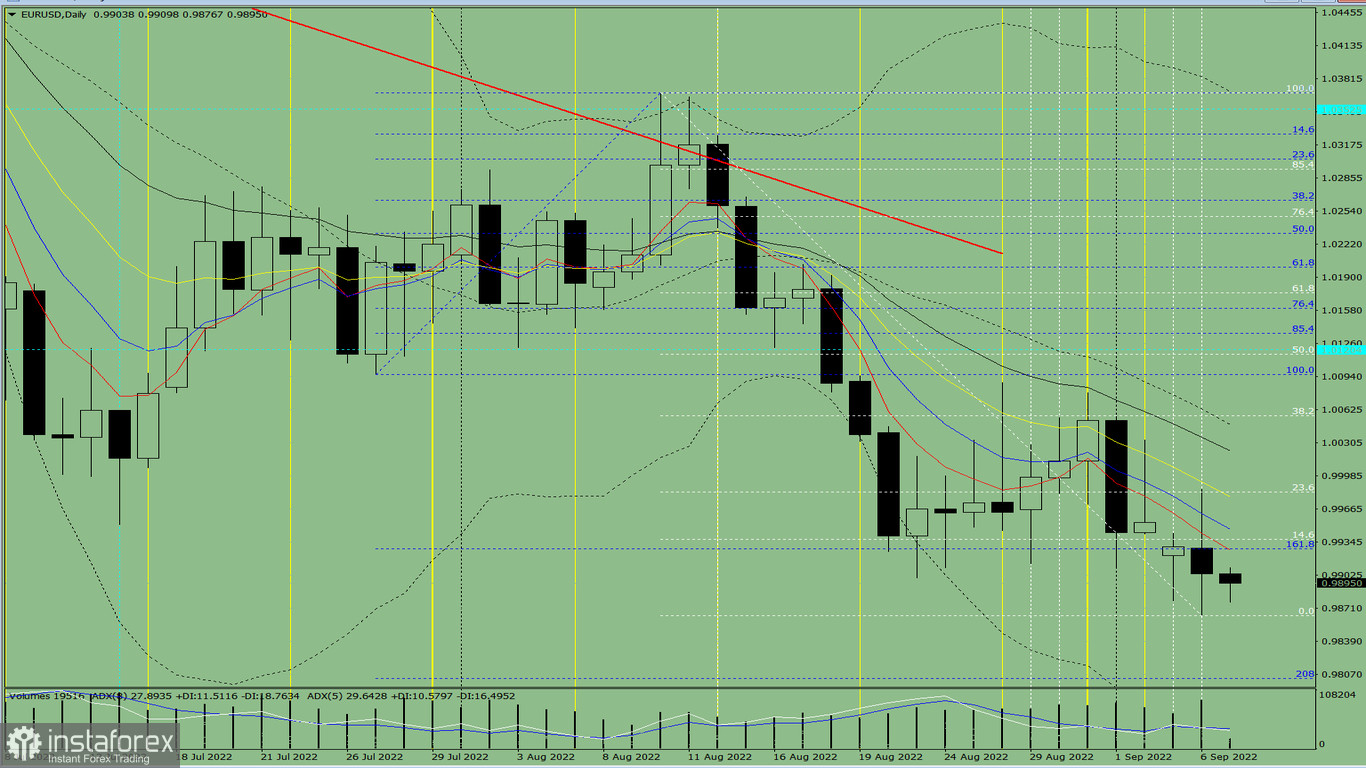

Trend analysis (Fig. 1).

The euro-dollar pair may move downward from the level of 0.9904 (close of yesterday's daily candle) to the target of 0.9864, the lower fractal (white dotted line). When testing this level, the price may move upward with the target of 0.9937, the 14.6% retracement level (white dotted line). After reaching this level, a continued upward movement is possible with the target of 0.9982, the 23.6% retracement level (white dotted line). Upon reaching this level, the price may move down.

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – down;

- Candlestick analysis – down;

- Trend analysis – down;

- Bollinger bands – down;

- Weekly chart – up.

General conclusion:

Today the price may move downward from the level of 0.9904 (close of yesterday's daily candle) to the target of 0.9864, the lower fractal (white dotted line). When testing this level, the price may move upward with the target of 0.9937, the 14.6% retracement level (white dotted line). After reaching this level, a continued upward movement is possible with the target of 0.9982, the 23.6% retracement level (white dotted line). Upon reaching this level, the price may move down.

Alternative scenario: from the level of 0.9904 (close of yesterday's daily candle), the price may move downward with the target of 0.9803, the 208.0% Fibonacci retracement level (blue dotted line). After testing this level, an upward movement is possible to test the lower fractal 0.9864 (white dotted line).