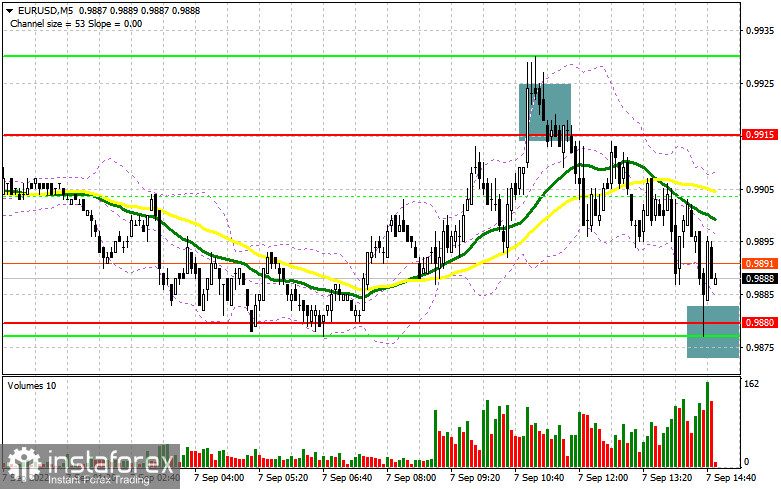

In my morning review, I outlined the level of 0.9915 as a good point for entering the market. Let's analyze the 5-minute chart. Strong macroeconomic data in Germany and the eurozone helped the bulls bring the price back to 0.9915. Yet, a false breakout of this level and a failure to settle above this range generated a sell signal and triggered a massive sell-off and a drop of 35 pips. As the pair is still trading within the channel formed in the morning, I left my strategy unchanged.

For long positions on EUR/USD:

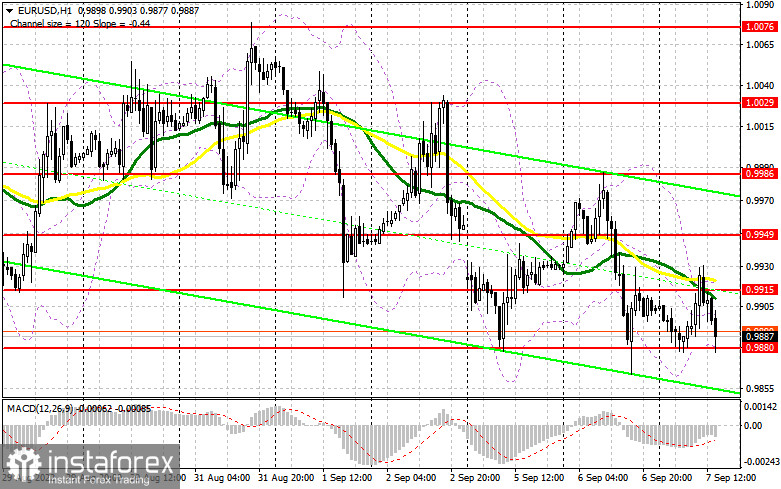

Today, markets may pay attention to the report on the US trade balance although its importance is minor for forex traders. At the same time, speeches by FOMC members Loretta Mester and Lael Brainard are far more significant. Their comments may prop up an already strong US dollar as both policymakers advocate for aggressive tightening and believe rates should stay above 4.0% for a long time. Bulls managed to fight back when the price tested 0.9880 for the first time. Yet, given a very weak movement, an upside correction is very unlikely. If the data from the US turns out to be positive, the second formation of a false breakout at the support of 0.9880 will create a good entry point for buying the pair, considering a return to 0.9915. A breakout and a downward retest of this range will definitely trigger stop-loss orders set by speculators. This will be another good moment to buy, keeping in mind a pullback to 0.9949. The resistance of 0.9989 will act as a more distant target where I recommend profit taking. If EUR/USD declines and bulls are idle at 0.9880 in the second half of the day, the pair will come under more pressure and stay in the descending channel formed on August 31. This will pave the way to new yearly lows. The best scenario for opening long positions will be a false breakout at 0.9849. You can buy EUR/USD right after a rebound from 0.9819 or lower near the parity level at 0.9770. Bear in mind an upside intraday correction of 30-35 pips.

For short positions on EUR/USD:

Sellers have reached all their targets in the first half of the day. Now they aim to retest the new yearly low that was formed yesterday. Hawkish comments by Fed officials will help bears reach their goal. Sellers still need to stay vigilant near the resistance area of 0.9915 and show more activity at 0.9880. If EUR/USD rises following the data from the US, the best moment to sell will be a false breakout near the level of 0.9915. This will generate a sell signal, and the euro may drop lower to 0.9880 in line with the main trend. This pair has tested this level in the European session. A breakout and consolidation below this range as well as its upward retest will create an additional entry point for going short. After that, the price may slide further to a new yearly low of 0.9849 where I recommend profit taking. The level of 0.9819 will serve as the next downward target. If EUR/USD advances in the afternoon and bears are idle at 0.9915 in the case of the downbeat data, it is better to consider sales near the next resistance of 0.9949. You can open short positions at this level only if there is a false breakout just like it happened in the first half of the day. It is advisable to sell EUR/USD right after a rebound from the 0.9986 high, or even higher from 1.0029, bearing in mind a possible correction of 30-35 pips within the day.

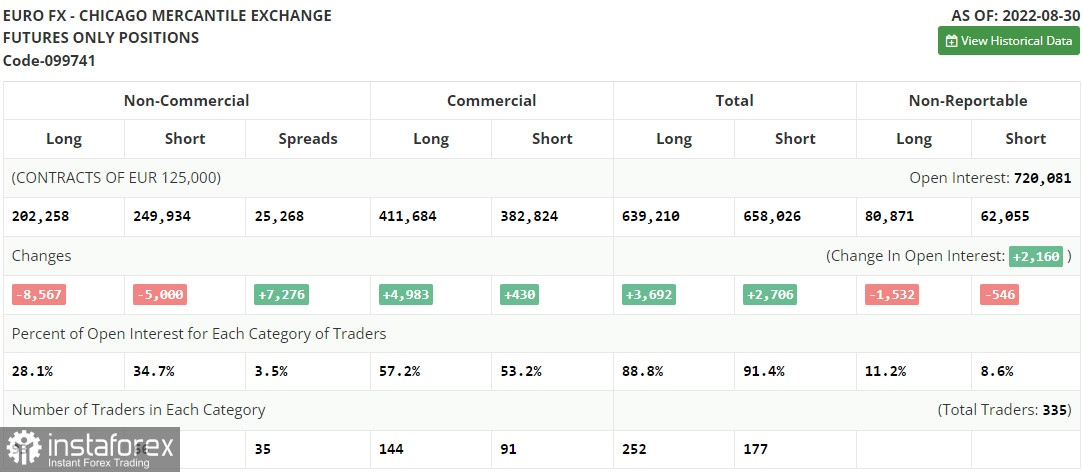

COT report:

The Commitment of Traders report for August 30 shows a decline in both short and long positions. A week ago, there was a spike in activity but now we can see a slowdown. This indicates higher risk aversion among traders after the publication of the inflation data in the eurozone. The report showed a record-high inflation rate for the past decade. The energy crisis makes the situation even worse as the flow of gas via the Nord Stream pipeline has been shut down. This will definitely trigger another price spike in winter and fuel already high inflation. Against this backdrop, the ECB will be forced to introduce more rate hikes and brace for the worst. This Thursday, the EU regulator will announce its decision on rates. As a result, the euro may weaken against its American rival. On the one hand, higher rates are viewed as a signal to higher yields. However, they also mean slower economic growth which is more important. Therefore, the euro is unlikely to recover in the medium term. According to the COT report, long positions of the non-commercial group of traders decreased by 8,567 to 202,258, while short positions dropped by 5,000 to 249,934. The weekly net position remained negative and declined to -47,676 from -44,109, signaling continuing pressure on the euro and its further depreciation. The weekly closing price went up slightly to 1.0033 from 0.9978.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 0.9880 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.