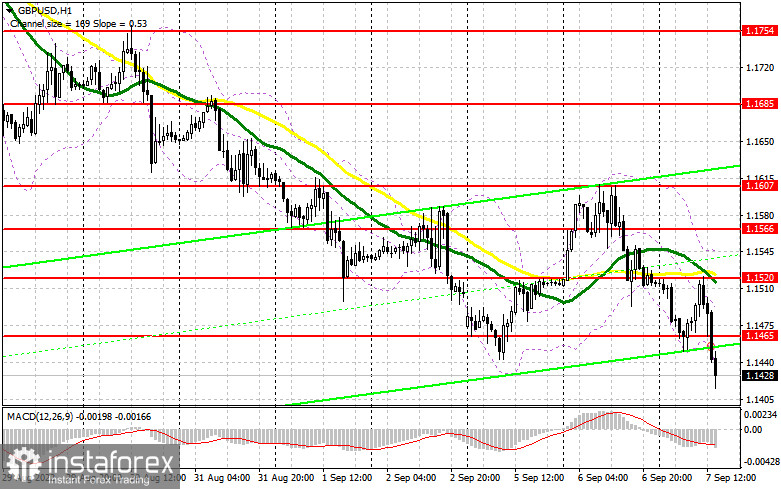

In the morning review, I turned your attention to 1.1509 and recommended making decisions with this level in focus. Let's analyze the 5-minute chart and try to figure out what actually happened. After a rise of the pound/dollar pair at the start of the European session, a false breakout at 1.1509 occurred. It gave a good sell signal within the trend. The pair dropped by more than 100 pips at the time of writing the article. For the second half of the day, the technical outlook was partially revised, as well as the trading strategy.

What is needed to open long positions on GBP/USD

The speech of the BoE Governor Andrew Bailey pushed the pound sterling down. The regulator is not going to abandon its hawkish stance. Some time ago, aggressive monetary policy would be a catalyst for a rise in the pound sterling. However, now, sharp rate increases may trigger a recession. In the afternoon, the trade surplus report is due. It may cause another wave of sell-off. However, the pair is highly likely to lose ground amid hawkish statements of FOMC policymakers Loretta Mister and Lael Brainard. In case of a further decline in GBP/USD, one should pay attention to the nearest support level of 1.1398. It will hardly help the bulls assert strength, especially after a breakout of the 2020 lows. Therefore, it is better to open long positions at this level only when a false breakout takes place. Apart from that, it would not be wise to trade against a bearish trend, looking for the bottom. If this scenario comes true, the pair may start a correction to the new resistance level of 1.1465 that was formed in the morning. The pair could advance to 1.1520 amid a breakout and a downward test of this level along with weak US economic reports. The moving averages are passing in negative territory at this level. A more distant target will be a high of 1.1566 where I recommend locking in profits. If GBP/USD falls and bulls show no activity at 1.1398, the pressure on the pair will only escalate. Below this level, a low of 1.1358 is located. It is better to open long positions at this level only if a false breakout occurs. You can buy GBP/USD immediately at a bounce from 1.1313 or a low of 1.1264, keeping in mind an intraday upward correction of 30-35 pips.

What is needed to open short positions on GBP/USD

Bears defended the level in the first half of the day, not allowing the pair to climb above the 1.500 level. The further trajectory will depend on the market's reaction to the US data and the statements of Fed members. Their remarks could have a significant impact on the pair, which will lead to a drop below the 1.500 level and a further fall in the trading instrument. Of course, it would be great if there is a sell signal from 1.1465. The pair may advance to this level in the afternoon if the Fed policymakers make dovish statements. A false breakout of 1.1465 will provide a sell signal with the prospect of a decrease to 1.1398. A breakout and an upward test of this level will generate an additional sell signal. The price is likely to decline to 1.1358 where I recommend locking in profits. A more distant target will be the 1.1313 level. If GBP/USD rises and bears show no energy at 1.1465, bulls will have a chance to start a correct and facilitate an upward movement. In this case, it is better to postpone short positions until a false breakout of 1.1520. It will give a sell signal. You can sell GBP/USD at a bounce from 1.1566 or a high of 1.1607, keeping in mind a downward intraday correction of 30-35 pips.

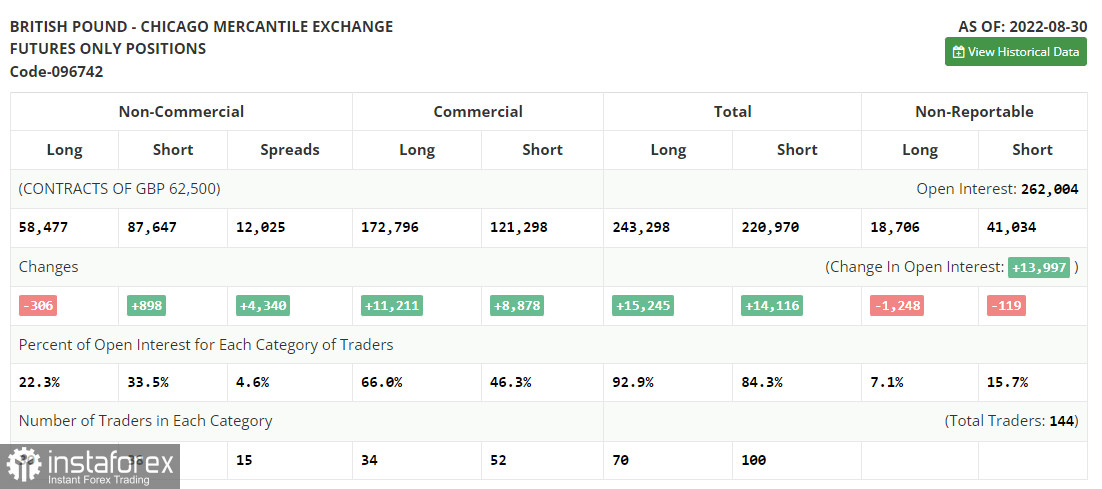

COT report

The CAT report (Commitment of Traders) for August 30 logged an increase in short positions and a drop in long ones. It proves the fact that the pound sterling is in the bears' claws. GBP/USD will remain under pressure in the future because the UK economy is dealing with internal headwinds. The UK GDP has been shrinking. The election of the new Prime Minister will provide the pound sterling only with short-term support because a new politician at the helm of the British government will hardly improve the economic situation. The US economy, on the contrary, remains resilient. The latest US Nonfarm payrolls assured investors that the Fed would stick to aggressive tightening. This will escalate pressure on the pound sterling which has been facing strong bearish pressure due to the worsening economy. Traders are unwilling to buy the pound sterling because of high inflation expectations and the looming crisis of the living cost in the UK. A series of weak fundamental reports will follow ahead. So, the pound sterling is likely to decline below the current levels. According to the last COT report, the number of long non-commercial positions dropped by 306 to 58,477 whereas the number of short positions grew by 898 to 86,647. It led to a minor increase in the negative non-commercial net positions to -29,170 against -27,966. GBP/USD closed on Friday much lower at 1.1661 versus 1.1822 a week ago.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, signaling a further drop in the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's upper border at 1.1540 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.