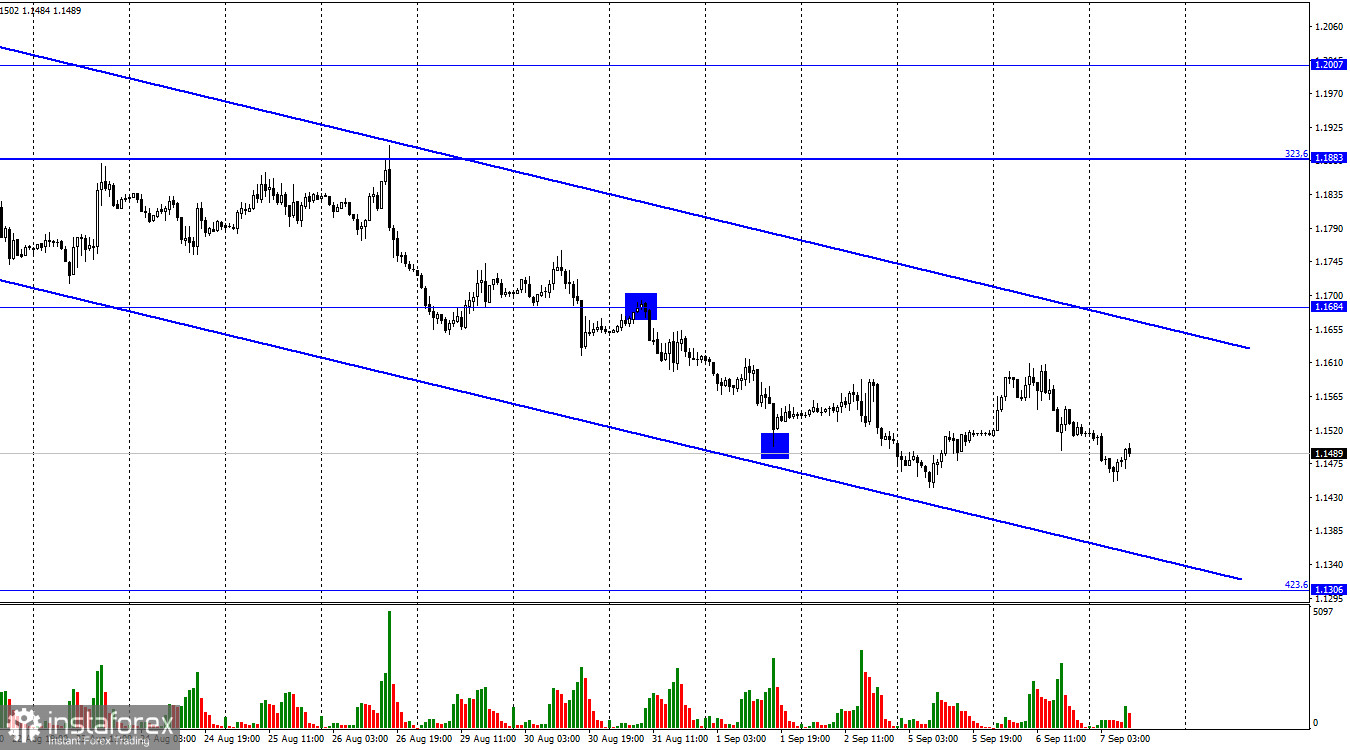

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the US dollar and resumed falling toward the corrective level of 423.6% (1.1306). There are very few important events in the UK and the US this week. The ISM business activity index was released yesterday, which again surprised and exceeded traders' expectations, amounting to 56.9 points. One could say that the dollar has grown because of this indicator, but the dollar has been growing almost constantly in recent months, even on days when there are no economic statistics. Today, the Governor of the Bank of England, Andrew Bailey, will give a speech in Britain, which may be interesting. Recently, traders have been confused about their expectations for various indicators of the UK economy. Forecasts have already begun to arrive that inflation could significantly exceed 15%.

There is no information on the final increase in the Bank of England's interest rate. Given the approaching energy crisis, it is unclear how much British GDP may decline. How much oil and gas prices will rise this winter – even more so. Due to the complete uncertainty, traders prefer to deal with the currency, the possession of which carries the least risks. The US dollar has been growing for quite a long time and is a reserve currency. Thus, traders logically choose it for purchases, not the euro or pound. In light of this conclusion, it seems that the US currency's growth will continue until something in the global economy changes dramatically. For example, the conflict in Ukraine will end, economic relations between Russia and the West will improve, the Fed will stop raising interest rates, and the recession will not begin or end quickly. It is obvious that with the current information background, traders are not ready to buy risky European currencies. And Andrew Bailey can at least clarify the situation with the future of the British economy today. But for sure, he will be pessimistic, as before.

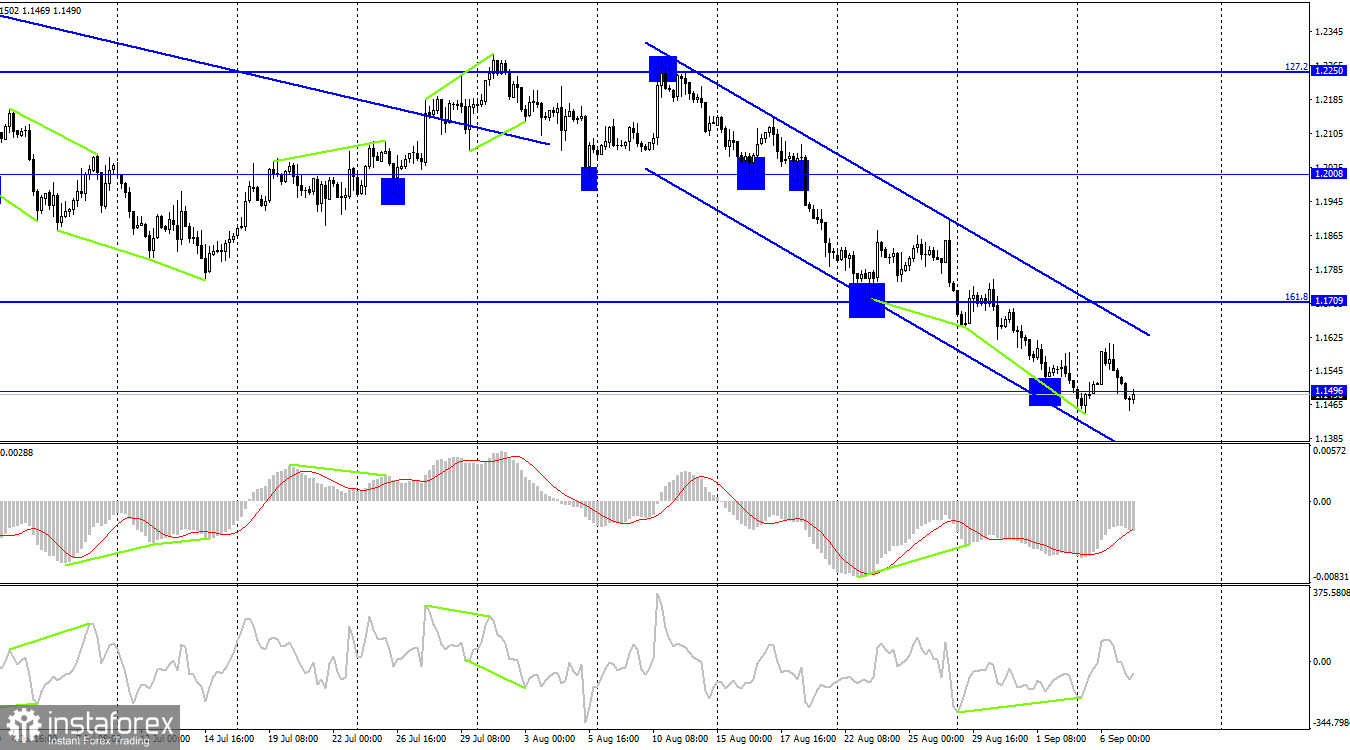

On the 4-hour chart, the pair reversed in favor of the US currency and resumed the process of falling with consolidation below the level of 1.1496. Thus, the falling quotes may continue toward the next corrective level of 200.0% (1.1111). A new "bullish" divergence is brewing in the MACD indicator, which may work again in favor of the British. The downward trend corridor continues to characterize the mood of traders as "bearish."

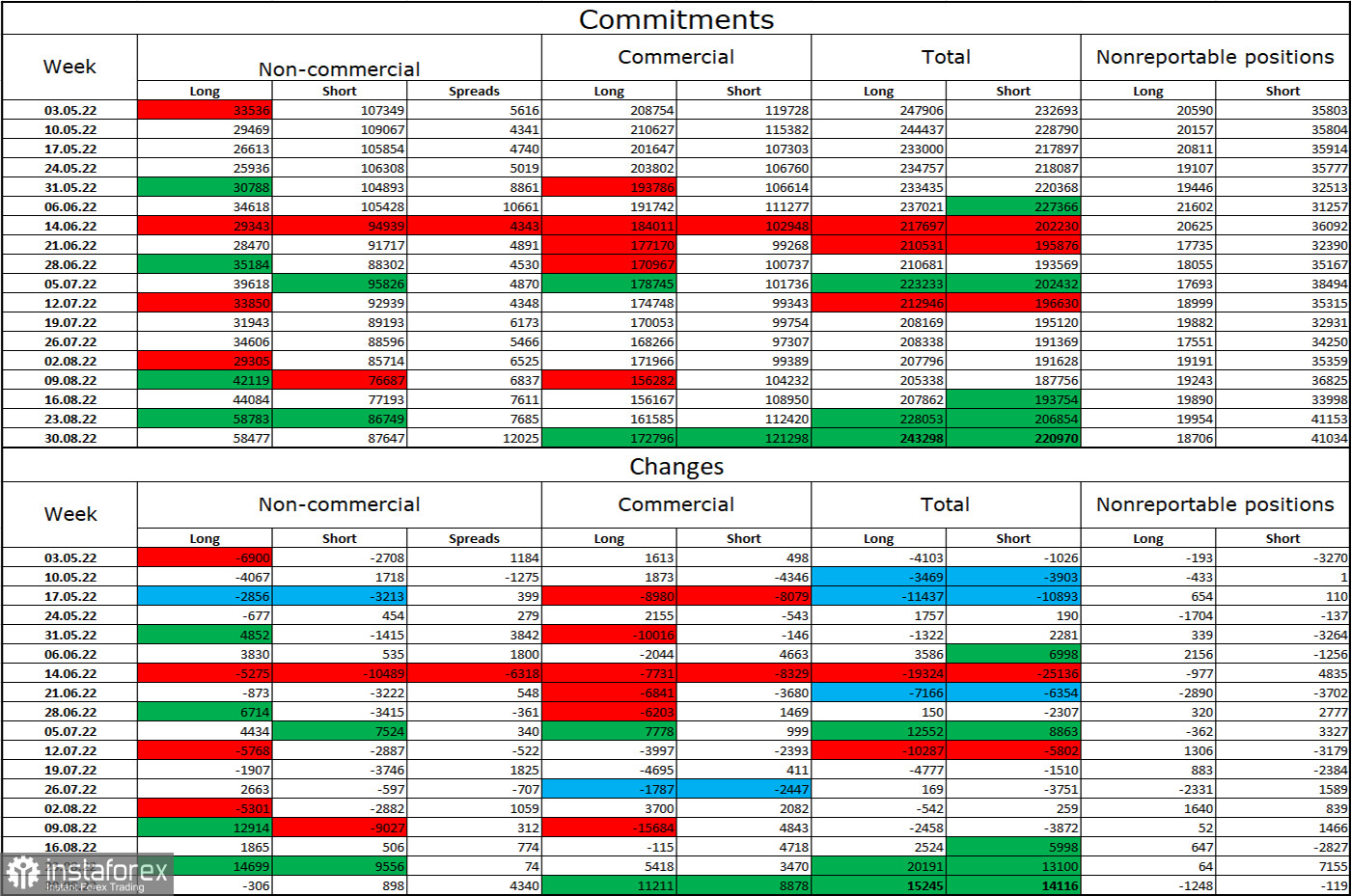

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become a little more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 306 units, and the number of short contracts increased by 898. Thus, the general mood of the major players remains the same – "bearish," and the number of short contracts still exceeds the number of long contracts, but much less than before. The big players stay in the pound sales for the most part, and their mood is gradually changing towards "bullish," but this process is still very far from completion. The pound itself has resumed falling, and COT reports so far make it clear that the pound is more likely to continue it than to start a long upward trend now.

News calendar for the USA and the UK:

UK – speech by the head of the Bank of England Bailey (09:00 UTC).

On Wednesday, the calendars of economic events in the United States and Britain contain one interesting entry for two. In the near future, Andrew Bailey's performance will begin, a rather rare event. And therefore important. The influence of the information background on the mood of traders may be average in strength today.

GBP/USD forecast and recommendations to traders:

I recommended selling the British at a close under 1.1684 on the hourly chart with a target of 1.1496. This level has been worked out. New sales of the British – at the close under 1.1496 with a target of 1.1306. I recommend buying the British when the pair's rate is fixed above the descending trend corridor on the hourly chart with a target of 1.1883.