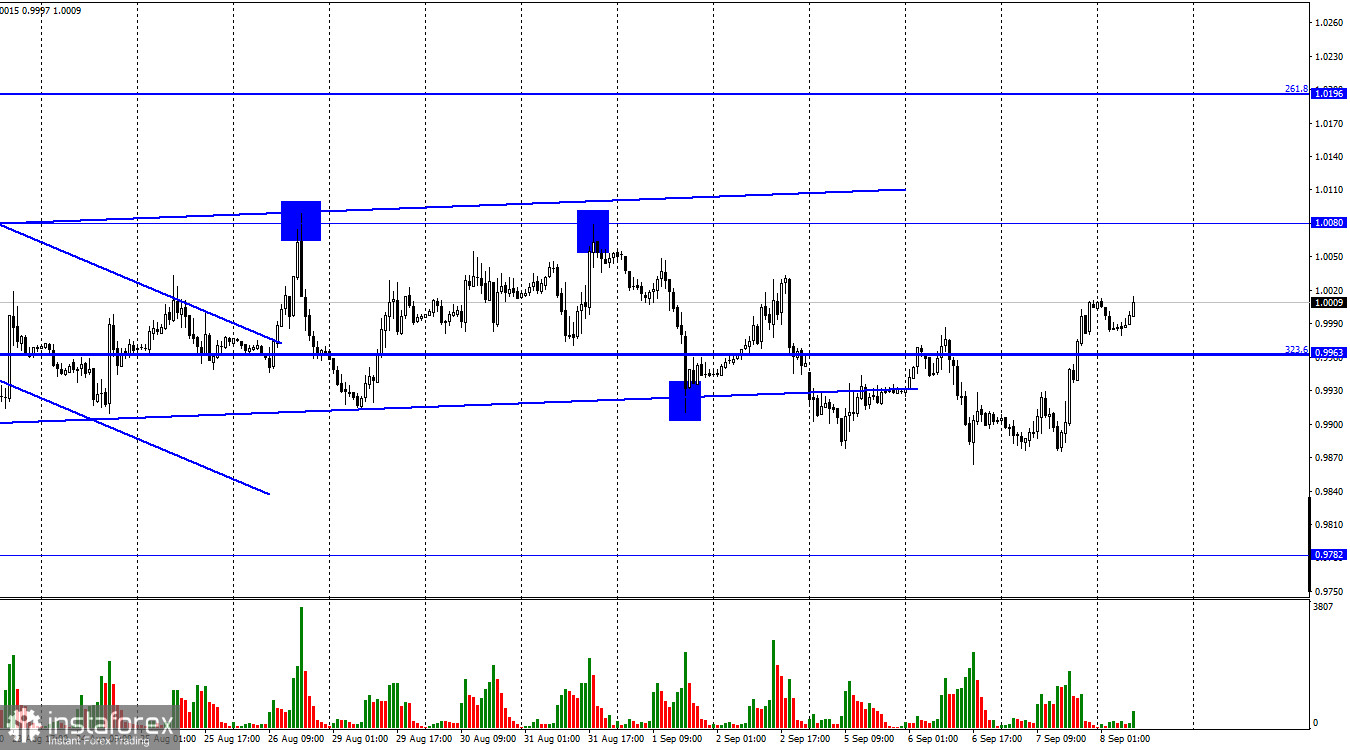

The EUR/USD pair reversed in favor of the European currency on Wednesday and rose above the corrective level of 323.6% (0.9963). Thus, the growth process can continue in the direction of the 1.0080 level, based on graphical analysis. However, today the graphical analysis may not be of much importance since, in a few hours, the results of the meeting of the European Central Bank will be known. Over the past two weeks, the probability of an interest rate hike in September has been steadily growing. If a month ago there were only rumors that the ECB could raise the rate for the second time in a row, two weeks ago, there were disagreements on how much the ECB would raise the rate, and now, traders have little doubt that the rate will rise by 0.75%. Perhaps yesterday's growth of the euro currency was associated with these expectations. However, I do not believe it since the British pound also showed growth yesterday, and the euro/dollar pair has been swinging from side to side for several weeks.

Thus, a correct explanation would be as follows: traders are waiting for the results of the ECB meeting, and at this time, the bears are not ready for new sales. The bears are holding the market in their hands now, as the pair remains near its lows for 20 years. The demand for the dollar is not falling, and the demand for the euro is not growing. But the bears do not increase the demand for the dollar, which is why the pair has been moving only in a limited zone for three weeks. Today it can get the necessary momentum. It is difficult to predict how traders will react to the results of the meeting, but you can count on strong movements during the day. Christine Lagarde's speech at the press conference will also be important, as her statements about the regulator's future actions are now expected. It remains unclear whether the ECB will fight high inflation to complete victory, or are the current measures to stop inflationary growth? If a signal is given that it is ready to raise the rate as much as necessary, the euro currency can get a boost for its growth.

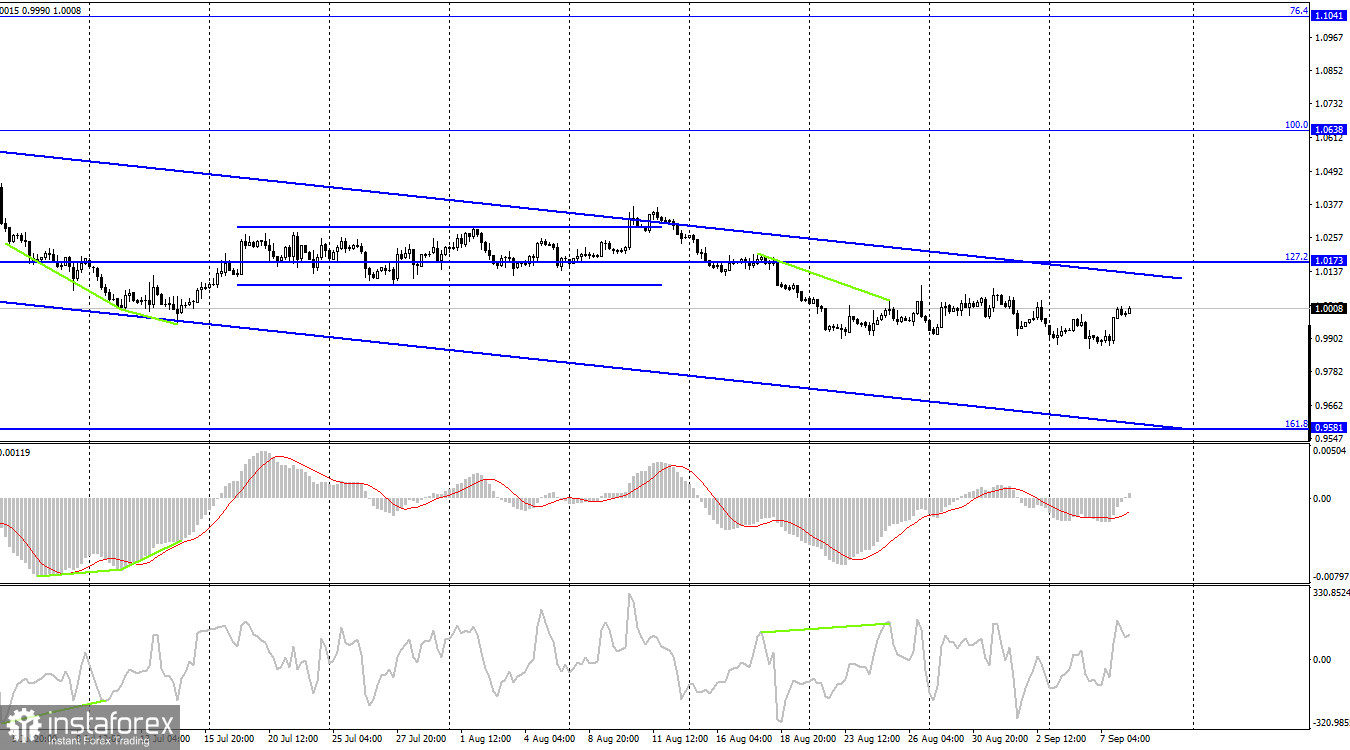

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). Thus, the process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). The downward trend corridor still characterizes the mood of traders as "bearish." No new emerging divergences are observed in any indicator today.

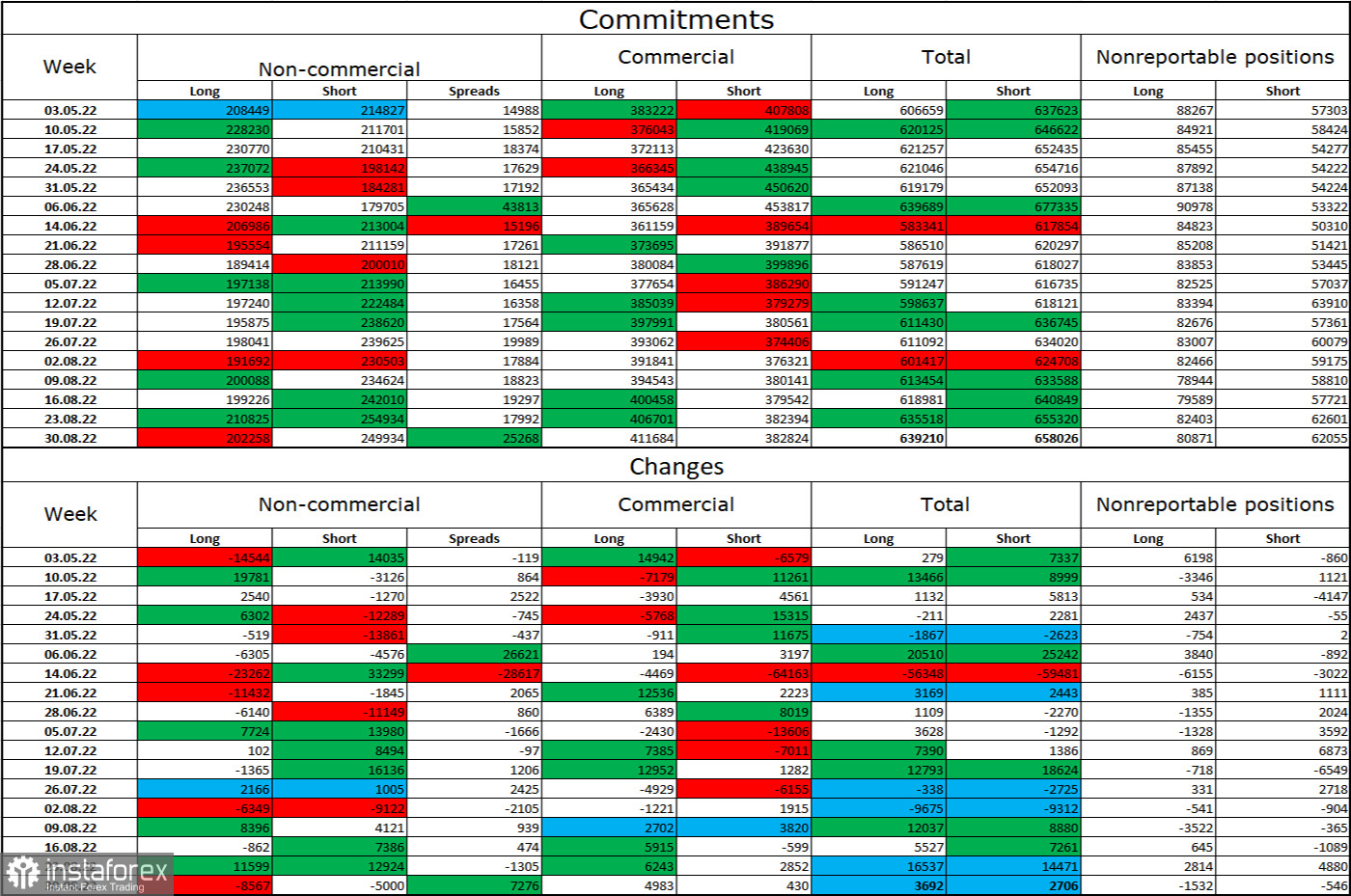

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 8,567 long contracts and 5,000 short contracts. This means that the "bearish" mood of the major players has intensified again, and the total number of long contracts concentrated in the hands of speculators now amounts to 202 thousand, and short contracts – 249 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last seven to eight weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to continue the fall of the euro-dollar pair, judging by the COT data.

News calendar for the USA and the European Union:

EU - ECB's decision on the interest rate (12:15 UTC).

EU - ECB monetary policy statement (12:15 UTC).

US - speech by the head of the Fed, Mr. Powell (13:10 UTC).

EU - ECB President Lagarde will deliver a speech (14:15 UTC).

There will be a lot of important events on September 8. I have already mentioned the ECB meeting and Christine Lagarde's speech, but there will also be a speech by Jerome Powell between these events. The influence of the information background on the mood of traders today can be very strong.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when rebounding from the 1.0080 level on the hourly chart with a target of 0.9900. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.