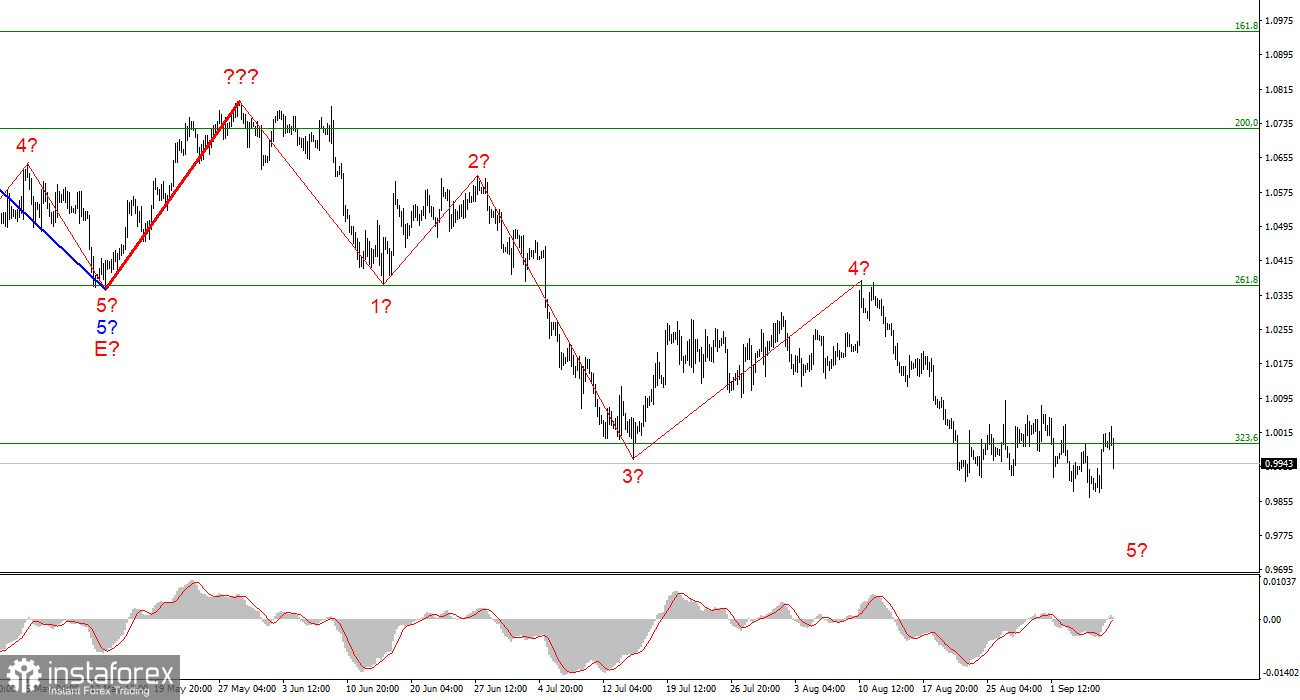

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments and does not even change, although wave 4 turned out to be longer than I expected, and now the construction of wave 5 is also delayed. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. There are no grounds to assume the completion of the downward trend segment yet. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will continue with the targets located below the 1.0000 mark within wave 5. Wave 5 can take almost any length since wave 4 turned out to be much longer than wave 2 – the waves acquire a more extended form as the downward trend section is built. However, I note that the low of wave 5 is below the low of wave 3, so this wave can complete its construction at any time. And with it, the entire downward section of the trend.

The US GDP is growing, the rate is rising, and the euro is falling.

The euro/dollar instrument declined by 50 basis points on Thursday at the time of writing. Remember that a decrease in the instrument means a fall in the euro and a rise in the dollar. Thus, the market reacted to the ECB meeting with new sales of the European currency, and today the regulator raised the interest rate by 75 basis points. At any other time, I would forecast that with such a strong tightening of monetary policy, we should expect a strong increase in demand for the European currency. However, times are different now, and almost any news background leads only to the fact that demand for the euro is declining. The euro has been holding up pretty well in the last few weeks, without heavy losses. But it seems that this will not continue for long. Wave 5, though delayed, does not look completely completed and completed yet.

A press conference with Christine Lagarde is important for the market today. It has already begun, but the ECB president's statements are not yet known. I can assume that her statements will be the same as or similar to Jerome Powell's earlier statements. The ECB has moved into fighting inflation, so Lagarde will surely assure the markets that the regulator will continue to raise the rate to return the CPI to 2%. Lagarde can also speak about gas prices, which can cause a gas crisis in the European Union and create additional economic problems. It should be understood that an increase in the rate itself causes a significant blow to economic growth. Suppose, at the same time, energy prices are also rising, which the European Union buys in large volumes in other countries. In that case, government spending is also growing, and household spending is also growing. And wages are not growing at the same pace. Therefore, we are talking about a decrease in the real incomes of Europeans and a deterioration in living standards. It seems to me that there will be little optimism in Christine Lagarde's speech.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. So far, I do not see a single signal indicating this wave's completion.

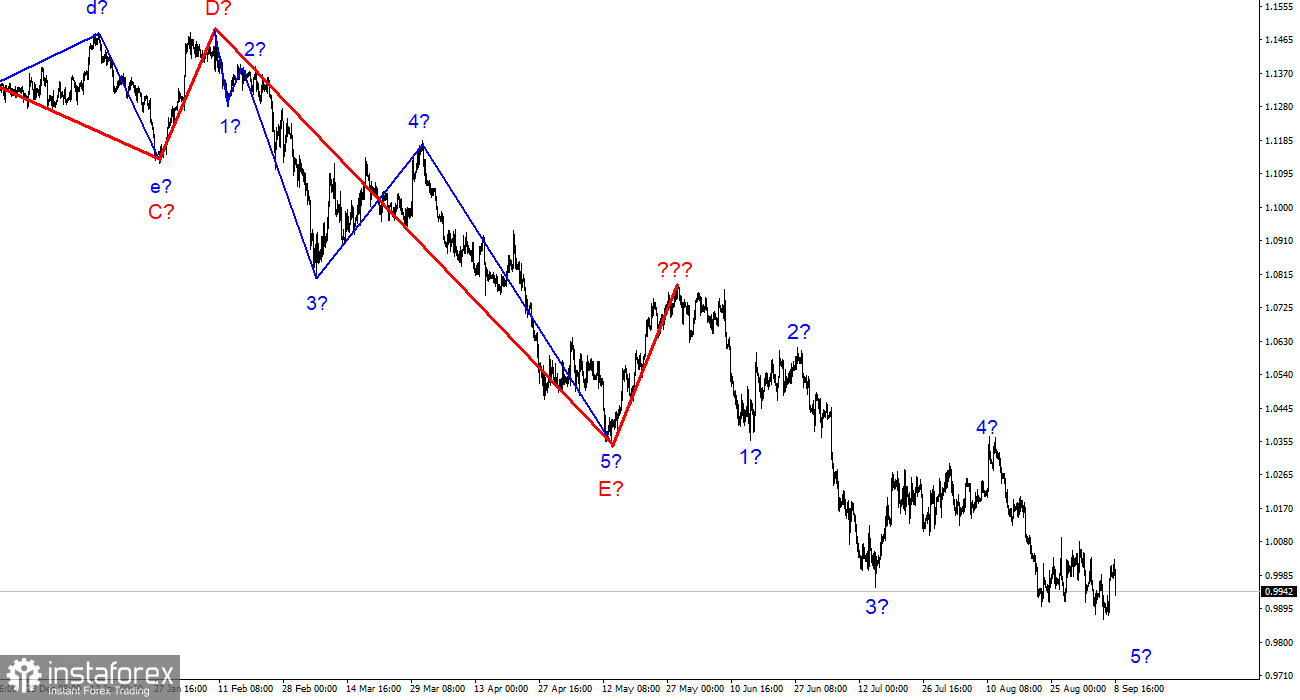

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them.