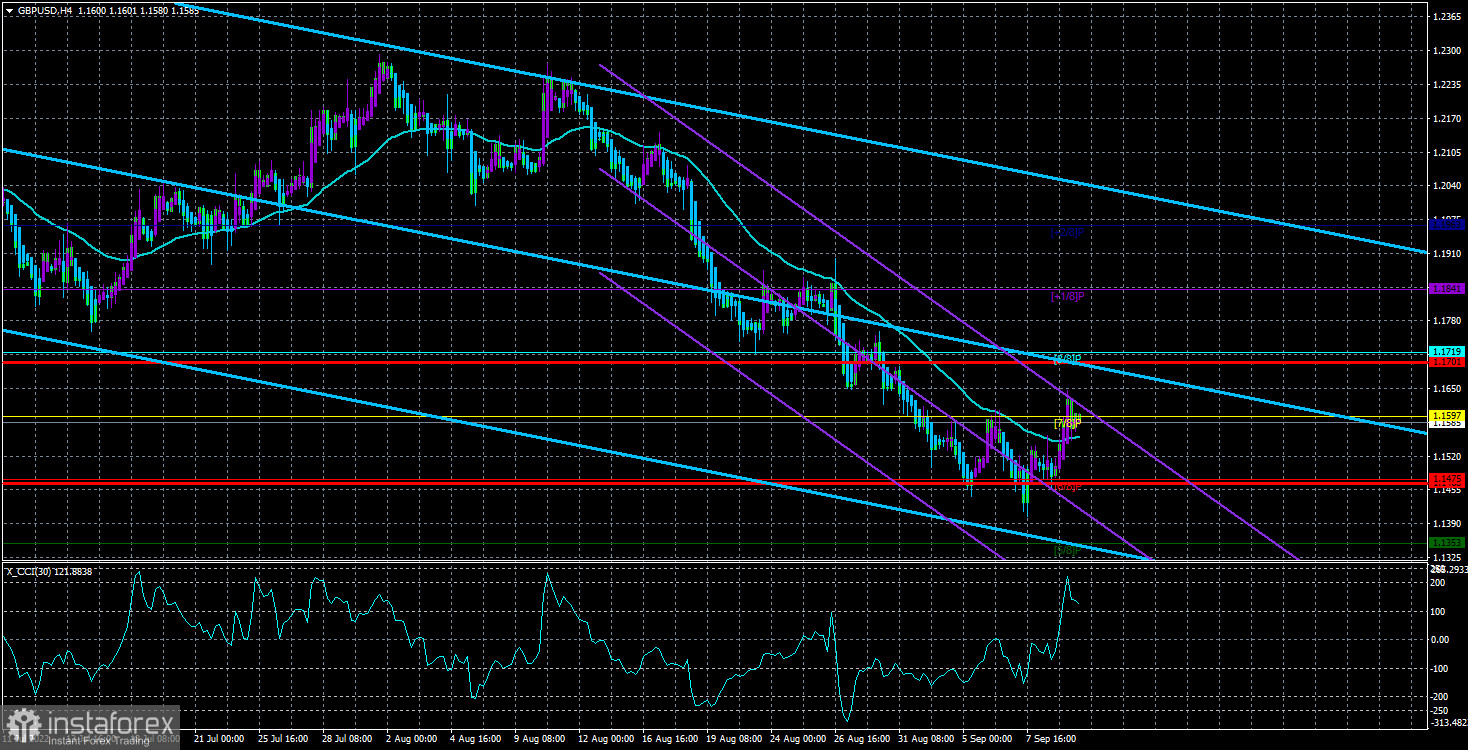

The GBP/USD currency pair ended last week above the moving average. This opens up certain growth prospects since the price has not been above the moving average line for a month. Yes, the pound has been in a downward rally for a whole month, during which it lost more than 800 points and updated its 37-year lows. So now is a pretty good time to correct it. If the European currency has been trading on a "swing" for three weeks, then the pound has not been falling but has been actively falling. Therefore, we believe the pound has even more reasons for growth now than the euro. At the same time, there is still no talk of ending the downtrend. The logic here is simple. First, the pair also failed to show strong and sharp growth after updating their lows over the past decades. Second, the fundamental background remains unfavorable to the pound. Thirdly, we do not believe that a few points, by which the price has gone below the level of 1.1411, will end.

The euro and the pound have been heavily oversold for a long time. But everything will depend on the market and its mood, not technical indicators. The pound can be oversold any number of times and continue to fall simultaneously. Now it is quite difficult to say whether there is any one factor or a set of factors that put pressure on this currency. There are many factors, and many of them can no longer be interpreted unambiguously. For example, power has changed in the UK, and the new Prime Minister, Liz Truss, may make several high-profile decisions at the beginning of her term. The Bank of England will raise the rate for the seventh time in a row this month, and this moment will not be ignored, but once again: everything will depend on traders' actions.

There will be no excess of macroeconomic statistics.

There will be enough important and interesting events this week. However, it is unclear how many will interest the market and how many will be followed by a reaction. For example, a GDP report for July will be published in the UK today. The indicator may show growth, but this is not a quarterly value but a monthly one. Usually, the market does not pay attention to it. A report on industrial production will also be published, rarely producing a reaction. Reports on unemployment, wages, and the number of applications for unemployment benefits will be released on Tuesday, as well as a speech by Andrew Bailey. However, unemployment may remain at 3.8%, and wages and applications are not the reports you need to wait for with trepidation and hope. Therefore, in the first two days, the most important event will be the speech of the head of the Bank of England. But on Wednesday, undoubtedly, the main report of the week in Britain will be released – on inflation for August. The consumer price index is expected to grow from 10.2% to 10.6% y/y. If so, then the reaction of traders to this report could be very strong. Another report on retail sales in August will be released on Friday.

In the US, Monday will be boring, but on Tuesday, the inflation for August will be published. Forecasts suggest that the index will decline from 8.5% to 8.1%. If the forecasts come true, the Fed will have more reason to raise the rate by 0.5% in a week rather than by 0.75%. However, we still believe that the FOMC will not reduce the pace of tightening. On Thursday, retail sales, applications for unemployment benefits, and industrial production were not the most important reports in the current circumstances. On Friday, the consumer sentiment index from the University of Michigan. All the reports we called "not the most important" can provoke a market reaction. But this reaction can be 20-30 points. They are interesting as possible pair reversals, but the movements after these data are unlikely to allow traders to earn. Nevertheless, we have important inflation reports this week and many speeches by ECB representatives.

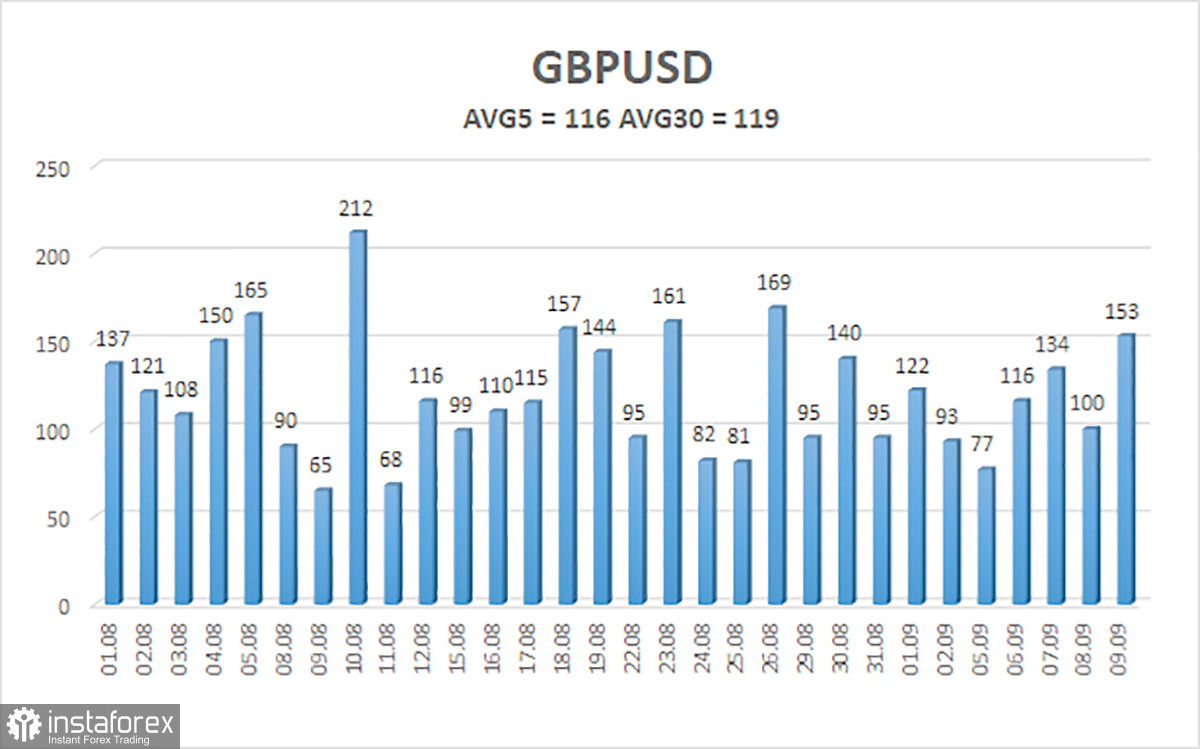

The average volatility of the GBP/USD pair over the last 5 trading days is 116 points. For the pound/dollar pair, this value is "high." On Monday, September 12, we expect movement inside the channel, limited by the levels of 1.1468 and 1.1701. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair has overcome the moving average on the 4-hour timeframe and will try to show new growth this week. Therefore, at the moment, you should stay in buy orders with targets of 1,1701 and 1,1719, which should be held until the Heiken Ashi indicator turns down. Sell orders should be opened when anchoring below the moving average line with targets of 1.1468 and 1.1411.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.