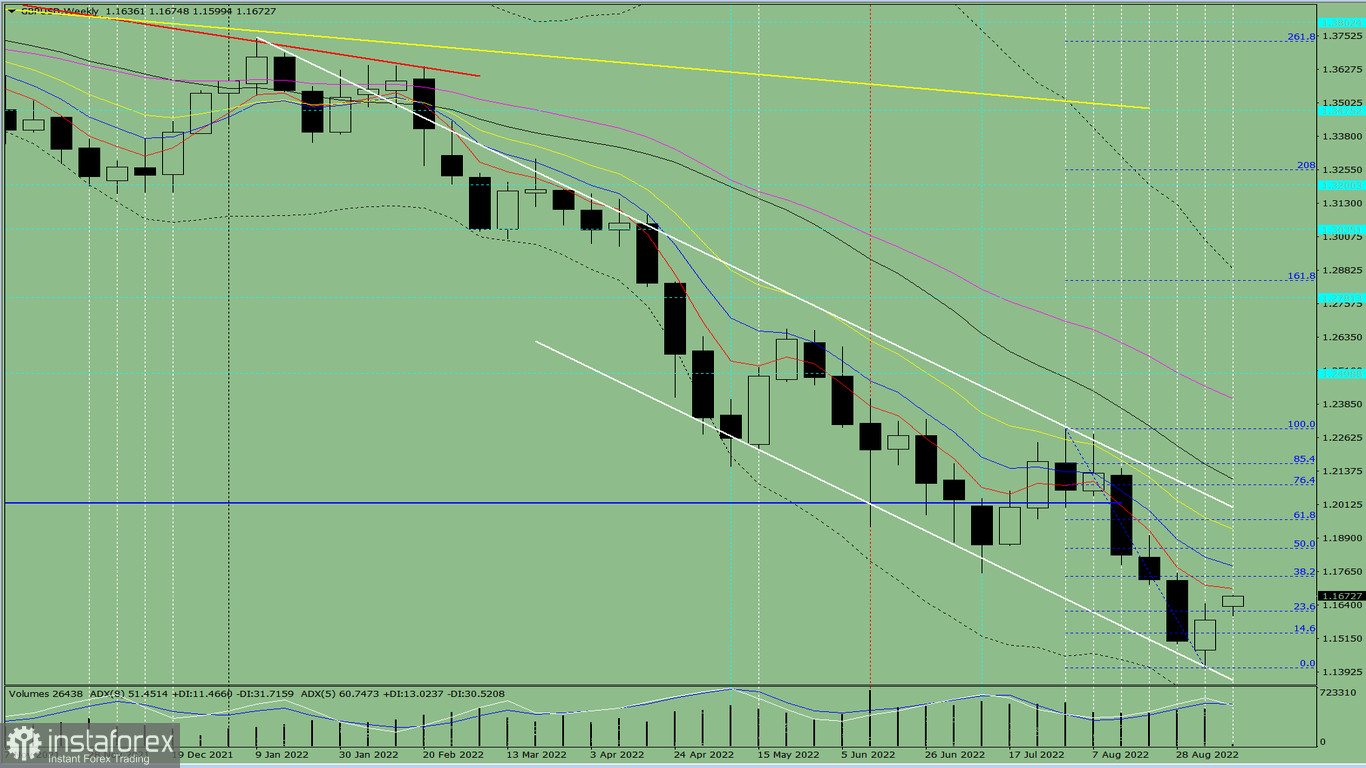

Trend analysis

GBP/USD will continue rising this week, starting from the closing of the last weekly candle at 1.1585 to the 38.2% retracement level at 1.1746 (dashed blue line). After that it will move higher to the 50.0% retracement level at 1.1850 (dashed blue line), then fall back to the 8 EMA at 1.1783 (blue thin line). Further upward move is possible from this level.

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - uptrend

Fibonacci levels - uptrend

Volumes - uptrend

Candlestick analysis - uptrend

Trend analysis - uptrend

Bollinger bands - downtrend

Monthly chart - uptrend

All this points to an upward movement in GBP/USD.

Conclusion: The pair will have a bullish trend, with no first lower shadow on the weekly white candle (Monday - up) and no second upper shadow (Friday - up).

So during the week, pound will climb from 1.1585 (the closing of the last weekly candle) to the 38.2% retracement level at 1.1746 (dashed blue line), go further up to the 50.0% retracement level at 1.1850 (dashed blue line), then fall back to the 8 EMA at 1.1783 (blue thin line). Further upward move is possible from this level.

Alternatively, quotes could increase from 1.1585 (closing of the last weekly candle) to the 38.2% retracement level at 1.1746 (dashed blue line), then roll back down to the upper fractal at 1.1665 (weekly candle from 09/04/2022). The pair may continue to rise from this level.