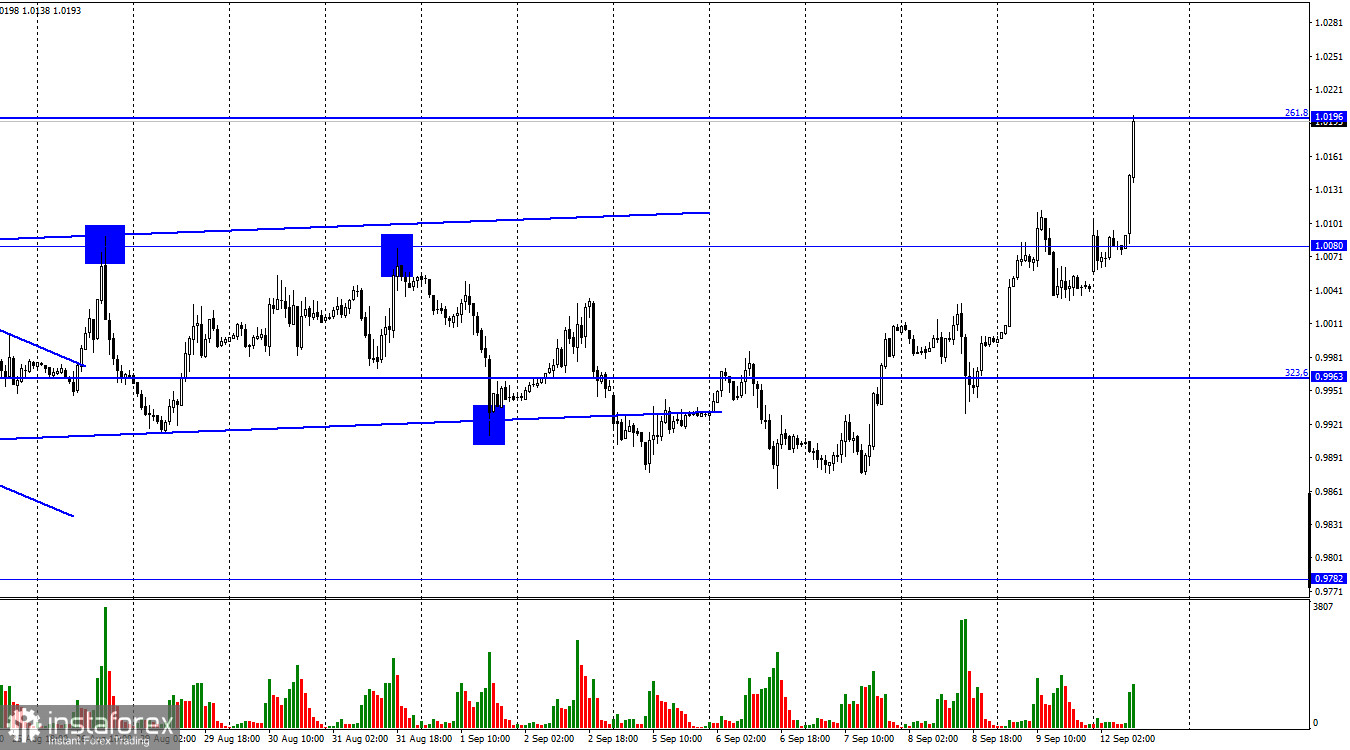

Hi, dear traders! EUR/USD extended its growth on Friday. It has grown to 1.0196 which matches the 261.8% Fibonacci correction today. The single European currency surged 105 pips just in two hours in the morning! A drop off 1.0196 might be in favor of the US dollar, so the price might go ahead with its decline toward the low of 0.9963. If the currency pair closes above 1.0196 today, it will increase the chance of further growth toward 1.0315. The economic calendar is empty for the US and the EU on Monday. The UK has released a few important economic reports that will be discussed in the appropriate article. The economic data on the UK hardly encouraged EUR's growth. Besides, the pound sterling is much weaker fundamentally. Thus, the euro gained ground without any obvious reasons. You're certainly aware that the ECB raised the key policy rate last week by a whopping 75 basis points. It also pledged to stick to this hawkish monetary policy and carry on with fast rate hikes.

From my viewpoint, this is weighty argument in favor of the euro. Previously, the ECB rejected the idea of monetary tightening but it is able to outpace the Federal Reserve and the Bank of England in terms of the pace of rate hikes. All in all, the fundamental background for the euro has changed radically in a single day. From now on, the euro might develop a nice rally following a losing streak for one and half a year in EUR/USD. The Federal Reserve is not going to stay idle. Importantly, inflation in the US has already plateaued and eased a bit. So, it doesn't make sense for the central bank to spur tightening financial conditions and soften its hawkish stance a little. The ECB is taking action in opposite economic conditions. Inflation has been accelerating and the ECB has to resort to drastic measures to stem inflation. Therefore, the ECB could take the lead among influential central banks in terms of aggressive tightening. It means that the euro bulls can eventually take advantage of the ECB hawkishness and grasp the opportunity to buy EUR/USD.

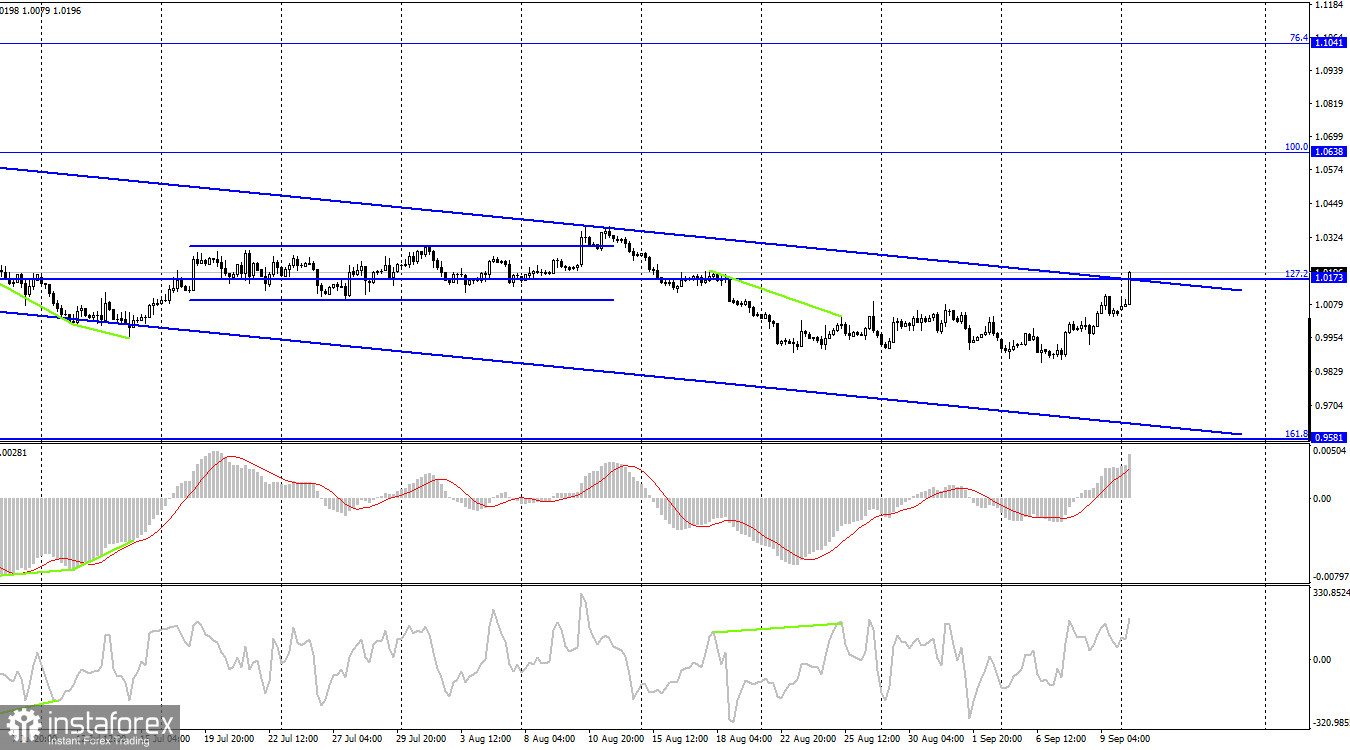

On the 4-hour chart, EUR/USD climbed to 1.0173, the 127.2% Fibonacci correction. A drop off 1.0196 might be in favor of the US dollar so that the price might resume its decline towards 0.9581, the Fibonacci 161.8% correction. The downward trend channel still defined market sentiment as bearish. However, if the currency pair closes above the channel, market sentiment could turn bullish for a long time.

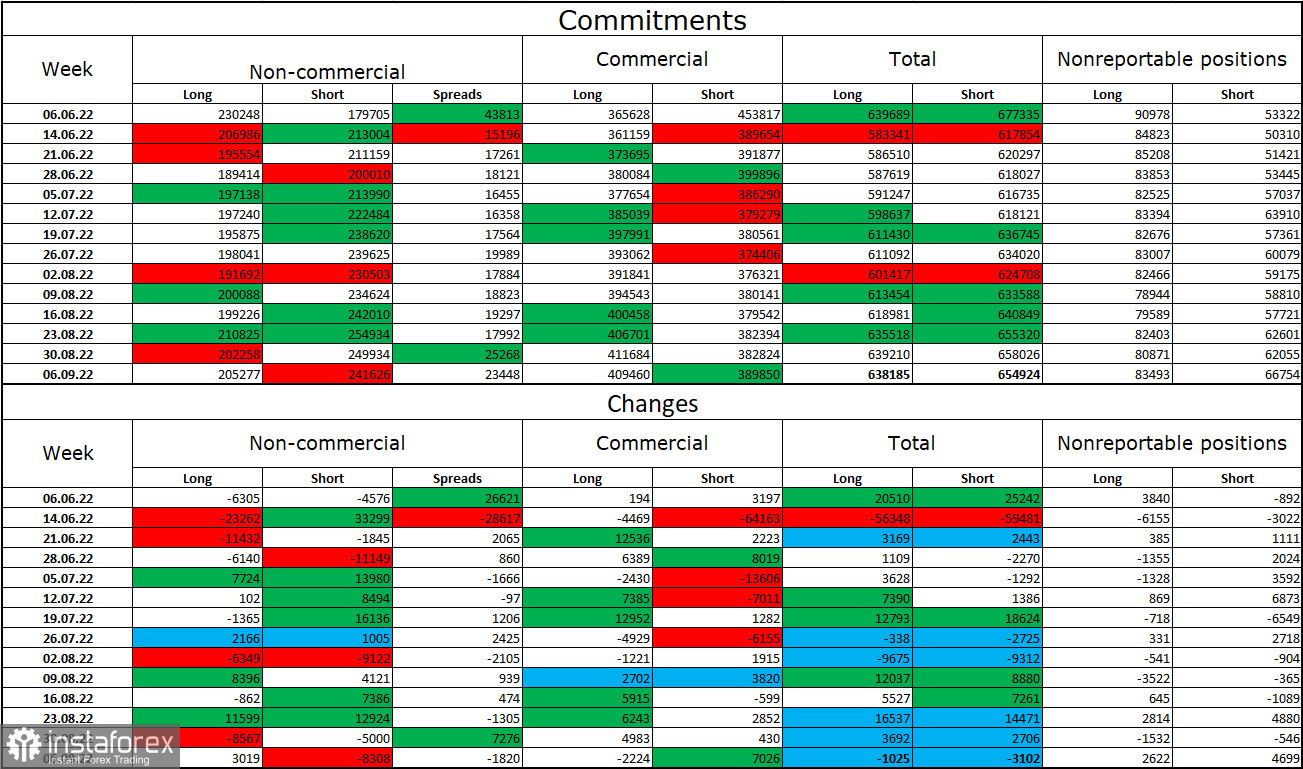

Commitments of Traders (COT):

Last week, speculators opened 3,019 long contracts and closed 8,308 short contracts. It means that the bearish sentiment of market makers is waning. For the time being, the overall number of long contracts opened by speculators stands at 205,000 and the number of short contracts is 241,000. The difference between these figures is not too big, but it is still not in the euro bulls' favor. In recent weeks, the euro has perked up and now has a bigger chance of gaining bullish momentum. Nevertheless, in light of the last COT report, the euro bulls are not able to assert strength. The single European currency did not develop strong growth in recent months. Perhaps, the ECB policy decision will give it a fresh impetus. Technical analysis matters a lot nowadays because it is rather complicated to recognize the exact time of the change in market sentiment. If technical charts generate a buy signal, it means that traders are poised to buy the instrument.

Economic calendar for US and EU

The economic calendar is absolutely empty both for the US and the EU. Hence, the information background is of no importance to market sentiment today. Nevertheless, judging by the active price action in the morning, EUR/USD is set to trade robustly even amid the empty economic calendar.

Outlook for EUR/USD and trading tips

I would recommend go short on EUR/USD on conditions of a drop off 1.0173 (1.0196) on the 4-hour chart with the target t 1.9900. We could buy EUR/USD once the price settles above 1.0173 on the 4-hour chart with the target at 1.0638.