As the Swiss State Secretariat for Economic Affairs (SECO) reported last week, the country's GDP grew in the 2nd quarter by +0.3% (+2.8% in annual terms). Despite the fact that the figures turned out to be lower than the forecast and previous values, this is still positive data that characterizes the stability of the Swiss economy and is a positive factor for the franc.

Last week's unemployment data in Switzerland remained at 2.0% for the third consecutive month, which is in line with the Swiss average and pre-coronavirus levels. A strong labor market is, of course, a bullish factor for the national currency.

But the franc is strengthening not only because of the positive Swiss macro data. Since the beginning of this month, it has strengthened significantly both against the dollar and other major world currencies. The franc seems to have seized the initiative from both the dollar and the defensive yen.

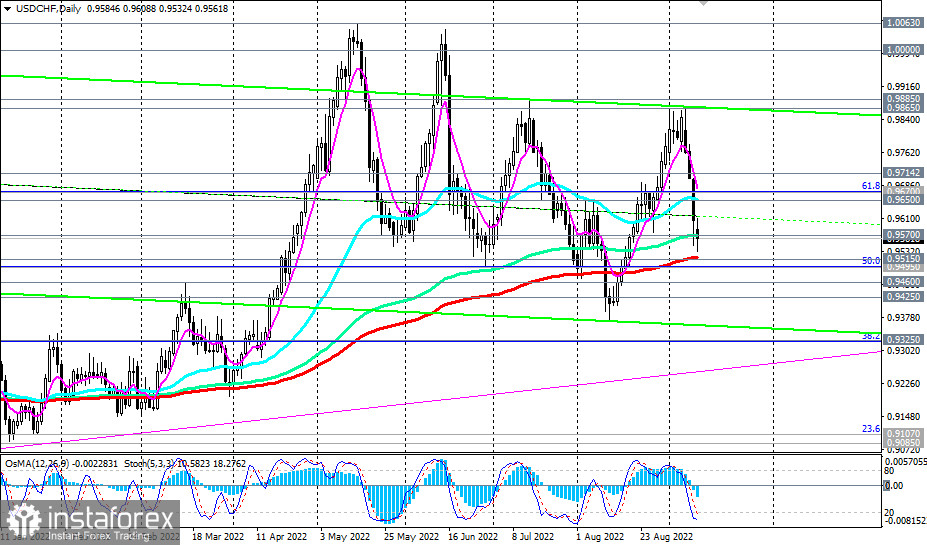

As of writing, the USD/CHF pair is trading near 0.9560, being in the zone of key support levels 0.9570, 0.9515, the breakdown of which could be a threat to the bullish trend of the pair and the dollar.

As for the latter, it continues to weaken at the beginning of the new week. As of writing, futures for DXY index are traded near the 108.00 mark, although, in the middle of last week, the price broke through the resistance level of 110.00 and came close to the next "round" mark of 111.00.

Now market participants will study tomorrow's statistics from the US with data on consumer inflation for August.

Economists expect annual inflation in the US to fall to 8.1% in August from 8.5%, 9.1%, 8.6% earlier, which indicates a slowdown in its growth. Fed's super tight monetary policy seems to be already bearing fruit—US inflation is slowing down. If this is the case, the Fed may start to slow down the pace of policy tightening. This is a negative factor for the dollar.

The next Fed meeting will be on September 20–21. So far, it is widely expected that the interest rate will be raised by 0.75% at this meeting. According to CME Group, this probability is taken into account by market participants in 90%.

This, in particular, is helped by the latest data from the US labor market, which remains strong. Thus, the number of initial claims for unemployment benefits last week turned out to be lower than preliminary estimates of 240,000, amounting to 222,000.

Recall also that the number of non-farm payrolls in the US rose by 315,000 in August, according to data released by the US Bureau of Labor Statistics last Friday. This data followed a July rise of 526,000 (revised from 528,000) and was slightly better than market expectations of 300,000 (Economists estimate that about 75,000 a month of job growth is enough to provide a growing trend and an aging US population with jobs).

But if the Fed officials signal a slowdown in the pace of the monetary policy tightening cycle, the dollar may decline even more. The softer the rhetoric of their accompanying statements, the stronger the dollar's weakening may be. The DXY index, despite weakening for the 4th day in a row, maintains positive dynamics and the possibility of taking another 20-year high above 111.00.