In anticipation of crucial economic data from the US, markets are regaining optimism. Investors expect the Federal Reserve at least to raise interest rates at a slower pace, if not make a pause in the cycle of monetary tightening.

The US inflation data is on investors' radars today. The consensus suggests that consumer inflation could have logged a downtick of 0.1% in August versus a flat reading in July. The annual CPI rate could have decelerated to 8.1% from an 8.5% increase a month ago.

How will the market respond if the actual data is in line with expectations or reveal a significate decline in consumer prices?

In fact, the market is already responding to this issue by selling the US dollar and buying risky assets. Yields of Treasures have stabilized against this background. Investors believe that if inflation continues its slowdown, the Federal Reserve could slacken the pace of rate hikes. For example, the central bank could increase the federal funds rate by 0.50% at the meeting in September, but not by 0.75% as promised. This could signal that interest rates might be lower at the year-end than planned by the Federal Reserve. In turn, the market will revise its forecasts and will offset sell-offs of stocks and bonds by their purchases to strike a balance. In this case, the US dollar will extend its decline across the board. Another factor for the greenback's retreat is that other influential central banks lagging behind the US Fed are poised to tighten aggressively.

Such a scenario suggests further weakness of the US dollar against other major currencies. In this context, EUR/USD has a fair chance to gain ground. The instrument could climb above 1.0200 and settle there. Other currency pairs could follow the same scenario. Besides, investors are dispelling fears that the global economy and the US economy in particular could escape from a recession. Nowadays, the global economy has come within an inch from slipping into a recession. Once investors realize that recession fears might be exaggerated, they will regain optimism. In this case, we could conclude that stock markets have bottomed out. Growing demand for risky assets could put pressure on safe-haven assets, especially the US dollar.

Intraday forecast

EUR/USD

The currency pair is now trading at 1.0145. The instrument may surpass this level following the US CPI publication with a lower indicator. EUR/USD could rise to 1.0200 and higher to 1.0250.

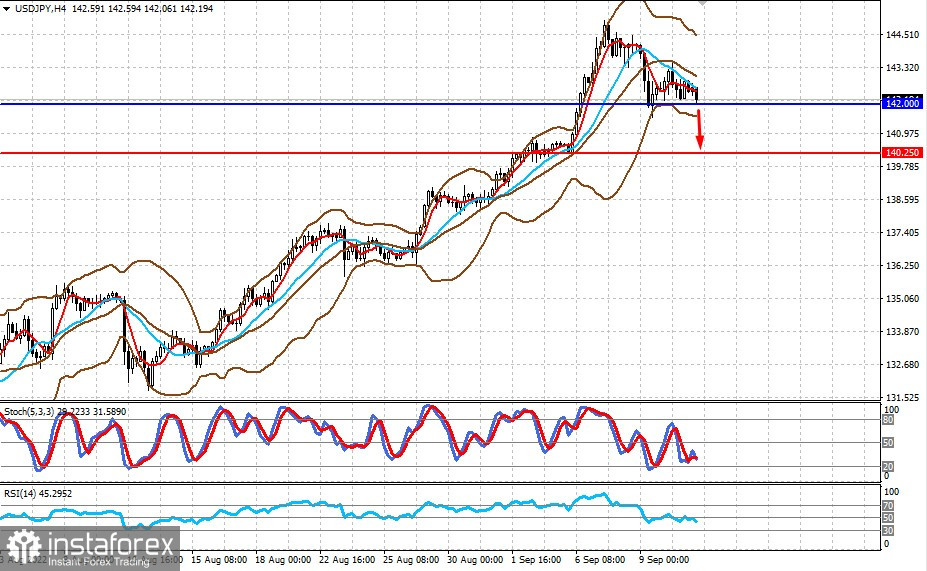

USD/JPY

The currency pair is now trading slightly above 142.00. A decline below this level could push the price down toward 140.25.