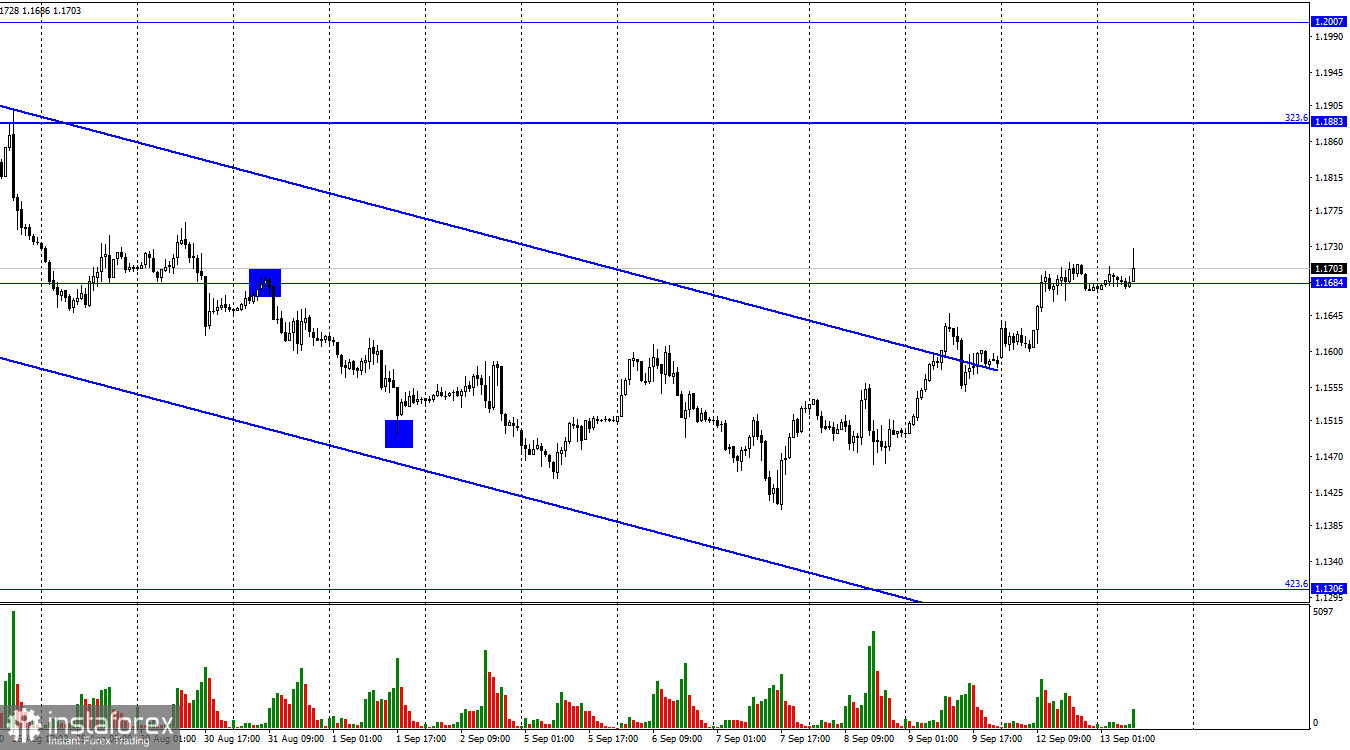

On the 1-hour chart, GBP/USD continues to advance and has already settled above 1.1684. So, the pair may extend its growth towards the next fibo retracement level of 323.6% at 1.1883. Two days ago, the pair also closed above the descending trend channel which changed the market sentiment to bullish. The same is happening on the H4 chart. Traders need to evaluate a big bunch of important data both on Monday and Tuesday. Yesterday, the GDP report was published in the UK together with the manufacturing data and the report on the trade balance. I don't think these publications were crucial but they eventually supported the pound. Today, the employment report was released, showing that the rate has dropped to 3.6%. Average earnings also rose by 5.5%, beating traders' expectations. Following these publications, GBP jumped by another 40-50 pips. But the best is yet to come!

Governor of the Bank of England Andrew Bailey is going to speak today. This event ahead of the meeting next week may be of high importance to traders. If Mr. Bailey indicates that the regulator is ready to maintain the same pace of rate increase or may want to accelerate it, the pound will certainly strengthen. Later on, the inflation report will be released. It is hard to predict the reaction when we don't even know the preliminary estimates. Otherwise, markets would have already reacted to this data. In general, inflation is expected to decline to 8.1% from 8.5%. But I think the range can be even wider from 7.5% to 8.5%. Naturally, the reaction will be different in every case. One thing is for sure: the day will be full of events and high trading activity. The more support the pound gets today, the higher its upside potential will be. Everything will get clear next week after the Fed's and the BoE's policy meetings.

On the 4-hour chart, the pair continues to rise after the CCI and the MACD indicators have formed a bullish divergence. The price is moving towards the retracement level of 161.8% at 1.1709. A rebound from this level will be in favor of the US dollar. So, the pair may resume its fall towards the level of 1.1496. Consolidation above the descending trend channel makes the uptrend more likely, and a firm hold above 1.1709 will eventually confirm it.

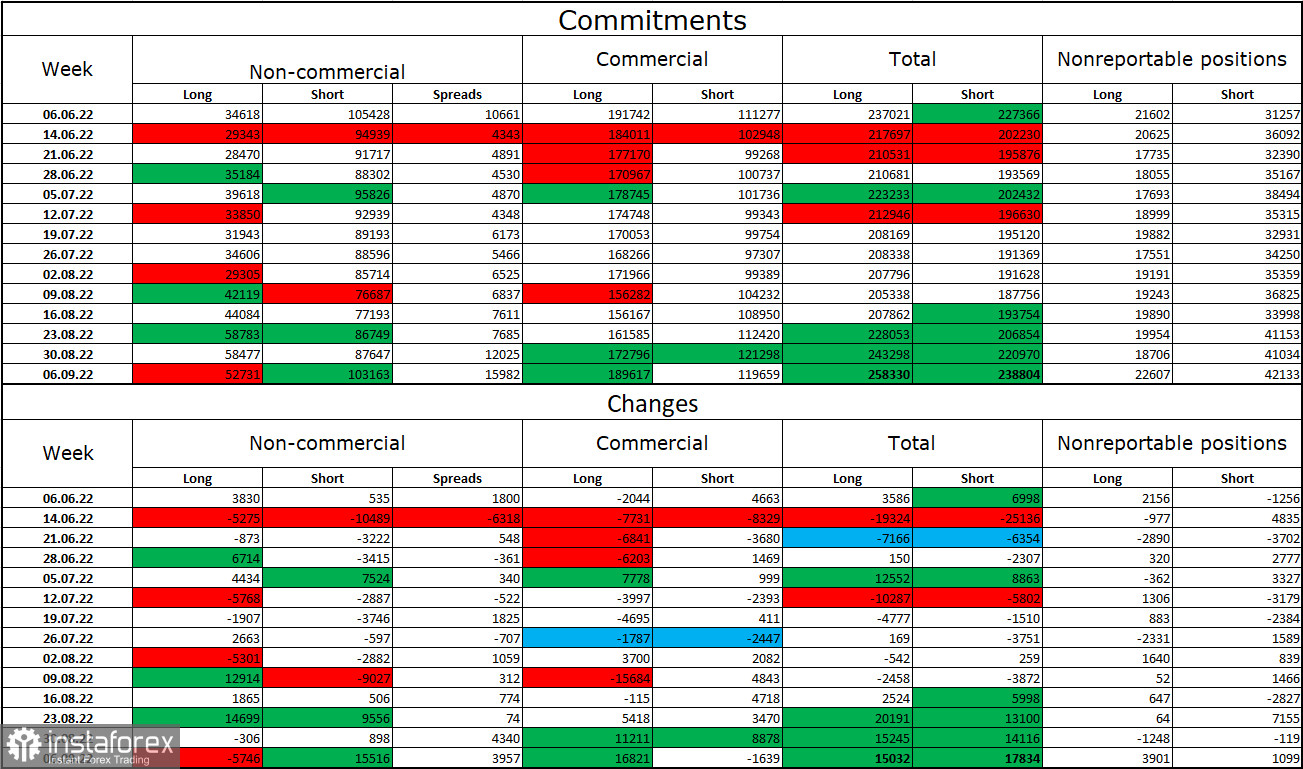

Commitments of Traders (COT) report:

Economic calendar for US and UK:

UK – Unemployment rate (06-00 UTC).

UK – Average Earnings (06-00 UTC).

UK – Bank of England Governor Andrew Bailey speaks (08-00 UTC).

US – CPI report (12-30 UTC).

On Tuesday, all major reports in the UK have already been released. Later in the day, Andrew Bailey will speak. The US will publish the inflation report in the second half of the day. Therefore, the impact of the news background on traders' sentiment may stay strong until the end of the day.

GBP/USD outlook and trading tips:

I would recommend selling the pound when the price rebounds from 1.1709 on the H4 chart with the target at 1.1496. It is better to buy the pound when the price settles firmly above the descending channel on H1 with the target at 1.1883. These positions can be kept open if the price closes above the level of 1.1684.