Don't Look Up - "do not look up." Perhaps this phrase can be used as a "strong recommendation" for EUR/USD traders, especially those who risk opening long positions.

Yes, on the one hand, in September, bulls were able to return to the "bottom-up" parity level, pulling the price away from the bottom of the 99th figure, and even managed to develop a fairly large-scale corrective growth, having risen above the key mark of 1.0000 by 200 points. But they still failed to gain a foothold at this height: as soon as the dollar began to strengthen its positions, the pair dutifully returned to its previous orbit, to the parity zone. All this suggests that long positions in the pair are risky, since the euro is not able to hold the line. The pair's corrective growth was built solely on the weakening of the greenback, which fell under a wave of shorts ahead of inflation reports and amid increased risk appetite.

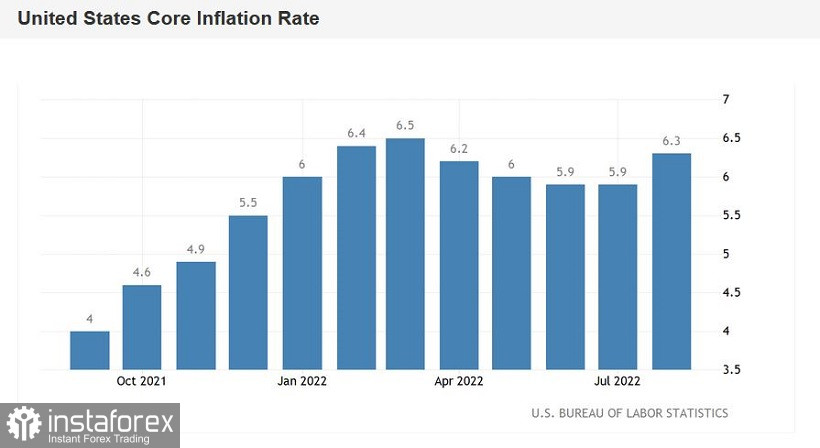

The most important macroeconomic report of the current week for the EUR/USD pair was just published. According to the data, the general consumer price index in the US came out at 8.3% y/y in August (against the forecast of a slowdown to 8.1% and the previous value of 8.5%). The indicator continues to be in the area of 40-year highs. And although the indicator has retreated from the July high, this does not change the essence: the CPI is still at a too high level (including for the Federal Reserve). On a monthly basis, the index also went into the green zone, rising to 0.1%, contrary to forecasts for a decline in the negative area. The structure of this component shows that food prices have increased by 11% compared to last year (the highest growth rate since 1979), and the cost of electricity has increased by almost 16% (the highest growth rate since 1981). The core consumer price index, excluding volatile food and energy prices, also surged. In monthly terms, an increase of up to 0.6% was recorded, in annual terms - up to 6.3% (against the forecast of growth up to 6.1%). The prices of housing and accommodation, as well as medical care, have risen substantially. I repeat - all indicators of August came out in the green zone, exceeding the preliminary forecasts of most economists.

US inflation still acts as a conductor of many events, shaping the corresponding agenda. That is why the market reacted so sharply to the release, which reflected a further rise in the consumer price index. The dollar bulls regained their self-confidence, while the opponents were forced to accept the verdict: the greenback confidently returns the lost points in all dollar pairs of the major group.

It is noteworthy that the latest inflation report actually plays a secondary role in the context of the prospects for the September Fed meeting. It is safe to say that regardless of the dynamics of the August inflation in the US, the Fed would still come (and will come) to the same decision: to raise the interest rate by 75 points. The previous rhetoric of the Fed representatives (including Fed Chairman Jerome Powell) was militant, so the current market expectations, in my opinion, are absolutely justified. Let me remind you that the probability of the implementation of the 75-point scenario at the September meeting is now estimated at more than 90%.

Therefore, the latest figures should be considered rather in the context of future prospects. But in order to talk about subsequent events, it is necessary to return to Jackson Hole, where at the end of August the head of the Fed delivered his resonant speech. He assured that the US central bank will continue to raise interest rates and keep them high, "even if it hurts households and businesses." Powell actually said that Americans will have to put up with slower economic growth and a weaker labor market, as this is the sad price of lower inflation. At the same time, he noted that the pace of tightening monetary policy this year "will depend on incoming data," primarily in the field of inflation.

Figures released today suggest the Fed will maintain its aggressive pace of interest rate hikes this year (and likely into early 2023), with a 75 bps hike in both November and December. As for the September meeting, here the probability of the implementation of the 75-point scenario after the latest release will be close to 100%.

It is worth noting that the Fed members will be able to comment on the August rise in inflation only next week, after the announcement of the results of the September meeting - at the moment there is a 10-day "silence mode". Therefore, traders of dollar pairs will have to independently draw conclusions from the current situation, without "tips" from members of the Fed. But, I think, in this case, the organizational conclusions are obvious: the EUR/USD bears have received a powerful informational trump card to strengthen their positions. "Looking up" for the pair is still risky – it is advisable to use any corrective price rollbacks as a reason to enter shorts. Bearish targets are unchanged at 1.0000, 0.9950 and (medium term) 0.9900.