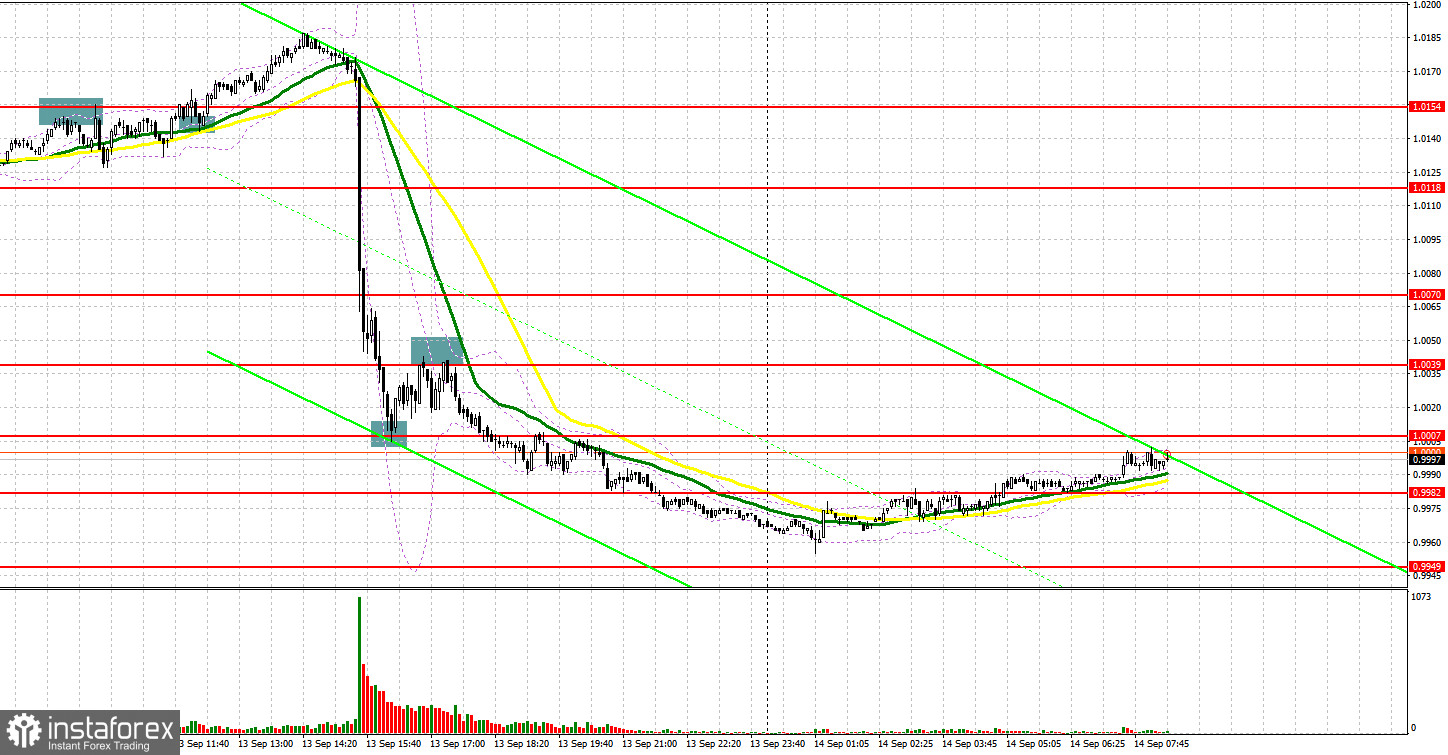

Several market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.0146 level in my morning forecast and advised making decisions on entering the market from it. The rather gloomy statistics on Germany and the eurozone kept the euro below the level of 1.0146 in the morning, which even made it possible to get a sell signal after a false breakout. However, it never came to a big sell-off as traders switched to more important US statistics. The highest that could be seen was a downward movement of 20 points. A breakthrough and consolidation above this level with a reverse test from top to bottom provided a signal to buy, which resulted in an increase of more than 35 points. After the euro sharply fell in the afternoon, the bulls defended the parity, providing a signal for a correction, which amounted to about 30 points, but then the bears returned to the market, having achieved a false breakout around 1.0039.

When to go long on EUR/USD:

The growth of inflation in the US was not included in the plans of euro bulls, which led to such a sharp fall in the pair. I mentioned this in yesterday's forecast. The apparent increase in inflation in the US will force the Federal Reserve to continue to act aggressively by raising interest rates - September's increase of 0.75% at once is already a done deal. It is very important how the committee will show itself further and what plans will be outlined for the pace of raising interest rates in the US until the end of the year. All this will be an incentive to buy the US dollar, since as a result of such a policy, the economy will most likely slide into a recession, which will return the demand for safe-haven assets. Today there will be speeches by European politicians. You should pay attention to the statements of the Chairman of the Supervisory Board of the European Central Bank, Andrea Enria, and members of this Board: Philip Lane and Elizabeth McCaul. The hawkish remarks will strengthen the euro's position, but hardly for a long time.

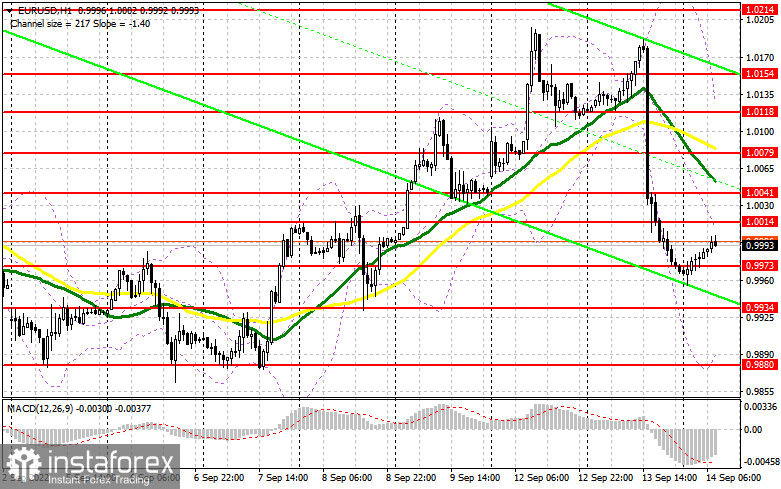

In case the euro falls further, the best scenario for buying will be a false breakout in the new support area of 0.9935, since the bulls have probably lost parity. This will provide an entry point for an upward correction with immediate recovery target towards 1.0014. As I noted above, the statements of the ECB representatives can help the euro if it continues to aggressively raise interest rates. A breakthrough and a downward test of 1.0014 will hit the bearish stop orders, which will create another signal to open long positions with the possibility of a correction to the 1.0041 area, where the moving averages play on the bears' side. A more distant target will be resistance at 1.0079, where I recommend taking profits.

If the EUR/USD falls and there are no bulls at 0.9973, the pressure on the pair will increase. The optimal decision to open long positions in this case would be a false breakout near the low of 0.9934. I advise you to buy EUR/USD immediately on a rebound only from 0.9880, or even lower - in the area of 0.9849, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

The bears are in control of the market, and will most likely take control of parity, which will return pressure on the euro again and lead to new annual lows. The bears' main task for today is to protect the nearest resistance at 1.0014, from which I expect major players to appear in the market. Together with a false breakout, short positions will be opened in order to further move the euro down to 0.9973. A breakdown and consolidation below this range with a reverse test from the bottom up creates another sell signal with the removal of bulls' stop orders and a larger fall of the pair to the 0.9934 area. I recommend taking profit there. A more distant target will be a low of 0.9880, but this is in case the bulls lose all interest in the euro after the US producer prices data in the afternoon.

In case EUR/USD jumps up during the European session, as well as the absence of bears at 1.0014, an upward correction will lead to the next resistance at 1.0041, just above which the moving averages, playing on the bears' side, pass. In this scenario, I recommend opening short positions from 1.0041 only if a false breakout is formed. You can sell EUR/USD immediately for a rebound from the high of 1.0079, or even higher - from 1.0118, counting on a downward correction of 30-35 points.

COT report:

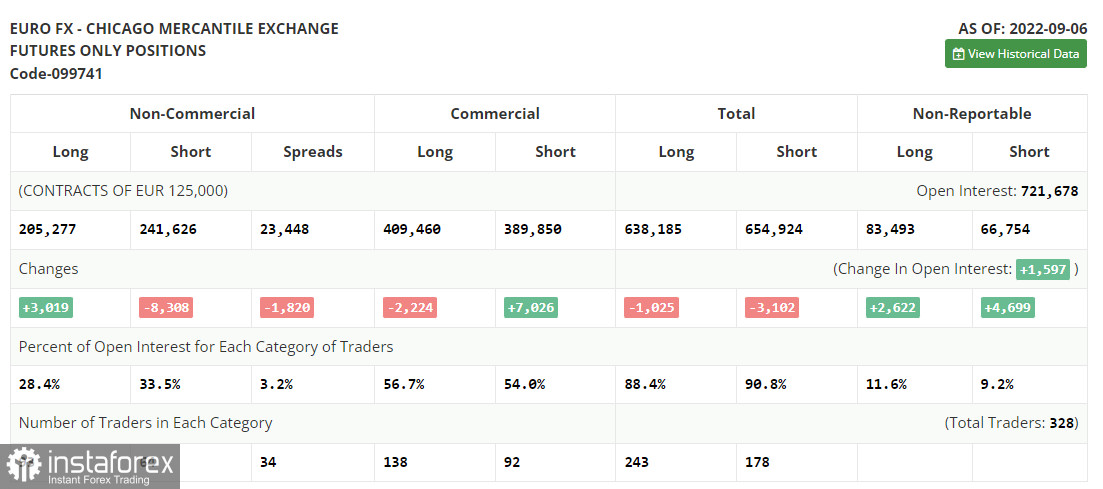

The Commitment of Traders (COT report) on September 6 logged a decline in short positions and a sharp increase in long positions. Considering that all this was ahead of the European Central Bank meeting, at which the central bank raised interest rates by 0.75% at once, such changes are not surprising. With an ever smaller gap in interest rates between the Federal Reserve and the ECB, the demand for the euro will gradually return, but you need to understand how difficult the European economy is now and how difficult it will be for this winter period - especially with such high energy prices due to the deficit. In the US, the Fed also plans to raise interest rates by 0.75% as early as next week, but quite a lot will depend on what inflation data comes out. If the growth rate of consumer prices remains at a high level, the central bank will not hesitate for a long time. The COT report indicated that long non-commercial positions rose by 3,019 to 205,277, while short non-commercial positions decreased by 8,308 to 241,626. As of the end of the week, the overall non-commercial net position remained negative, but rose slightly to - 36,349 against -487,676, which indicates the first prerequisites for building an upward correction for the pair and finding the bottom. The weekly closing price decreased and amounted to 0.9917 against 1.0033.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, indicating a return to the bears' market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 0.9905 will act as support. In case of growth, the upper border of the indicator in the area of 1.0079 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.