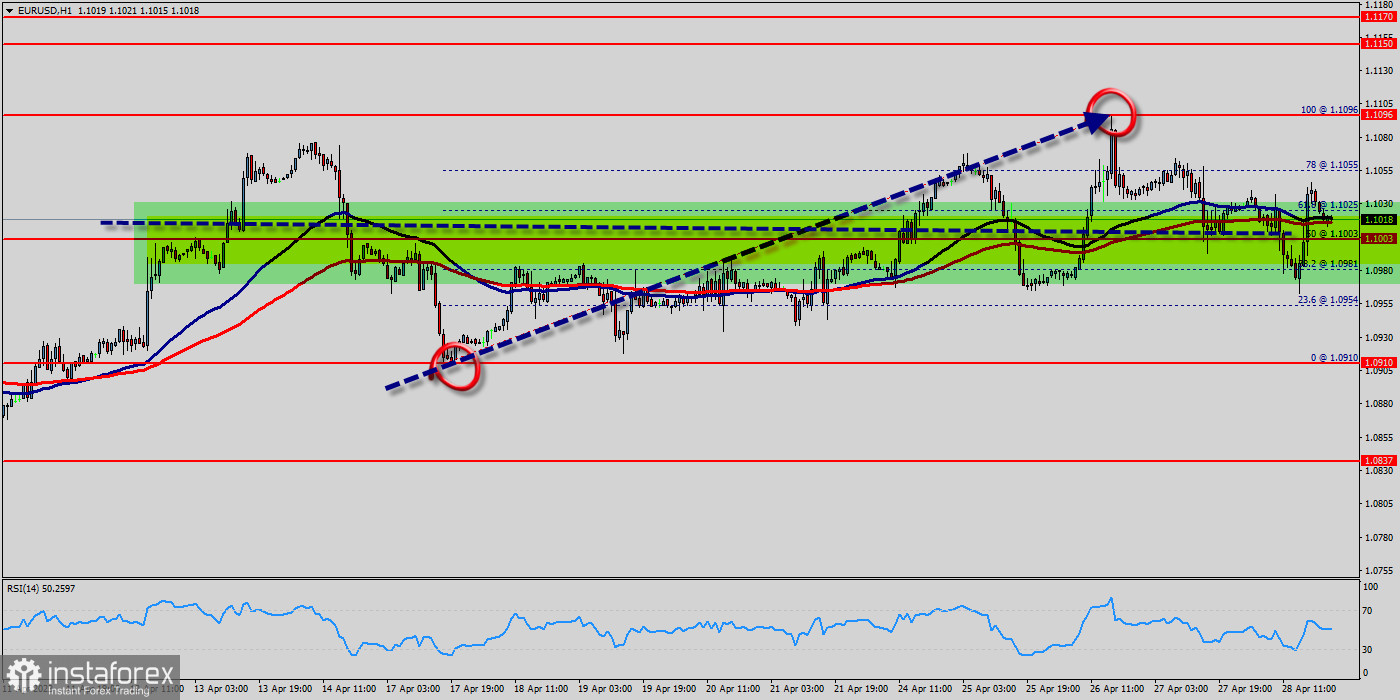

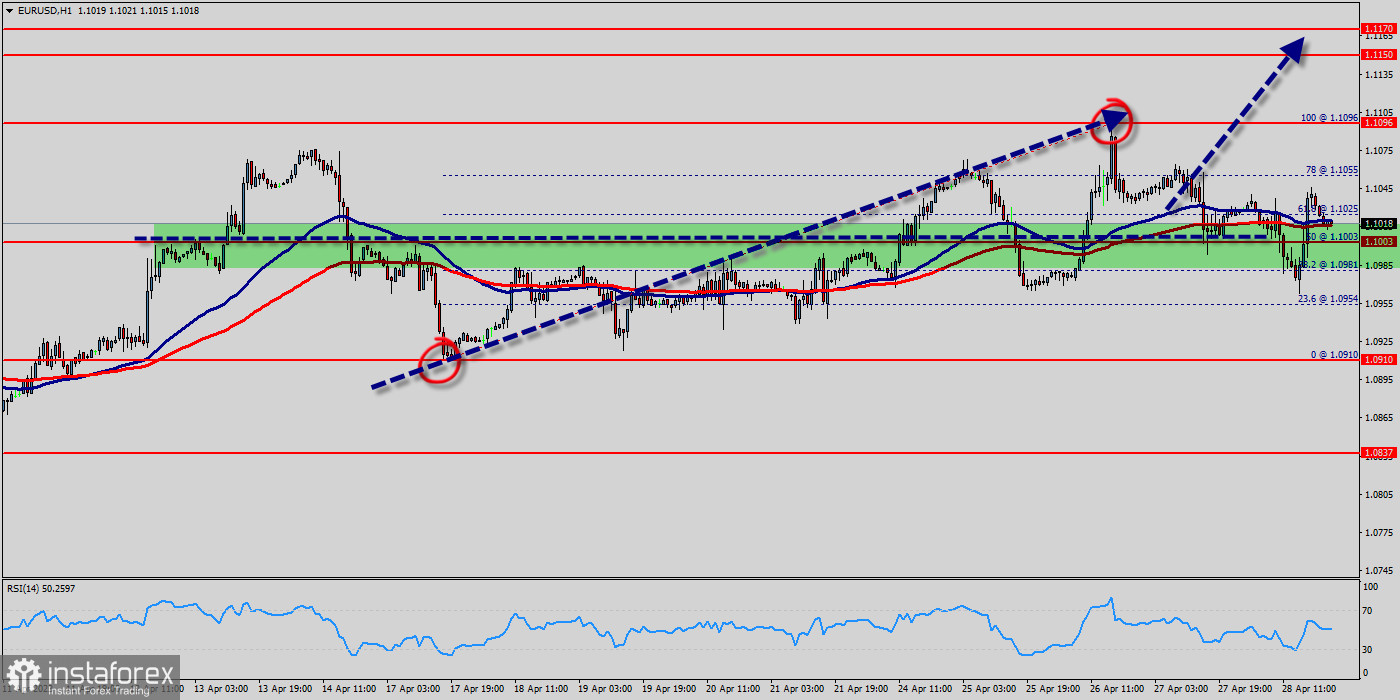

The volatility is very high for that the EUR/USD pair is still moving between 1.0925 and 1.1022 in coming hours. Consequently, the market is likely to show signs of a bearish trend again. The EUR/USD traded lower and closed the day in the red area near the price of 1.0954. Today it, on the contrary, grew a little, having risen to the level of 1.0954.

On the hourly chart, the EUR/USD pair is testing the strength of the support - the moving average line MA (100) H1 (1.0954). At the same chart, the GBP/USD pair is still below the MA 100 H1 line - the first resistance of 1.1022. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the GBP/USD pair remains below MA 100 H1, it may be necessary to look for entry points to buy at the end of the correction.

The EUR/USD pair tests 1.0954 level and still below it, and the contradiction between the technical indicators still valid, to continue with our neutrality until the price confirms its situation according to the mentioned level followed by detecting its next destination clearly. To review the expected targets for the upcoming period, please check our morning report. Intraday bias in EUR/USD pair stays on the downside, as fall from 1.0985 is targeting 100 day EMA (now at 1.0968).

Firm break there will target 61.8% retracement of 1.0985 to 1.0925. The expected trading range for today is between 1.0925 support and 1.0985 resistance. The EUR/USD pair has extended its daily slide and declined below 1.0985. With the US Dollar staying resilient against its rivals following the better-than-forecast data, the pair is having a difficult time staging a rebound in the early American session.

The expected trend for today: Bearish market. Targets : 1.0925 and 1.0900. On the upside, break of 1.0985 minor resistance will turn bias back to the upside for retesting 1.1076 instead. However, if the EUR/USD pair is able to break out the daily resistance at 1.0985 , the market will rise further to 1.1076 to approach resistance 2 today.

On the one-hour chart, the current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.1076 (major resistance), the market will indicate a bearish opportunity below the strong resistance level of 1.1013. This resistance (1.1013) has been rejected several times confirming the downtrend.

The US dollar's strong gains against the Euro have continued today ahead of the sturdy news. The common currency reached a high of more than three week earlier this morning. This technical analysis of EURUSD looks at the one-hour chart.

The highest price that EUR/USD reached for that period was 1.1076 (last bullish wave - top). The lowest price that the EUR/USD pair reached during that period was 1.0950 (right now). Thus, the EUR/USD pair settled below 1.0950 and is testing the support level at 1.0910. RSI and Moving averages continue to give a very strong sell signal with all of the 50 and 100 EMAs successively above slower lines and below the price.

The 50 EMA has extended further below the 100 this week. Support from MAs comes initially from the value zone between the 50 and 100 EMAs. Industriously, Euro Is Losing ground against U.S. Dollar around -85 pips. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.0910, the market will decline further to 1.0850 in order to test the weekly support 2.