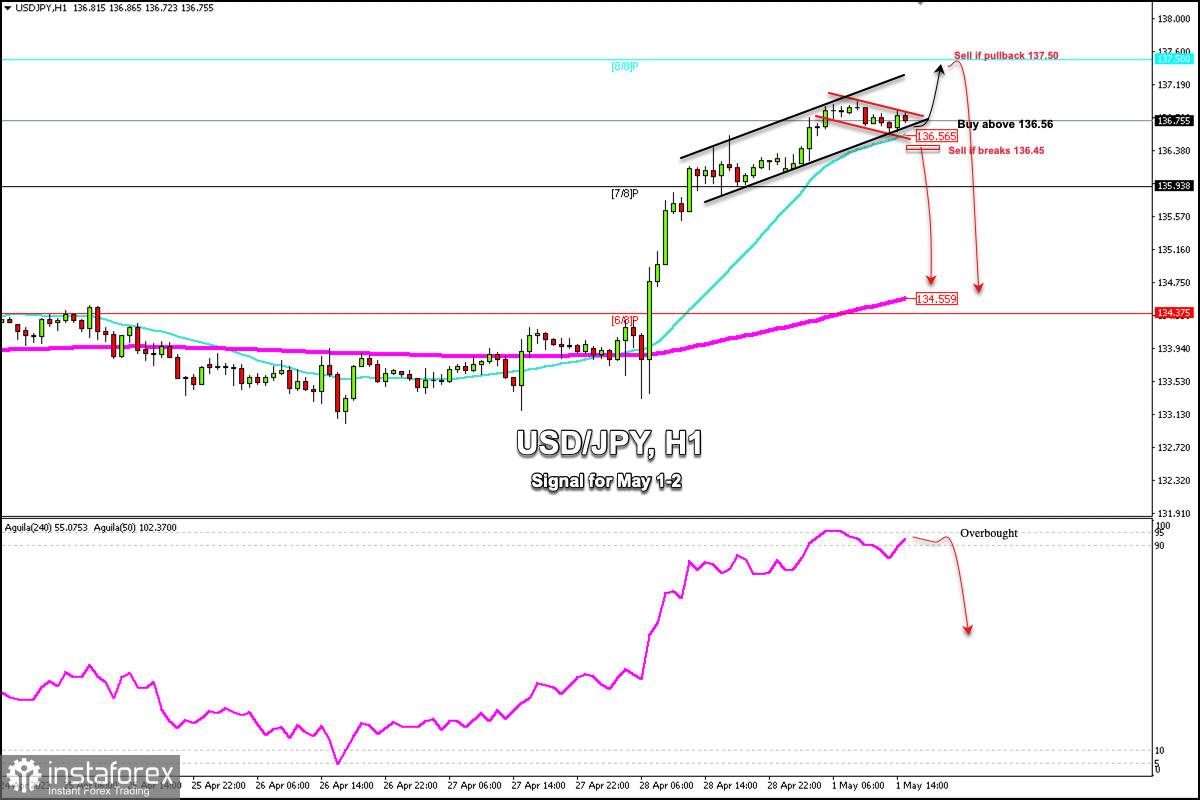

Early in the American session, the Japanese yen (USD/JPY) is trading around 136.75, above the 21 SMA and below the 8/8 Murray. We can see a strong uptrend that could continue in the next few hours but is already showing signs of exhaustion.

On the 1-hour chart, we can see that the Japanese Yen has made a strong break above 6/8 Murray on April 28 and there was a rally to current price levels. It is now showing signs of overbought conditions, and if it falls below 136.45 (21 SMA), a technical correction towards the 200 EMA located at 134.55 could occur.

On the other hand, in the event that the Japanese yen consolidates above 136.56 (21 SMA), it may continue to rise and break through the bearish channel formed in the last few hours. If so, it may develop a bullish movement towards 8/8 Murray located at 137.50..

Since the eagle indicator is showing overbought signs, a pullback towards 13.700 -137.50 could mean that the Yen is preparing for a technical correction. The key is to wait for the USD/JPY pair to be rejected around 8/8 Murray and then it would be seen as an opportunity to sell.

Data from the US is expected in the next few hours, so we can expect two scenarios. In the first one, the Yen reaches the 137.50 area where it can be sold with targets at 136.50 and 134.55.

The other scenario would be that USD/JPY breaks and consolidates below the 21 SMA around 136.45. Then we could sell it with targets at 135.93 and 134.55.