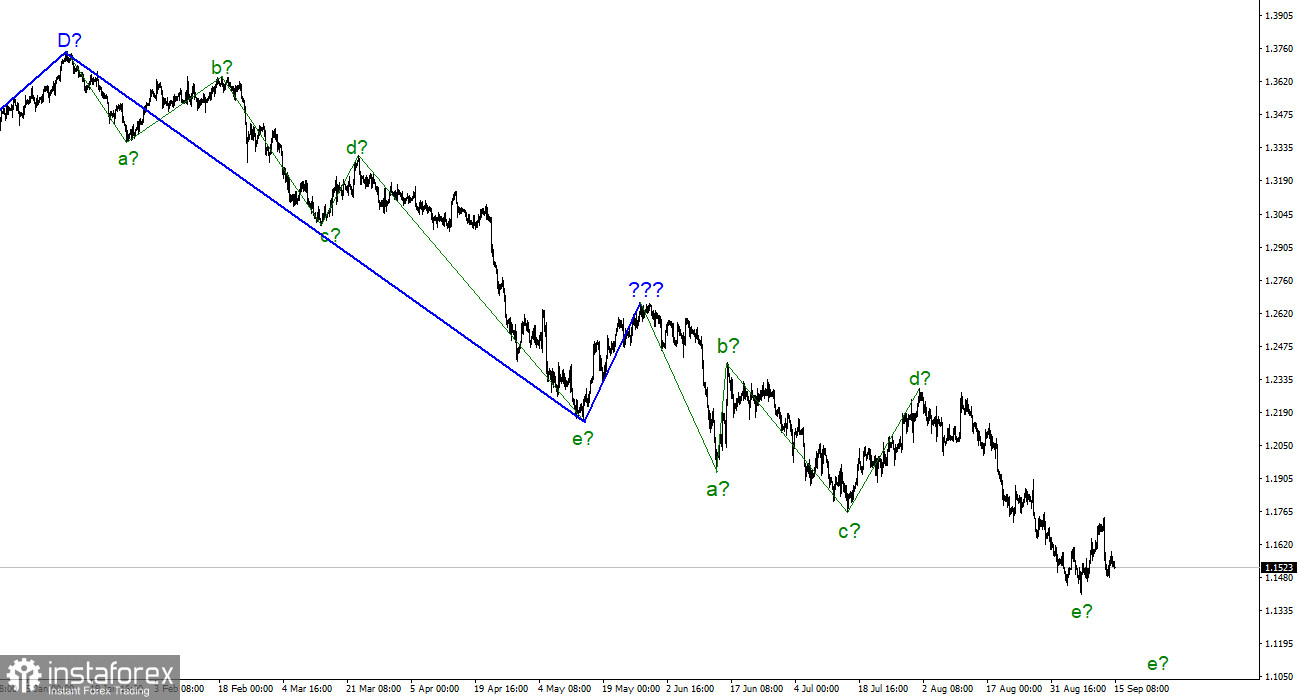

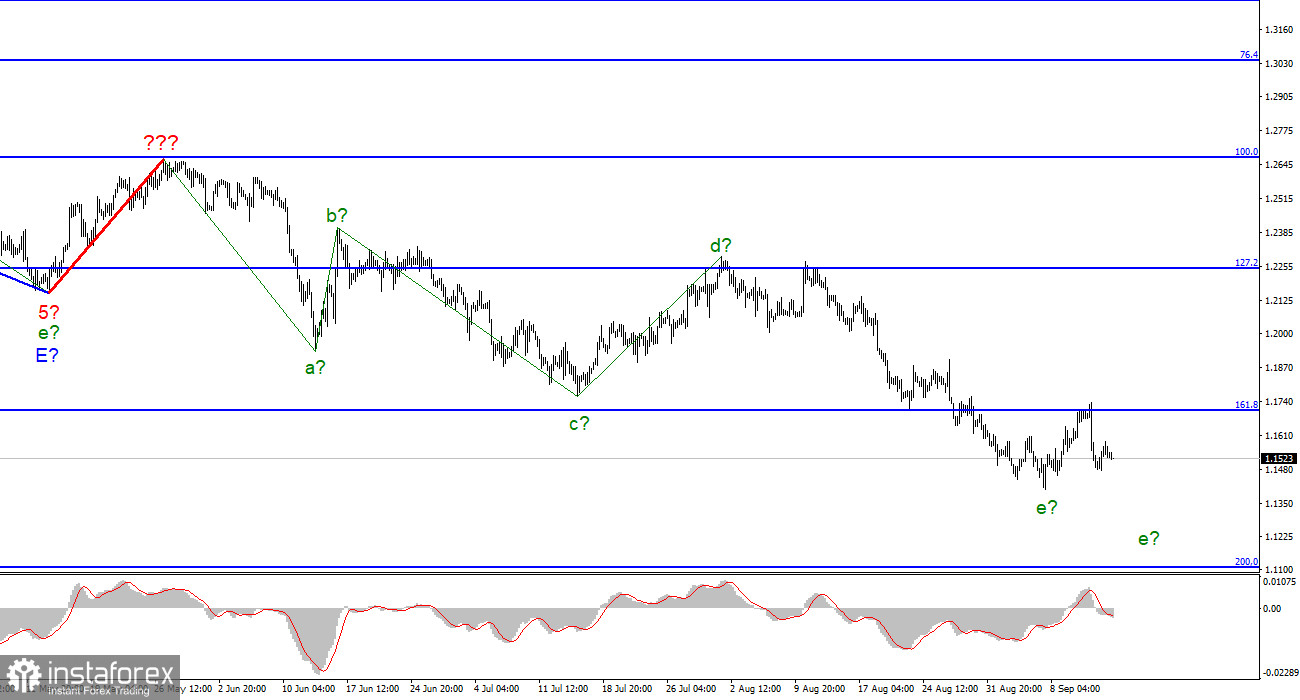

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend continues its construction. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument is inside wave e. Inside this wave, internal waves are being viewed, and I can assume that wave 4 in e is being built now. If this is true, the quote decline will resume within wave 5 in e. However, in this case, the wave markings of the euro and the pound will cease to be similar because, with a high degree of probability, the construction of a downward trend section for the euro has been completed. I suggest focusing on the next moment. Wave 4 should not be too strong. An unsuccessful attempt to break through the 161.8% Fibonacci level may mean that this is a correction wave inside e. Therefore, I expect another downward wave in the current trend area.

The pound is ready for a new decline

The exchange rate of the pound/dollar instrument increased by 50 basis points on September 14 but decreased by 190 a day earlier. The amplitude of yesterday's was not too high, but the corrective departure from the reached lows was carried out. Thus, now the instrument can move (or has already moved) to construct a new downward wave. Let me remind you that the wave marking of the euro may also become more complicated, and the downward trend may take an even longer form. The euro and the pound have been building very similar wave structures lately, so I believe that if the British dollar continues to decline, the pound will too. According to the British, we have a good signal for new sales – an unsuccessful attempt to break through the 161.8% Fibonacci level.

Meanwhile, in the UK, the inflation report for August was also released, which the markets did not react to in the same way as the inflation report in the US. Having examined the movements of the instrument in the next two hours after the release of this report, I can say that the reaction was very weak. And it certainly did not affect the current wave mark in any way. The consumer price index slowed to 9.9% y/y, which grounds the Bank of England's belief that it is doing everything right and additional tightening of monetary policy is not required. Let me remind you that the British economy is on the verge of recession, which everyone is already talking about as a fait accompli. And a stronger increase in the interest rate may lead to the fact that the economy will fall even more at the end of 2022–2023. I believe that against the background of this report, the Bank of England will raise the rate by only 50 basis points next week. The markets may regard such a decision as "dovish."

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the instrument may not reach it. Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment. An unsuccessful attempt to break through the 1.1708 mark keeps the sales option working.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.