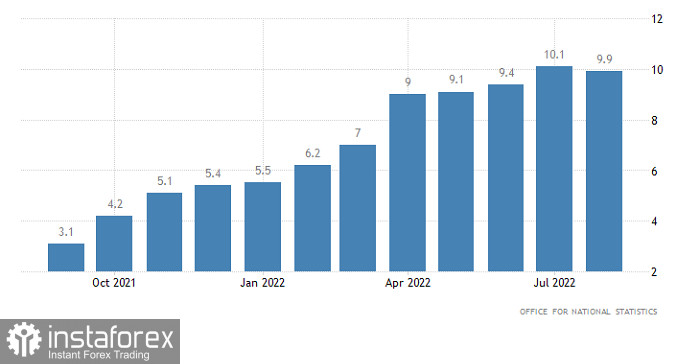

Inflation in the UK was supposed to rise from 10.1% to 10.6%, but it slowed to 9.9% instead. This should have led to the further decline of pound, but the decrease on the previous day was so massive that a rebound occurred. So, despite the data, pound grew very noticeably.

Inflation (UK):

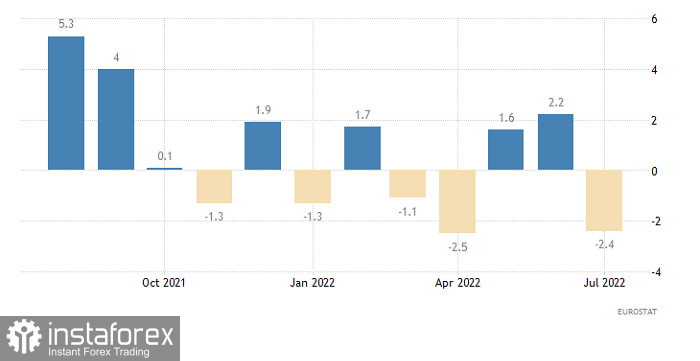

Exactly the same thing happened with euro, but it was not as noticeable. The reason was the decline of industrial production by 2.4%.

Industrial production (Europe):

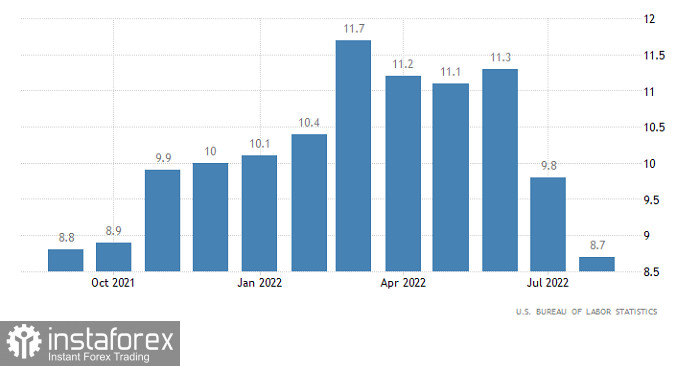

Market reaction came after the opening of the US trading session. More specifically, it was when the data on US producer prices was released, which showed a slowdown from 9.8% to 8.7%. This is a sign of easing inflation, so it is likely that the Fed will no longer need to raise rates aggressively.

Producer Price Index (United States):

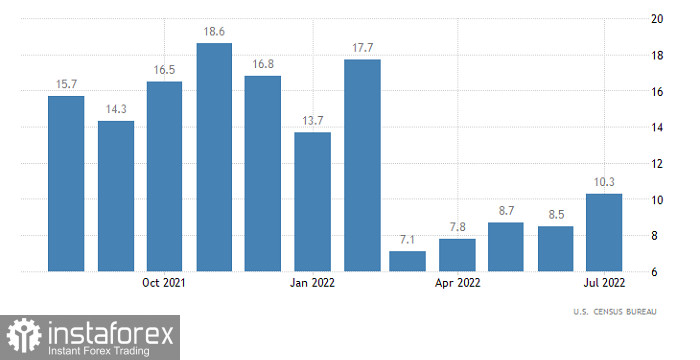

There is a possibility that the rebound, which did not take place yesterday, can happen today. The reason is the incoming US retail sales data, which should slow down from 10.3% to 9.0%, and industrial production, which may also slow down from 3.9% to 3.5%.

Retail Sales (United States):

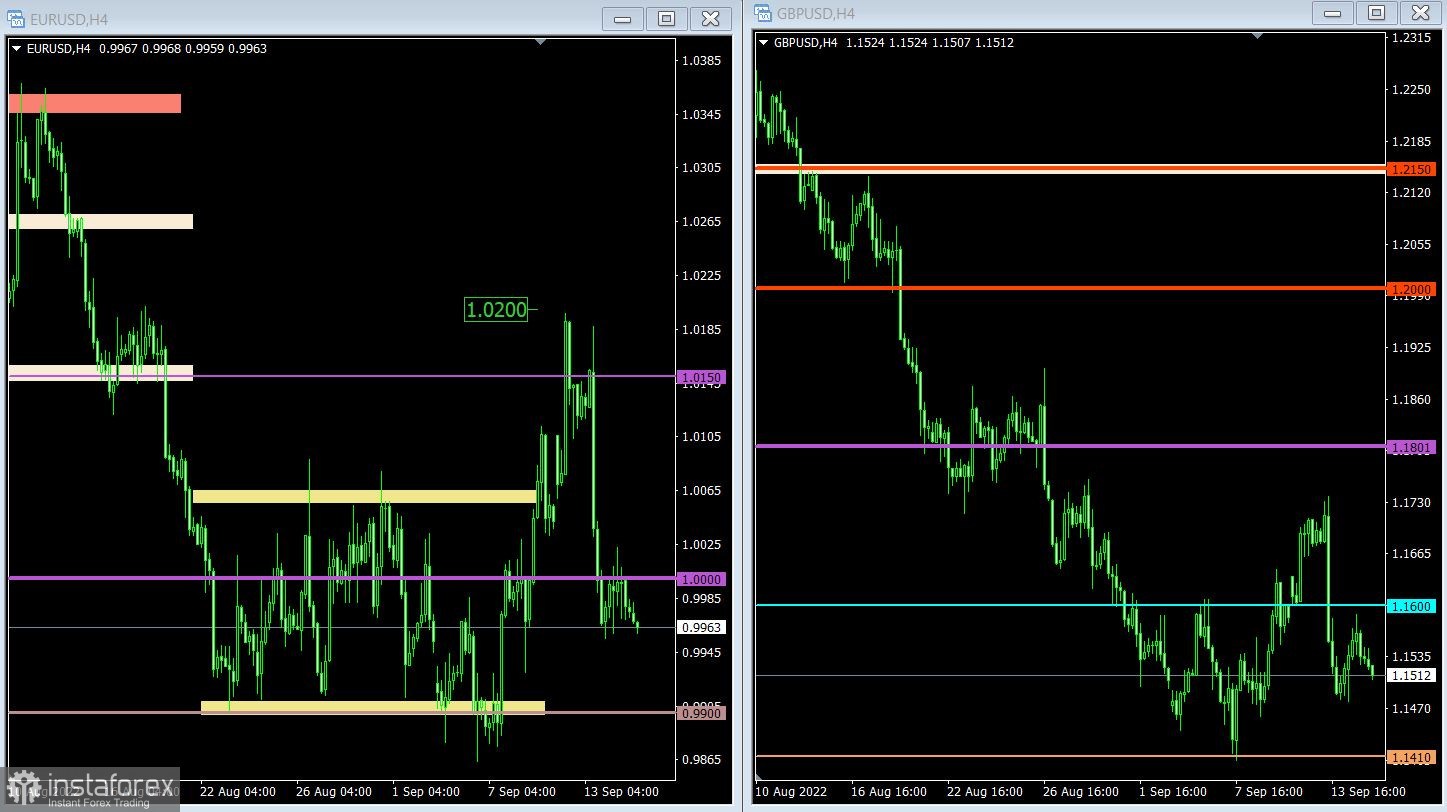

The recent slowdown of EUR/USD around 0.9955 led to the formation of an amplitude of about 50 pips. Despite the persisting signal on the market about being oversold, sentiment remains bearish, so it is likely that the pair will stay below 0.9950. Price will increase only when euro rises above parity.

GBP/USD has a similar picture despite a more significant rollback on the previous day. Nevertheless, it is still oversold, and staying below the local low will lead to a further decline towards the trend base. Price will increase to 1.1600 only when 1.1480 is broken.