EUR/USD

Higher time frames

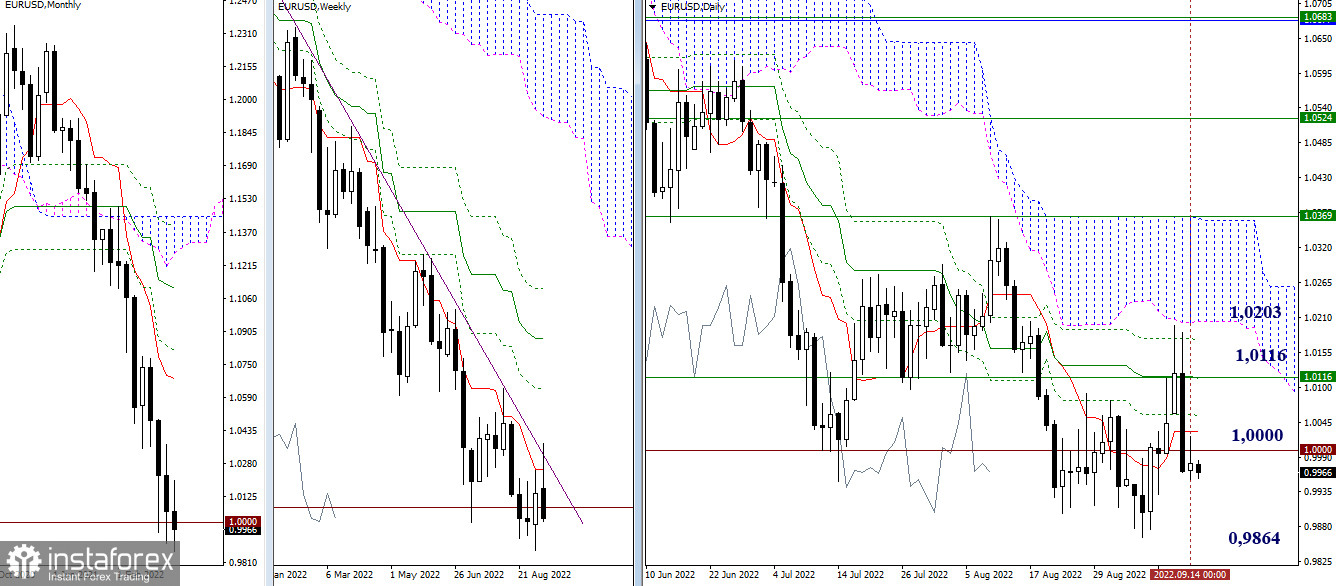

Bear traders took a break after yesterday's active trading and stayed near the key zone of 1.0000. A slight pause has not changed the overall market setup. The main goal for sellers remains the test of the minimum extremum point of 0.9864 and the resumption of the downtrend. Buyers will have to cancel the daily cross pattern and gain support from the weekly short-term trend. They will also need to enter the daily Ichimoku cloud located at 1.0116 – 1.0176 – 1.0203).

H4 – H1

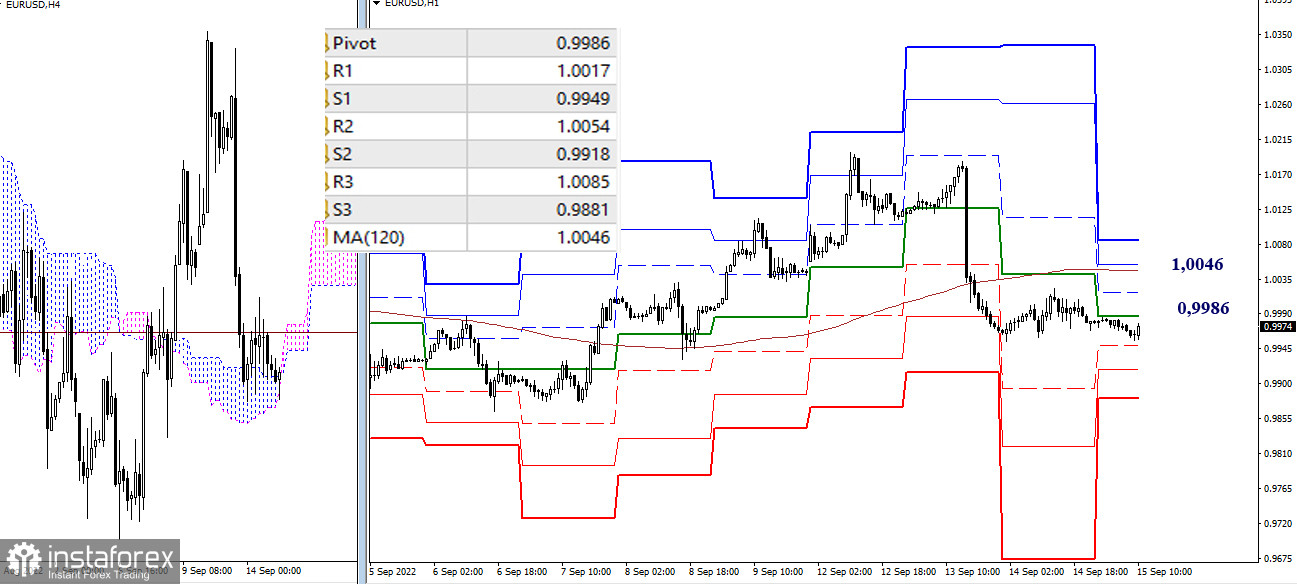

The pair continues to trade below the key levels on lower time frames. Therefore, bears are prevailing at the moment. Today, the main downward targets on the intraday chart are found at 0.9949 – 0.9918 – 0.9881 (the support of standard pivot levels). A breakout and consolidation above the key levels will change the existing balance in the market and will require new guidelines. The key levels are located at 0.9986 (the daily central pivot point) and 1.0046 (the weekly long-term trend).

***

GBP/USD

Higher time frames

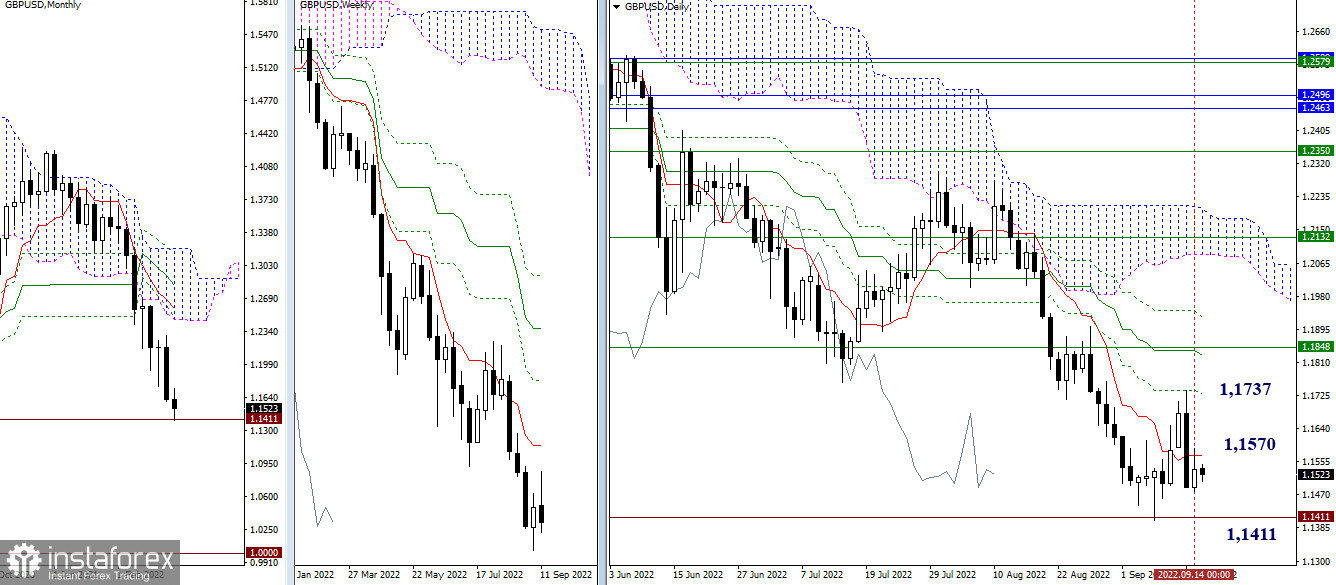

After a rapid drop, the GBP/USD pair slowed down the pace of decline. The sellers failed to extend the downtrend yesterday. The key level today is seen at 1.1570 which serves as a daily short-term trend. The nearest downward target for bears is found at the level of 1.1411 which served as support earlier. Buyers are facing resistance at the level of 1.1737 on the daily chart.

H4 – H1

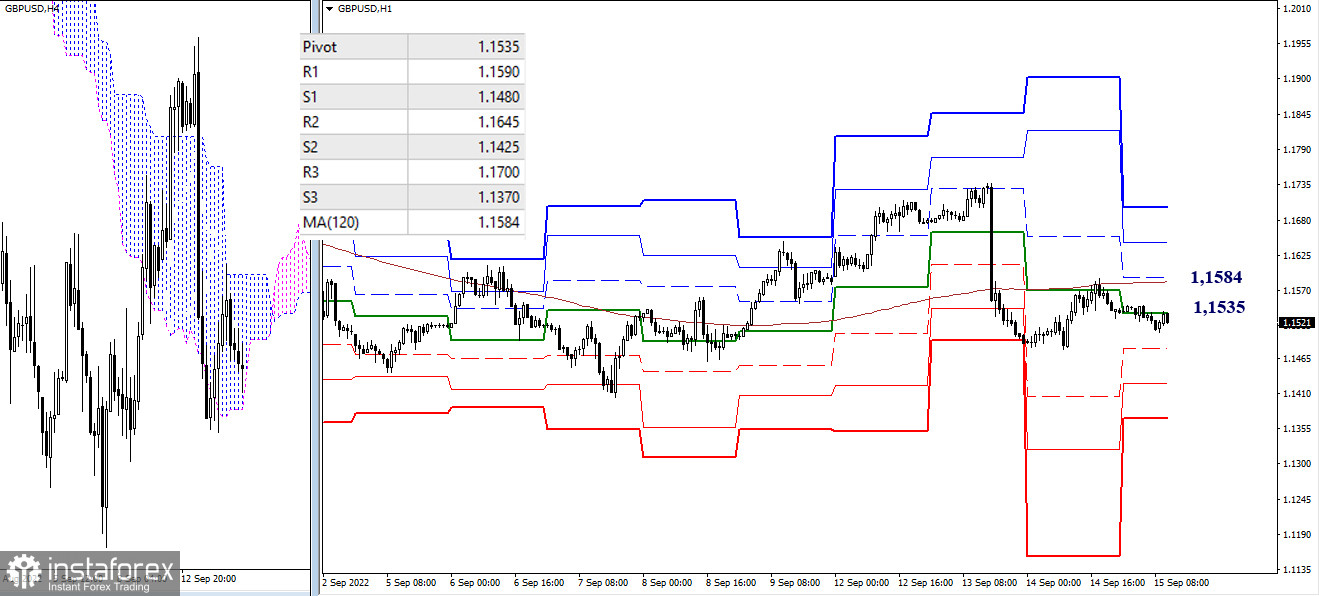

On lower time frames, the pair is trading near the key levels located at 1.1535-84 (the central pivot point of the day + weekly long-term trend). In case of a reversal, the main targets intraday will be the standard pivot levels. Bulls will focus on the resistance areas of 1.1590 – 1.1645 – 1.1700 while bears will pay attention to the support levels of 1.1480 – 1.1425 – 1.1370.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)