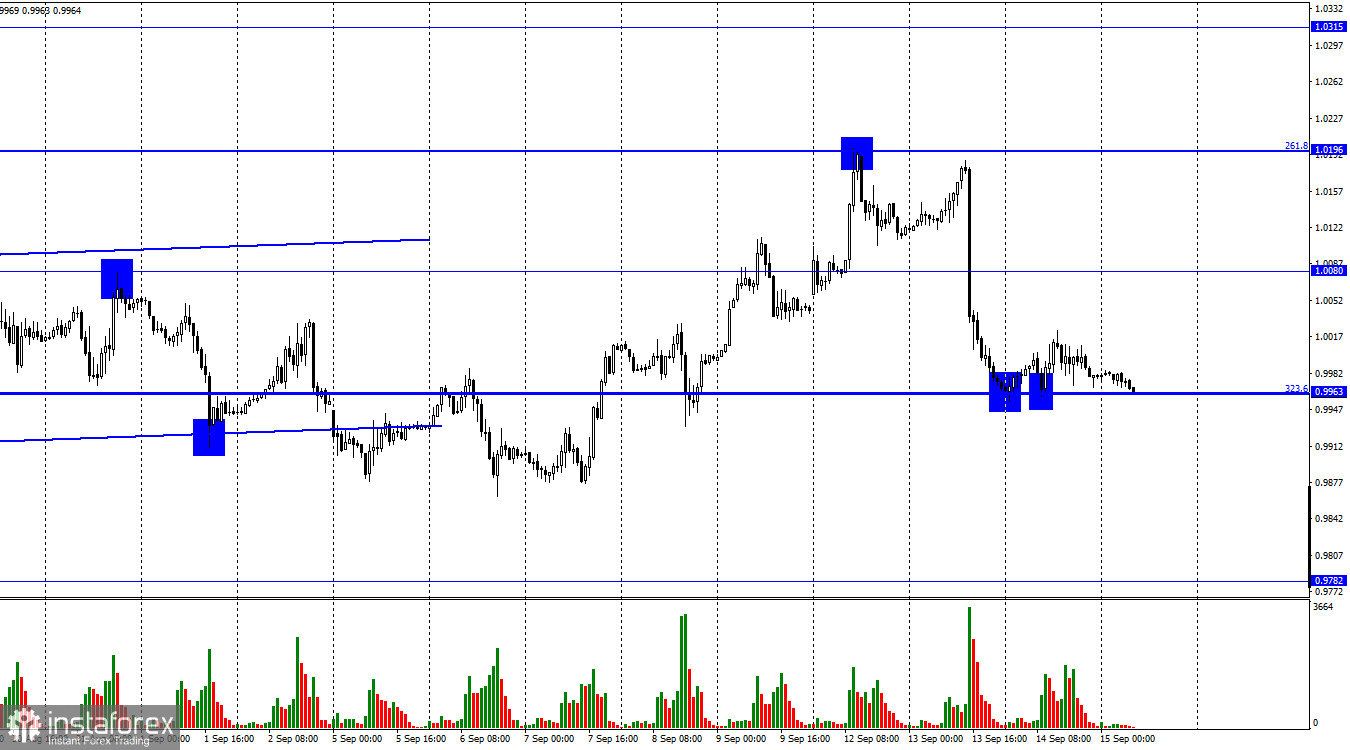

Good afternoon, dear traders! On Wednesday, the EUR/USD pair performed two rebounds from 0.9963, the Fibonacci correction level of 323.6%. However, its growth was rather modest. The quotes retreated to the 0.9963 level. If they close below this level, the likelihood of a further fall to 0.9900 and 0.9782 will increase. The euro could resume an upward movement if it grows to 1.0080. Given the events of recent weeks, I assume that the euro is likely to decline. The main reason is not that US inflation has slowed down less than expected and the Fed could raise the interest rate by 0.75%. Bears may regain the upper hand as the European economy may face a recession in the near future. One may say that the US economy has already slid into it, which is almost correct. However, on Forex, traders pay more attention to the movements of the currencies rather than the economic conditions of the countries where they are issued.

On Forex, traders open short or long positions on any currencies, without paying any attention to the fundamental background. Recent months have revealed that demand for the US dollar is higher than for the euro. In other words, traders are ready to buy the US dollar even despite the risk of a recession. However, they were unwilling to open long positions on the euro even at a time when no one was talking about a recession. Thus, investors are concerned more about the possibility of a recession and problems with the replacement of Russian gas than the slowdown in the US economy. The EU is still unable to tackle the energy crunch. Ursula von der Leyen has already announced a cap on the revenues of electricity production companies. She also proposed to limit the electricity price The collected money will be allocated to help households and companies that use gas in energy production. However, it is still difficult to say how effective this plan will be.

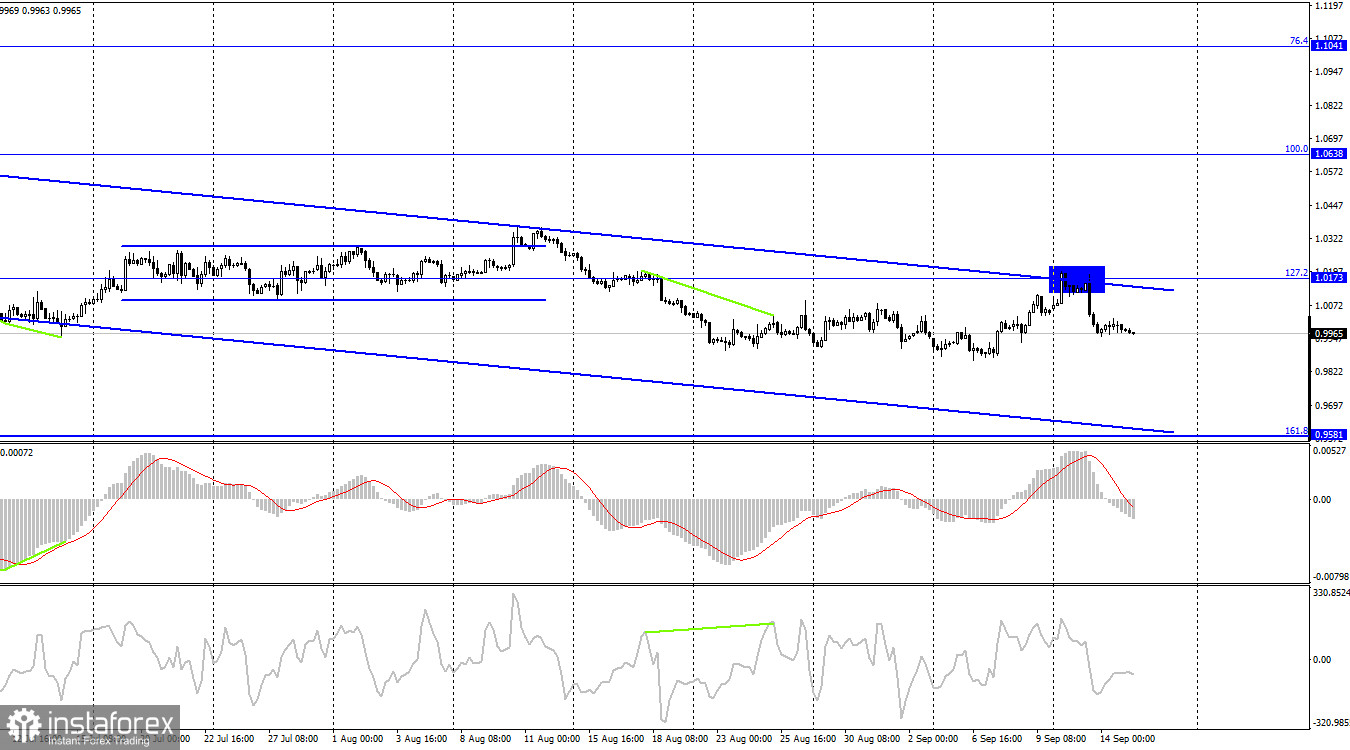

On the 4-hour chart, the pair bounced from 1.0173, the Fibonacci correction level of 127.2%. It declined to 0.9581, the Fibonacci correction level of 161.8%. The downward corridor indicates that the mood of traders remains bearish. If the pair rises above the downward corridor, the mood may become bullish for a long time. However, the last attempt was unsuccessful.

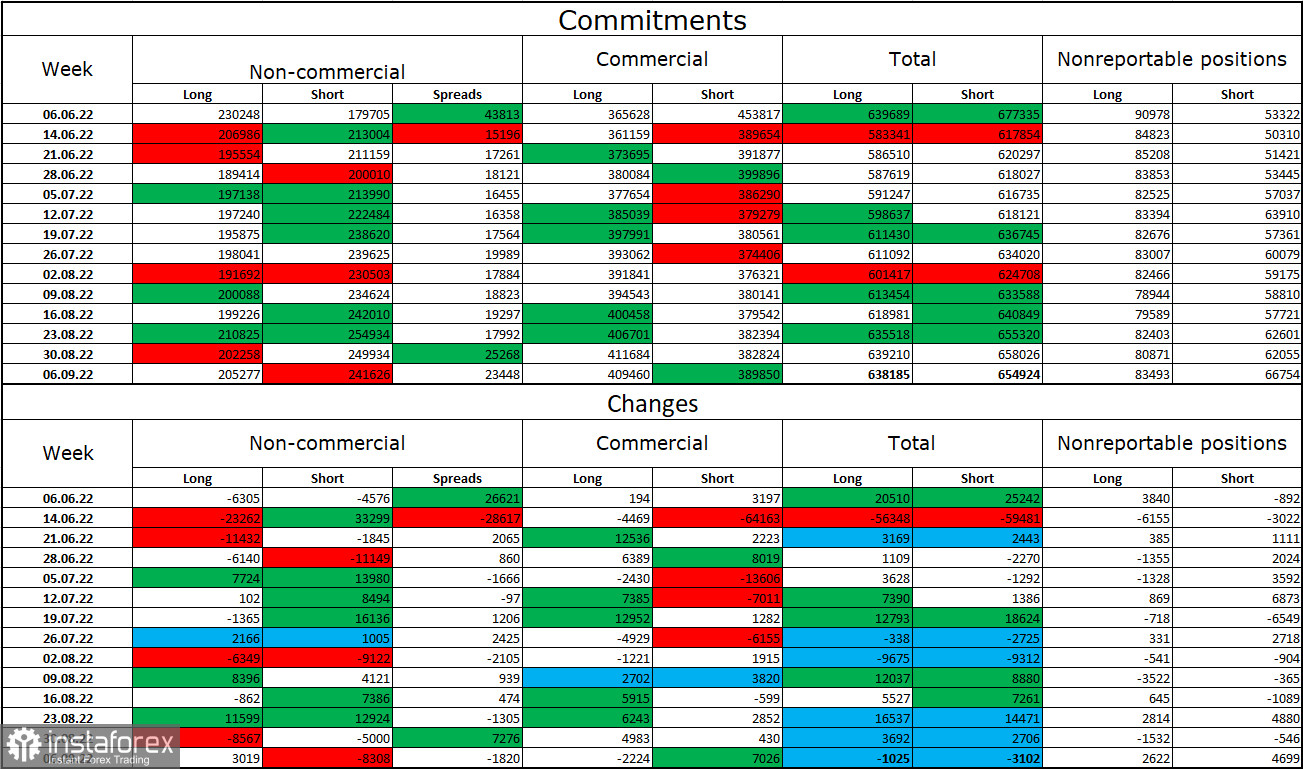

Commitments of Traders (COT):

The latest COT report revealed that speculators opened 3,019 Long positions and closed 8,308 Short positions. It means that the bearish sentiment of large traders has weakened. The total number of Long positions now amounts to 205,000 and the number of Short ones totals 241,000. The difference between these figures is not too big. However, it clearly shows that bulls are unable to take the upper hand. In the last few weeks, the likelihood of a rise in the euro has been gradually growing. Yet, recent COT reports have shown that an increase in long positions was insignificant. The euro has not been able to assert strength in the last few months. Maybe the situation will change after the ECB meeting. Technical analysis is of great importance now because it is quite difficult to determine when there could be changes in market sentiment. If there is a buy signal on charts, traders are sure to increase long positions on the euro.

Economic calendar for US and EU:

US – Retail Sales (12:30 UTC).

US – Initial Jobless Claims (12:30 UTC).

US – Industrial Production (12:30 UTC).

On September 15, the economic calendar for the EU is uneventful. This is why traders are anticipating today only the US economic reports. The impact of fundamental factors on market sentiment may be weak today.

Outlook for EUR/USD and trading recommendations:

It is recommended to open short positions if the pair rolls back from 1.0173 (1.0196) on the 4-hour chart with the target level of 0.9900. Now, it is better to keep these positions open. I would advise opening long positions if the price climbs above 1.0173 on the 4-hour chart with the target level of 1.0638.