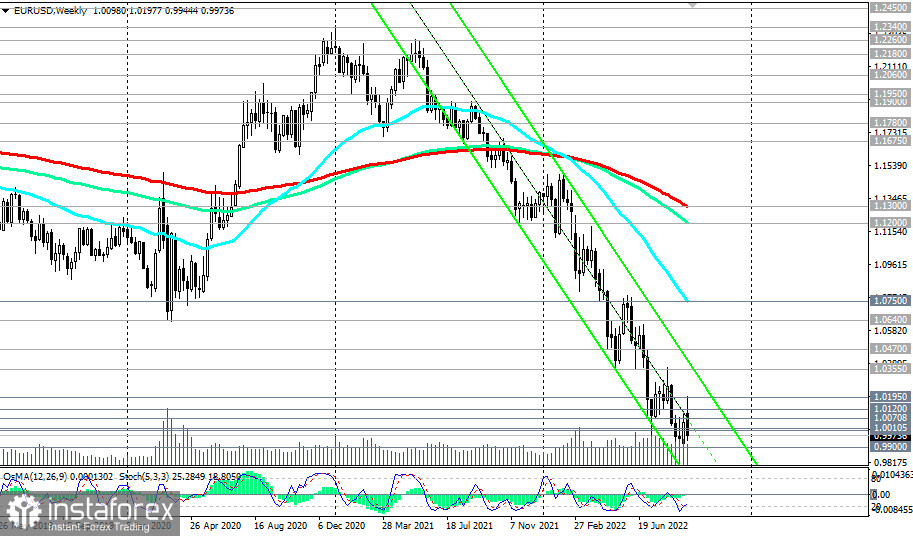

Generally, EUR/USD continues to move downwards.

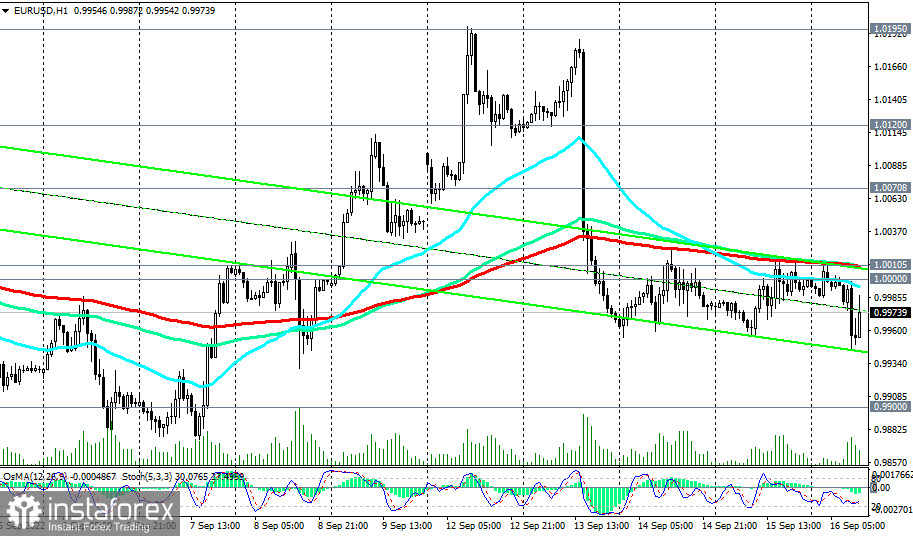

The pair remains in the bear market zone, both long-term—below resistance levels 1.1200 (144 EMA on the weekly chart), 1.1300 (200 EMA on the weekly chart), and short-term—below resistance levels 1.0010 (200 EMA on the 1-hour chart), 1.0070 (200 EMA on the 4-hour chart).

If the dollar comes under pressure today after the publication of the preliminary consumer confidence index of the University of Michigan, then EUR/USD may have a chance to grow at the end of this week by fixing long positions on USD.

The breakdown of the resistance level 1.0010 will be a signal for the implementation of this scenario. Although, the correction is likely to be limited by the resistance levels 1.0120, 1.0200.

In the main scenario, we expect further decline. The nearest target is the local low and the support level of 0.9900. Then deep into the descending channel on the weekly chart.

Support levels: 0.9950, 0.9900, 0.9865, 0.9800

Resistance levels: 1.0000, 1.0010, 1.0070, 1.0120, 1.0195, 1.0200

Trading Tips

Sell Stop 0.9940. Stop-Loss 1.0025. Take-Profit 0.9900, 0.9865, 0.9800, 0.9700

Buy Stop 1.0025. Stop-Loss 0.9940. Take-Profit 1.0070, 1.0120, 1.0195, 1.0200, 1.0300, 1.0355, 1.0500, 1.0600