Futures on US stock indices extended their decline on Friday. The pressure on the indices escalated a day earlier amid expectations of new aggressive rate hikes by the Fed. Futures on the S&P 500 index decreased to the 2-month low. They were also down today, losing 0.3% at the opening. The heave-tech NASDAQ tumbled by 0.3%, while the Dow Jones sank by 0.2%. The EURO STOXX 50 index also dropped. Stocks in Japan, Hong Kong, and China fell despite the fact China's industrial production and retail sales data topped expectations.

Further aggressive tightening is sure to have an impact on the US 2-year government bond yield, which rose to the highest level since 2007. As a result, the yield curve has been inverted even more, which is viewed as a sign of a recession. The latest US economic reports revealed a mixed outlook for the economy. Economic growth is slowing down due to monetary tightening. Retail sales in August will certainly continue to boost inflation, which will force the central bank to raise rates more aggressively. Now, traders are pricing in a 75 basis point increase at the September meeting. On top of that, some analysts do not exclude a 100 basis point rate hike.

According to fresh macro stats, the Fed is likely to raise the interest rate by 75 basis points once again next week. However, the likelihood of another 0.75 basis point rate hike in November has increased considerably. Such expectations will continue to limit risk appetite, pushing risk assets down. Given that the stock market has fallen below the level of the last correction, the bullish momentum seems to be losing steam. We will talk about the technical outlook below. The initial jobless claims have been declining for 5 weeks in a row. It indicates that the labor market remains resilient, showing one of the best results on record. The University of Michigan Consumer Sentiment Index is due today. It will provide clues about inflation expectations.

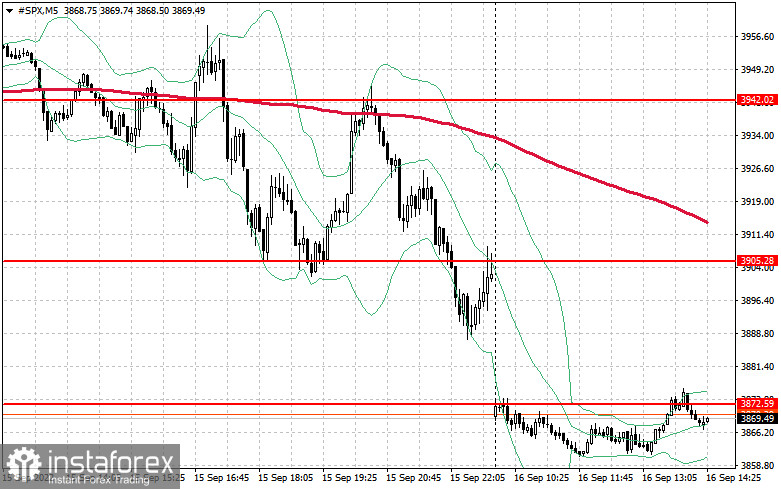

As for the technical outlook of the S&P500, after yesterday's collapse, the pressure on the index is only increasing. To build an upward correction and find the bottom, bulls need to push the index above the $3,872 level. It will open the way to $3,905. The index is likely to regain um upward movement only after a breakout of this level. If so, it could reach the resistance zone of $3,942-$3,968. A more distant target will be the $4,038 level. In case of further downward movement, a breakout of $3,835 will push the index to $3,801. After that, it may drop to a low of $3,772. Hence, the price is likely to decline to $3,744 where the index may rise slightly.