Analysis of Friday's deals:

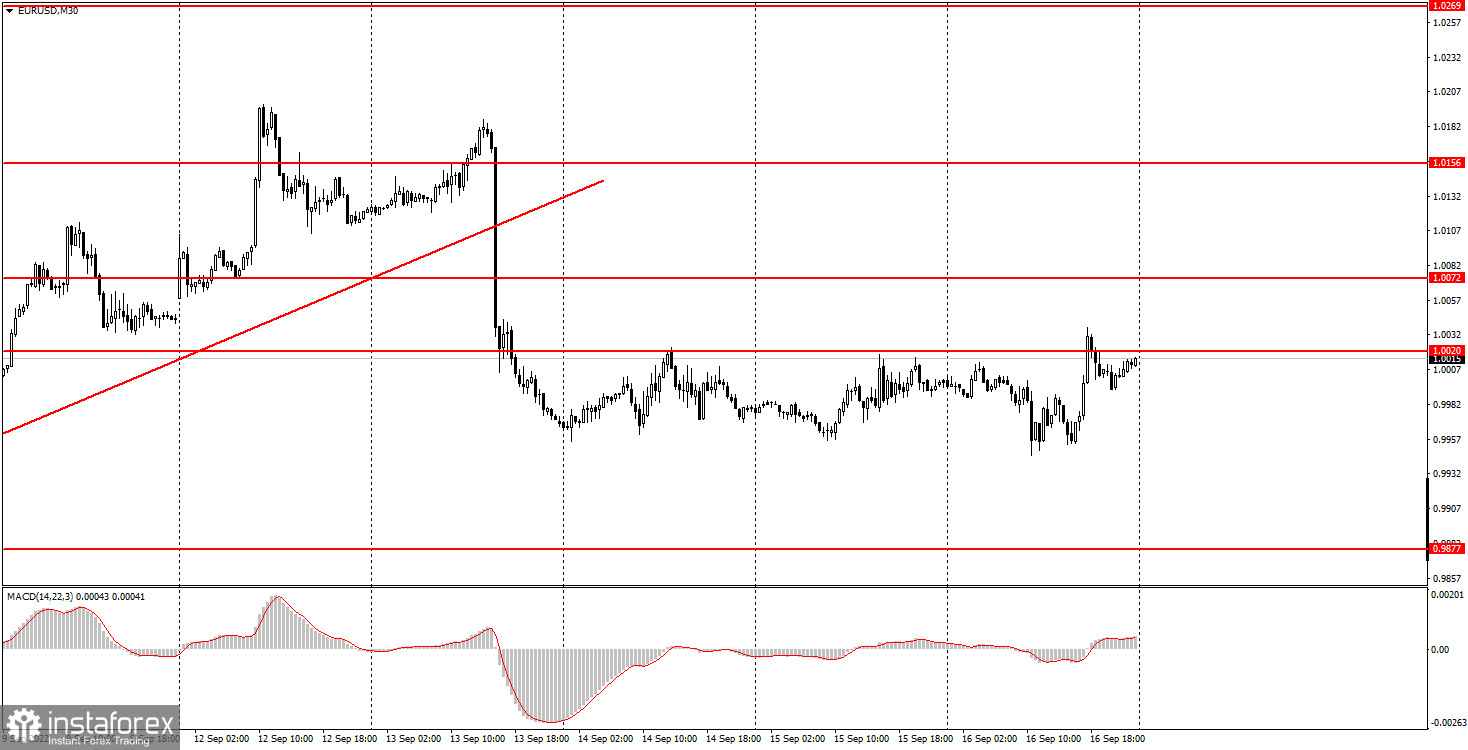

30M chart of the EUR/USD pair.

The EUR/USD currency pair ended last week as boring as possible. Of the most important reports on Thursday and Friday, we can single out only the consumer price index in the European Union, which in general fully corresponded to forecasts and amounted to 9.1% at the end of August. The market reaction to this report was completely different than the report on American inflation, or it was practically non-existent. We have already drawn attention in previous articles to some inadequacy in the market's reaction to inflation in the United States, which was 200 points. As you can see, European inflation has practically not interested market participants. The pair failed to fall to their 20-year lows this week and updated them. And the last three days have been completely flat. Thus, after falling by 200 points on Tuesday, the bears failed to build on their success and continue moving down.

Nevertheless, the pair continues to trade only 150 points from its 20-year lows, so we believe the downward movement will resume. Next week we are waiting for the Fed meeting, and the market's reaction to this event may be very strong. Moreover, a new rate increase of 0.75% is expected.

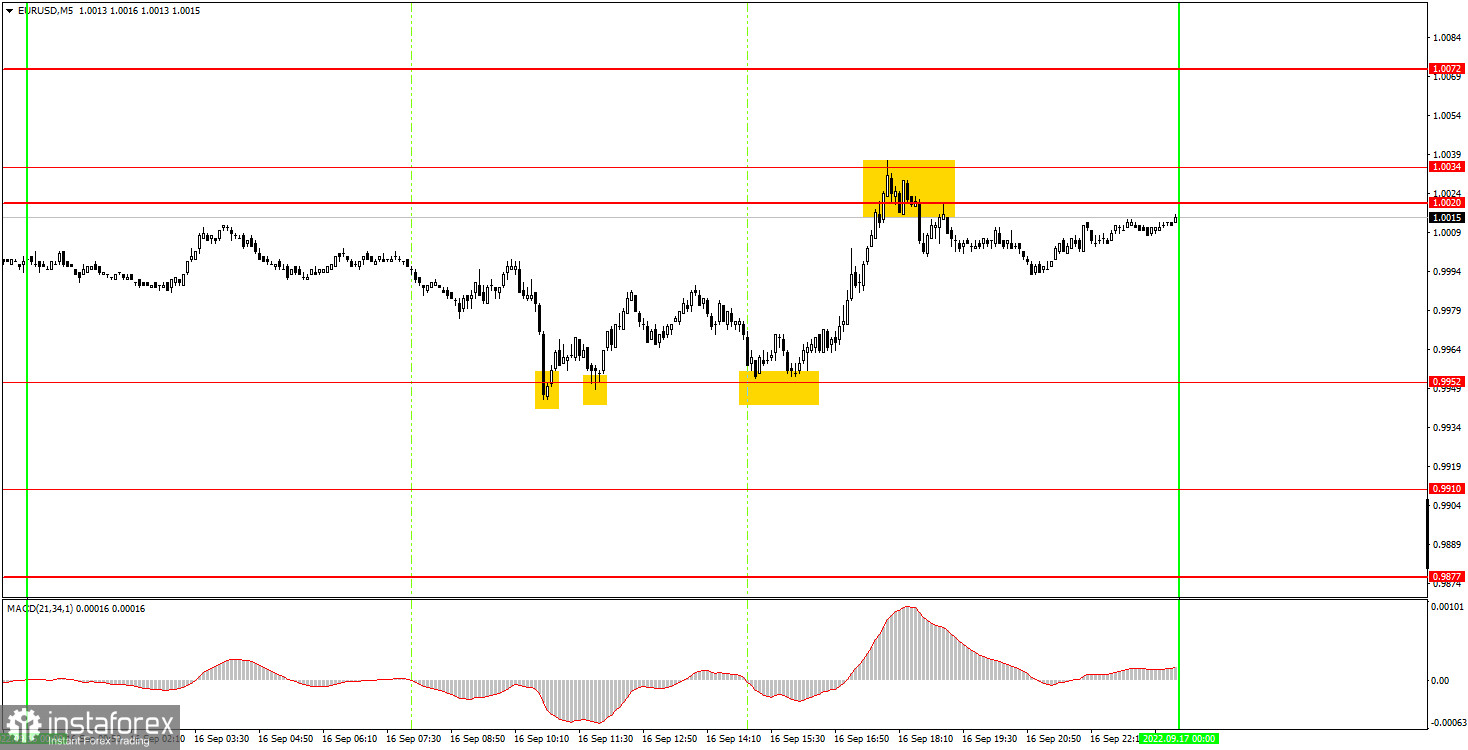

5M chart of the EUR/USD pair.

On the 5-minute timeframe, the situation with trading signals on Friday was very good, despite the flat. The flat occurred between the current levels of 0.9952 and 1.0034, and no attempts were made to get out of this range. Therefore, novice traders had three buy signals near the 0.9952 level and one sell signal near 1.0034. According to the buy signals, two long positions should have been opened. The first one closed at breakeven on a stop loss, as the price went up 24 points and returned to its original position. The second transaction brought a profit of 42 points, as the target level was fulfilled. The sell signal was formed just a few hours before the week's close, so it should not have been worked out, but it was profitable.

How to trade on Monday:

In the 30-minute timeframe, the pair shows with all its appearance that it is ready to continue falling, but this very fall has stalled in the last three days. Nevertheless, next week there will be important events that can provoke a reaction no less than the reaction to inflation in the United States. A new downward trend has formed, as the price has consolidated below the ascending trend line. On the 5-minute TF tomorrow, it is recommended to trade at levels 0.9877, 0.9910, 0.9952, 1.0020-1.0034, 1.0072, 1.0123, 1.0156, 1.0221. When passing 15 points in the right direction, you should set the stop loss to breakeven. According to tradition, no important events or publications will be held in the United States or the European Union on Monday. Therefore, the market will have nothing to react to. Nevertheless, the Fed's meeting, which will take place on Wednesday, may be worked out by the market in advance.

The basic rules of the trading system:

1) The strength of the signal is calculated by the time it takes to generate the signal (rebound or overcome the level). The less time it takes, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form many false signals or not form them at all. But in any case, it is better to stop trading at the first signs of a flat.

4) Trade transactions are opened between the beginning of the European session and the middle of the American session, when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), they should be considered a support or resistance area.

What's on the charts:

Price support and resistance levels are the levels that are the targets when opening purchases or sales. Take Profit levels can be placed near them.

Red lines are channels or trendlines that display the current trend and show which direction is preferable to trade now.

The MACD indicator(14,22,3) is a histogram and a signal line – an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

To trade in the forex market, beginners should remember that every transaction cannot be profitable. Developing a clear strategy and money management is the key to success in trading for a long period.