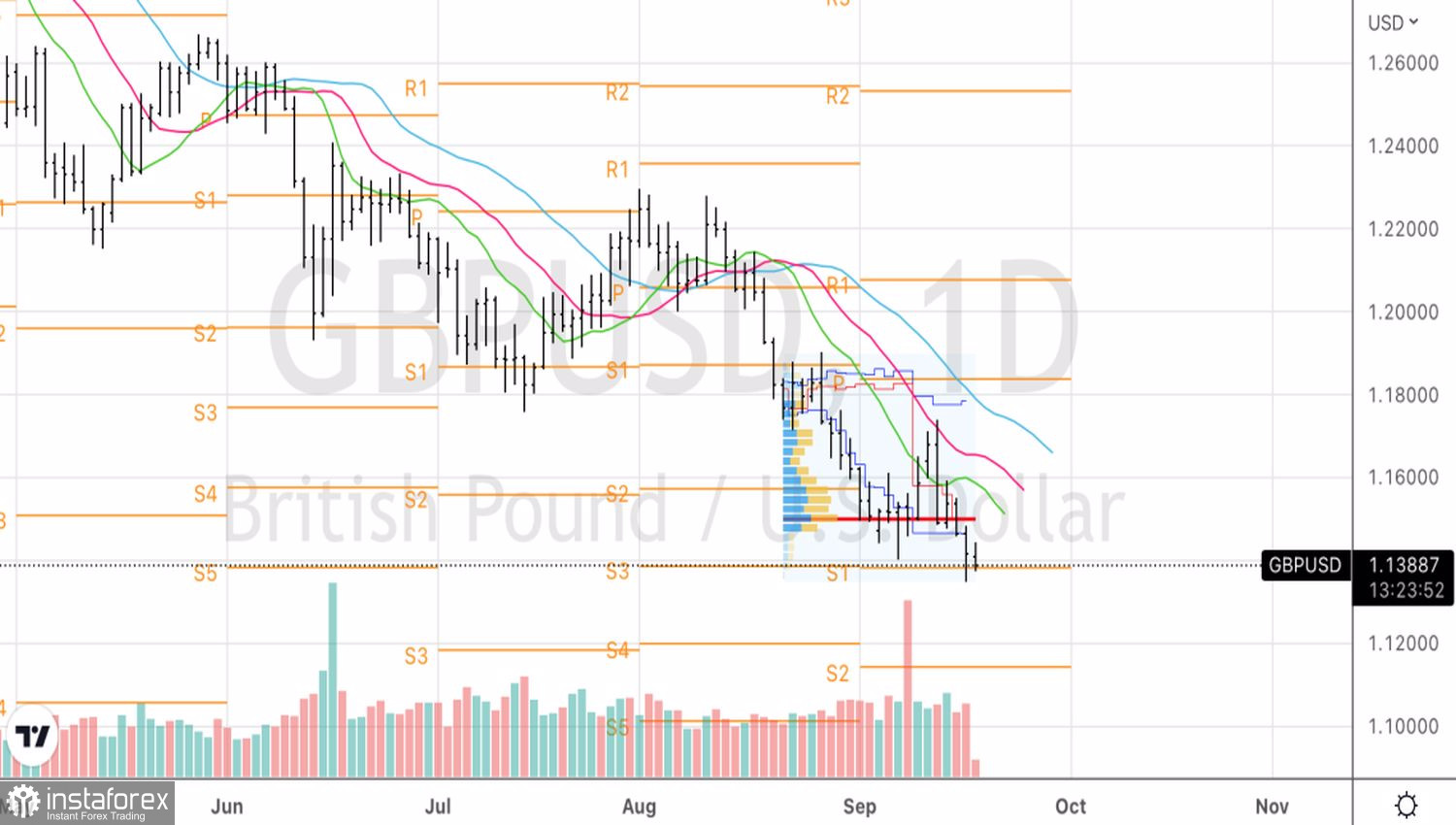

The markets are scared of stagflation, but if it's anywhere, it's Britain. It is the combination of high prices and extremely slow and, most likely, negative GDP growth that can explain the collapse of the GBPUSD to the 37-year bottom area. And you don't need to blame all the bumps on a strong US dollar. In mid-September, the pound collapsed not only against it, but also against the euro after the release of statistics on retail sales.

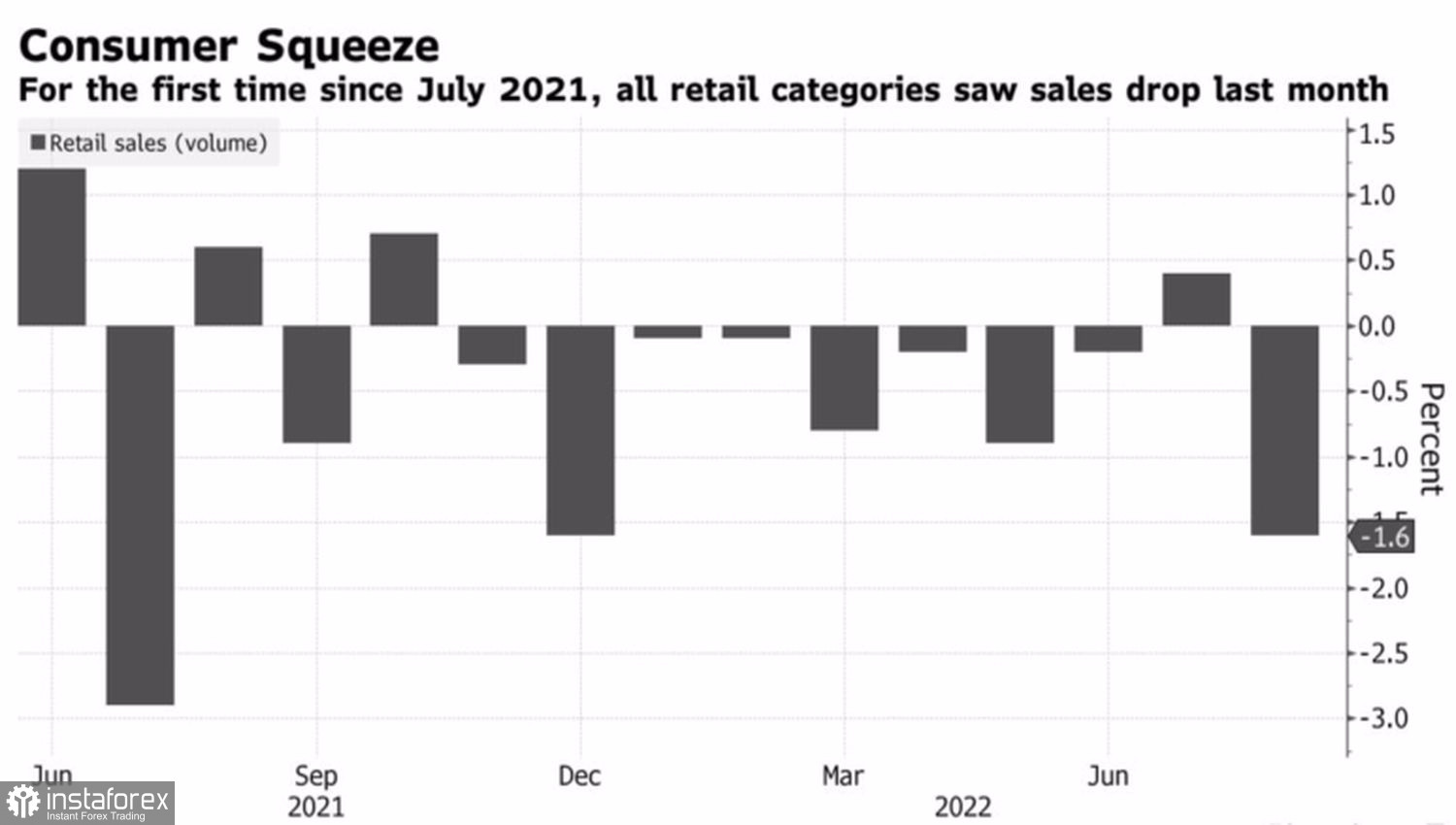

In August, the indicator sank 1.6% MoM, and on an annualized basis, it was stuck in the red zone for five months in a row. Barring the early days of the COVID-19 pandemic, there hasn't been such a bad streak for retail in over 10 years. MUFG called the report terrible, predicting a further fall in the sterling, and Capital Economics believes that the data indicate that the UK economy is already in recession.

Dynamics of retail sales in Britain

An attempt to revive it with a £150 billion support package for households affected by the energy crisis and the tax cut of about 1% of GDP announced during the election race by Liz Truss's team is a double-edged sword. Conservative intervention in the gas market could slow down inflation in the short term but accelerate it in the medium term. Indeed, the growth rate of consumer prices in Britain decreased from 10.1% to 9.9% in August, but inflation expectations on the 12-month horizon, on the contrary, rose from 4.6% to a record 4.9%.

Fiscal incentives complicate the work of the Bank of England, which, it seems, is simply obliged to act aggressively but is afraid to go too far, fearing the negative impact of an excessively fast monetary restriction on the economy. The derivatives market is fully confident in the increase in the repo rate by 50 bps at the MPC meeting on September 22 and gives a 65% chance of a 75 bps increase in borrowing costs.

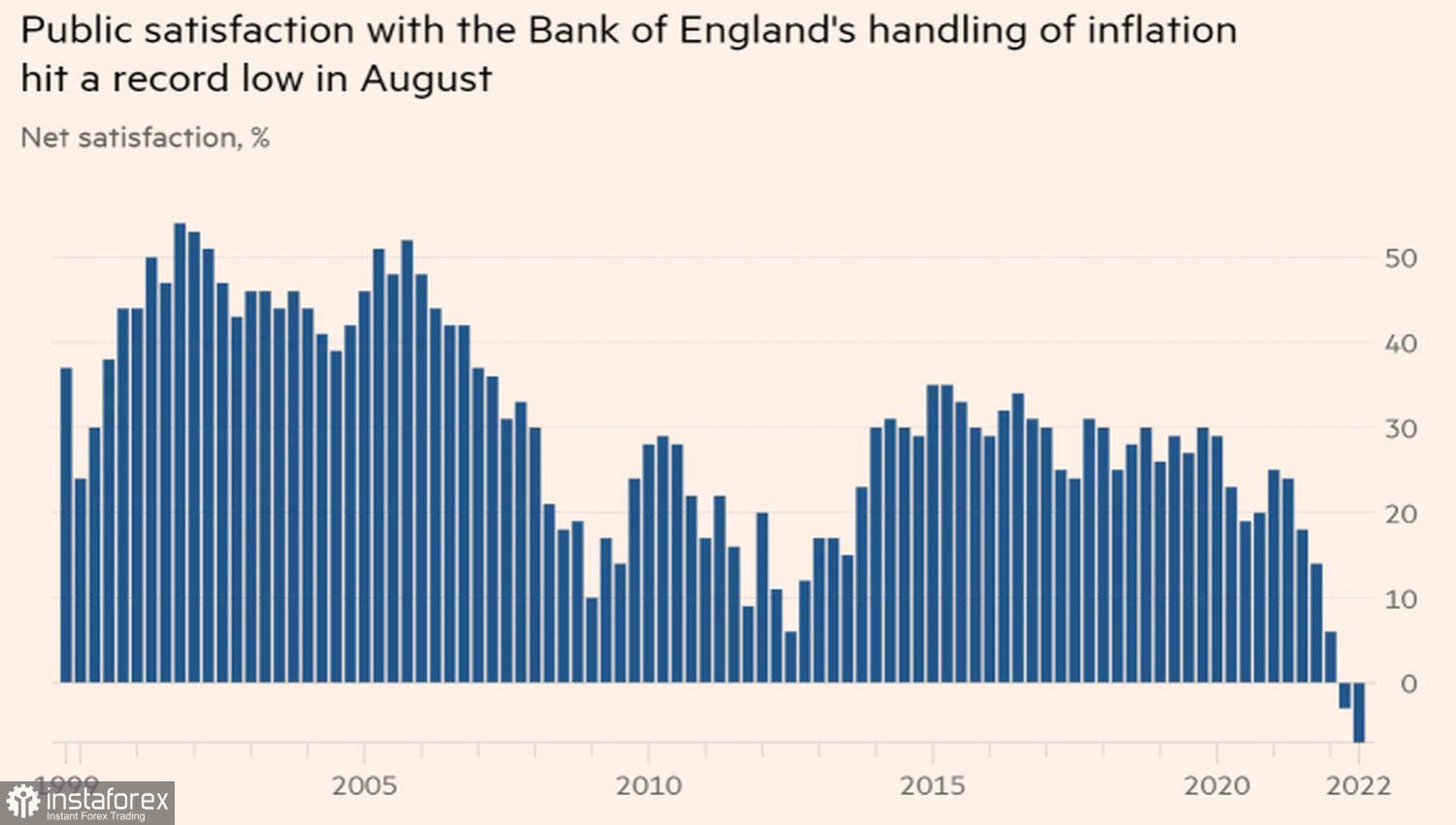

In the meantime, the dissatisfaction of the electorate with the BoE's monetary policy has reached its climax.

Dynamics of public satisfaction with the work of the Bank of England

I would not be surprised if, under such conditions, the intervention of the Liz Truss government in the work of Andrew Bailey and his colleagues does not cause public criticism.

Thus, the situation in the UK looks worse than ever, but any coin always has two sides. The collapse of the GBPUSD would not have been possible without the strong US dollar. The futures market predicts that in 2023 the federal funds rate will reach 4.5%, and about 70% of Financial Times experts believe that the 4–5% range will become its ceiling. 20% of economists believe that it is even higher. The Fed's monetary tightening potential has not been disclosed, and it appears to be greater than that of the BoE. The American economy looks better than the British one. Where can GBPUSD not fall?

Technically, on the daily chart of the analyzed pair, falling quotes below the pivot point 1.138 will increase the risks of the downward trend continuation in the direction of 1.12 and 1.115. While GBPUSD is trading below 1.15, the recommendation is to sell.