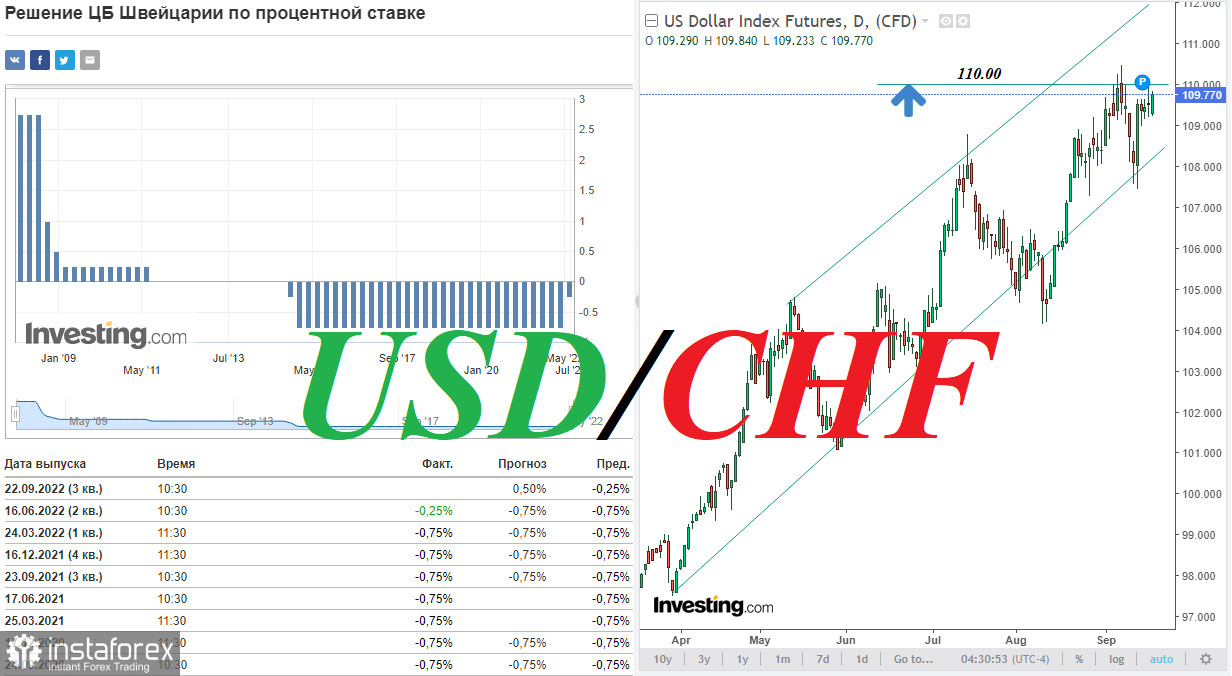

The dollar is strengthening ahead of the Fed meeting, which will begin tomorrow. Having closed the previous week in positive territory, the dollar index (DXY) rose again since the opening of today's trading day. As of this writing, DXY index futures are near 109.77, 127 pips above last week's opening price and 48 pips above today's trading day opening price.

Dollar buyers remain optimistic, and DXY—positive dynamics, in anticipation of the next tough measures from the Fed leaders to curb inflation in the US.

The US Bureau of Labor Statistics reported Tuesday that inflation rose above expectations in August. The consumer price index (CPI) came out with a value of +8.3% on an annualized basis against the forecast of +8.1% and +8.5% in the previous month. On a monthly basis, inflation rose by +0.1% from 0% in July, which was above expectations for a decline of -0.1%. It follows from the report that inflation has begun to gain momentum again. That, in turn, makes a 75 basis point rate hike at the September FOMC meeting now "virtually guaranteed," economists say. Moreover, a significant part of economists and market participants are betting that the Fed will raise interest rates by 100 basis points at once.

While the other major global central banks are also tightening their monetary policies, the Fed's interest rate decisions have the biggest impact on the market. And the Fed's tighter monetary policy compared to other major world central banks makes the dollar a more promising tool for long-term investment by strategic investors, for whom a guaranteed income, albeit relatively low, is more important.

The Fed's decision on the interest rate will be published on Wednesday.

This week, in addition to the Fed, four more of the world's largest central banks (China, Japan, Switzerland, Great Britain) will also hold their meetings on monetary policy issues. In particular, on Thursday (at 07:30 GMT), the decision of the Swiss National Bank (SNB) on the interest rate will be published.

During the June meeting, the SNB unexpectedly raised its interest rate on deposits to -0.25%, surprising investors and economists who had expected the interest rate to remain at the same level of -0.75%.

After the decision of the Swiss National Bank to raise the interest rate by 50 basis points, its head, Thomas Jordan, noted that the Swiss franc is no longer highly overvalued due to the recent decline. The accompanying SNB statement also said that "tighter monetary policy aims to prevent inflation from spreading more widely in Switzerland." At the same time, the bank reserves the right to "intervene in the markets in order to stop the excessive strengthening or weakening of the Swiss franc."

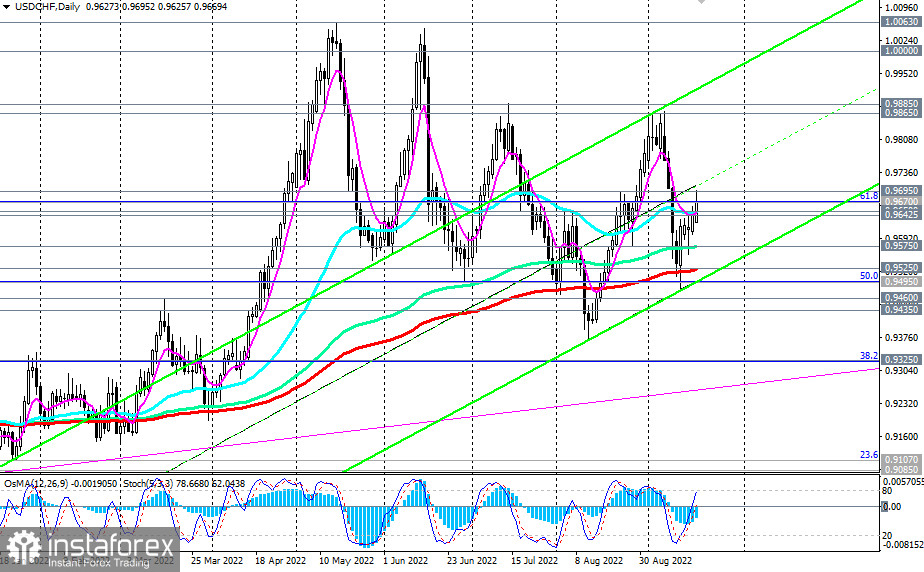

Last week, it was expected that the leaders of the SNB would keep the current deposit rate at -0.25%. Now it is assumed that the main interest rate will be raised again, and immediately by 0.75%, to 0.5%. It is likely that this move by the SNB, as well as the franc's traditional safe-haven status, will boost demand for the franc. This also applies to the USD/CHF pair. It may decrease the stronger, the more rigid the position of the SNB on the issue of monetary policy will be.

In the meantime, the pair maintains a positive momentum, trading in the bull market zone above the key support levels of 0.9460, 0.9525.

Today, publication of important macro statistics is not planned. Exchanges in Japan and the UK are closed (in Japan due to Respect for the Aged Day, and in the UK due to the mourning for the funeral of Queen Elizabeth II), so trading volumes on the market today are lower than usual.