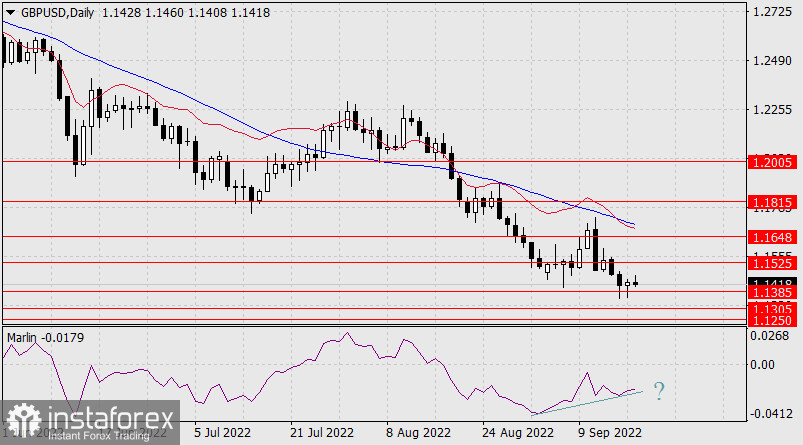

As on Friday, the British pound pierced the support at 1.1385 with its lower shadow, but closed the day with a white candle. Conceptually, this can be explained by market consolidation ahead of tomorrow's extended Federal Reserve meeting on monetary policy. The market is waiting for a rate hike of 0.75%, after which the pound may fall to the target support of 1.1305, and then to 1.1250.

Price convergence with the Marlin Oscillator is starting to form on the daily chart. And this situation has three options for development: continuation of corrective growth with a subsequent reversal into a medium-term decline, the formation of convergence at a lower level, since the current convergence has a steep rise, a decisive breakdown of convergence with a strong price decline. We are setting ourselves up for the development of one of the two bearish scenarios and are waiting for the Fed's decision on monetary policy.

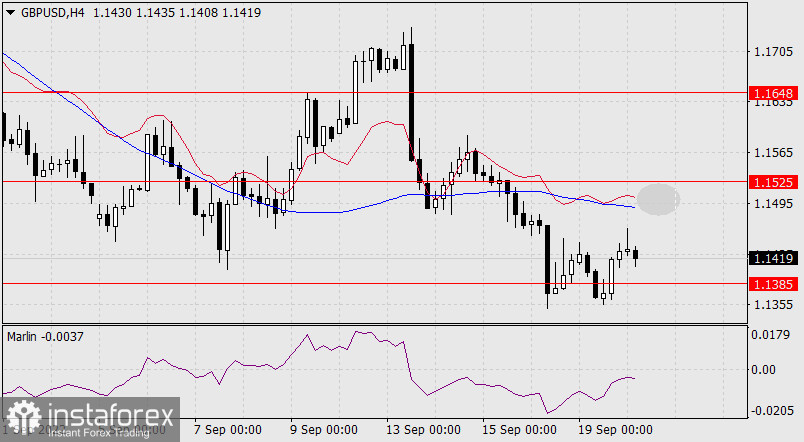

The price is below the indicator lines on a four-hour scale, the Marlin Oscillator is in the negative area. The price has a small space to wander to the MACD line or even above it, to the resistance level of 1.1525, but today there are no important economic indicators, so we expect strong movements tomorrow. Of course, the price does not have to fill this free space as a false move, the price can immediately fall when the Fed announces its vision of monetary policy.