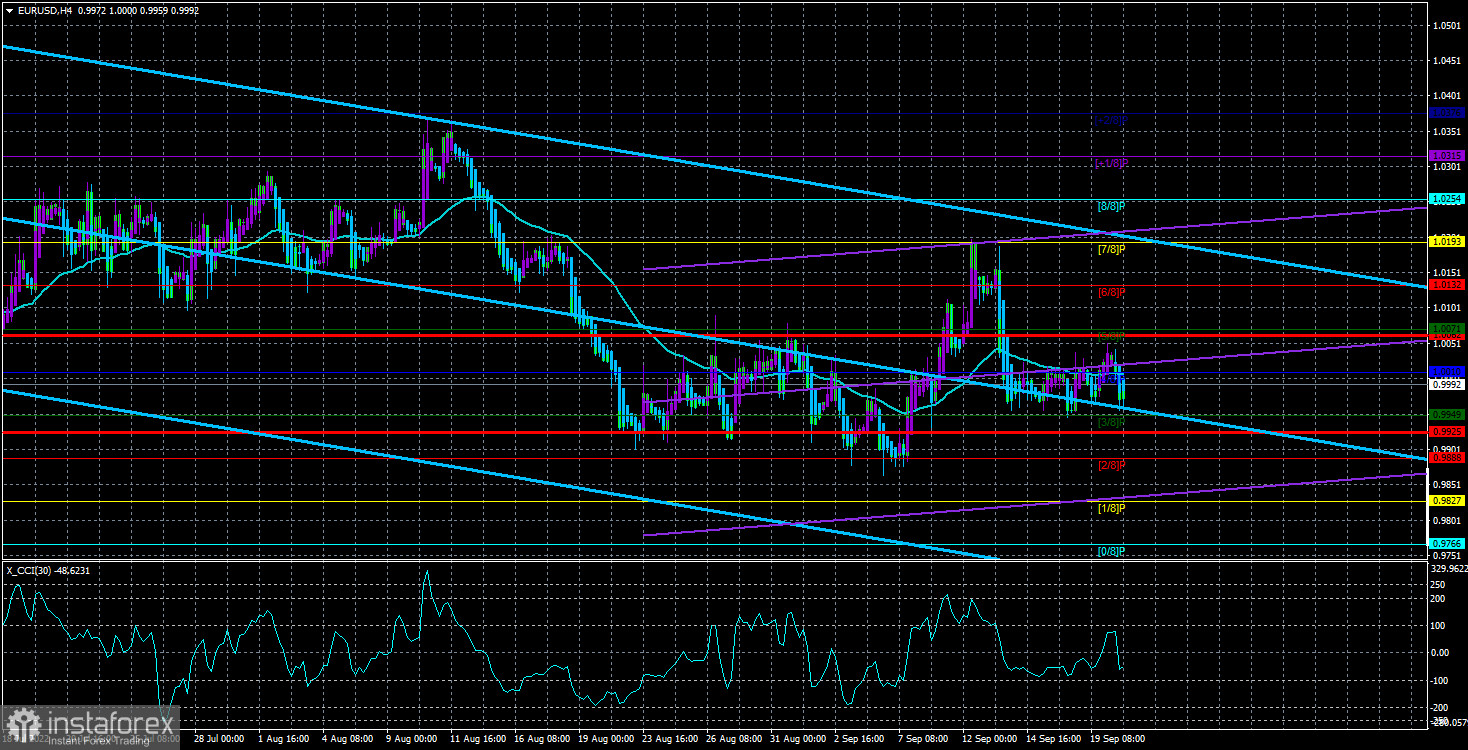

The EUR/USD currency pair continued to trade quite calmly throughout Tuesday. There is no need for the market to be nervous since the US dollar has already set all possible value records against its main competitors. Market participants do not doubt that they will continue to follow the general trend with a favorable fundamental background. Then why should they rush into this matter? The dollar has been growing for more than a year and a half. During all this time, the euro currency has only shown a correction of a maximum of 400 points several times. That is, from a long-term point of view, the euro currency is in a collapse against the dollar. In the last few days, the quotes have been firmly stuck around the 1.0000 level, and if we take the last month, then in the side channel of 0.9888-1.0072. In both the first and second cases, we are talking about a flat at the very "bottom" of the market. But at the same time, this "bottom" may become even deeper than it is now. The illustration above shows that the pair has been holding within 100 points of its 20-year lows for a long time.

This week, the Fed will hold a meeting that does not carry any intrigue. With almost 100% probability, the key rate will be increased by 0.75%. The only open question is, what will be the rate hike at the next meeting in November? Recall that we were talking about a total increase in the rate of 3–3.5% at the beginning of the year. Now we are talking about 4-4.5%. And everything will depend on the inflation indicator, which showed a good slowdown in July but slowed down in August. Thus, in a good way, the Fed should not slow down the pace of monetary policy tightening. And the higher the rate increases, the more reason traders have to continue buying the US currency. Moreover, they are not particularly interested in the ECB or BA rate.

The US economy is at risk of facing serious problems.

Meanwhile, many global economists are analyzing the Fed's actions very closely. Most of them believe that the regulator was very late with the start of the policy tightening cycle, and now the US economy will face serious problems. The recession has already begun. They note that it has now become normal to expect a 0.75% increase from the central bank, although at the beginning of the year, such a step looked wild and strange. Many also note that the rate of inflation slowdown is too weak, hinting that rates will have to be raised more and faster than initially expected. All this will harm lending, investment, consumer demand, and economic growth.

Moreover, the consequences of high rates, which, according to Powell himself, will remain high longer than planned, will be visible in 2023 and 2024. Many economists wonder what the Fed will do if economic growth is negative for a long time. Or if GDP starts to fall too fast? The fight against inflation, of course, is in the first place if we are talking about a 1-2% loss of economic growth, but what if we are talking about a larger reduction in the economy?

It can also be noted that Jerome Powell's plans for a gradual rate hike "so as not to shock the economy and markets" have failed. The Fed has been adjusting monetary policy very slowly for decades, but now we are talking about raising the rate by 0.75% at the third meeting in a row. The markets are already in shock. The stock market has lost 30–40% since the beginning of the year and may lose another 20–25%, according to most experts. The US dollar has risen to historic highs against the pound and the euro and will not stop there. What is it, if not a state of shock? Based on all of the above, we believe that the trend may continue for now. Although the downward trend cannot be eternal, the lower the pair falls, the more likely it is that the trend will end soon. So far, the market has not taken any actions that could be interpreted as attempts to start a new upward trend.

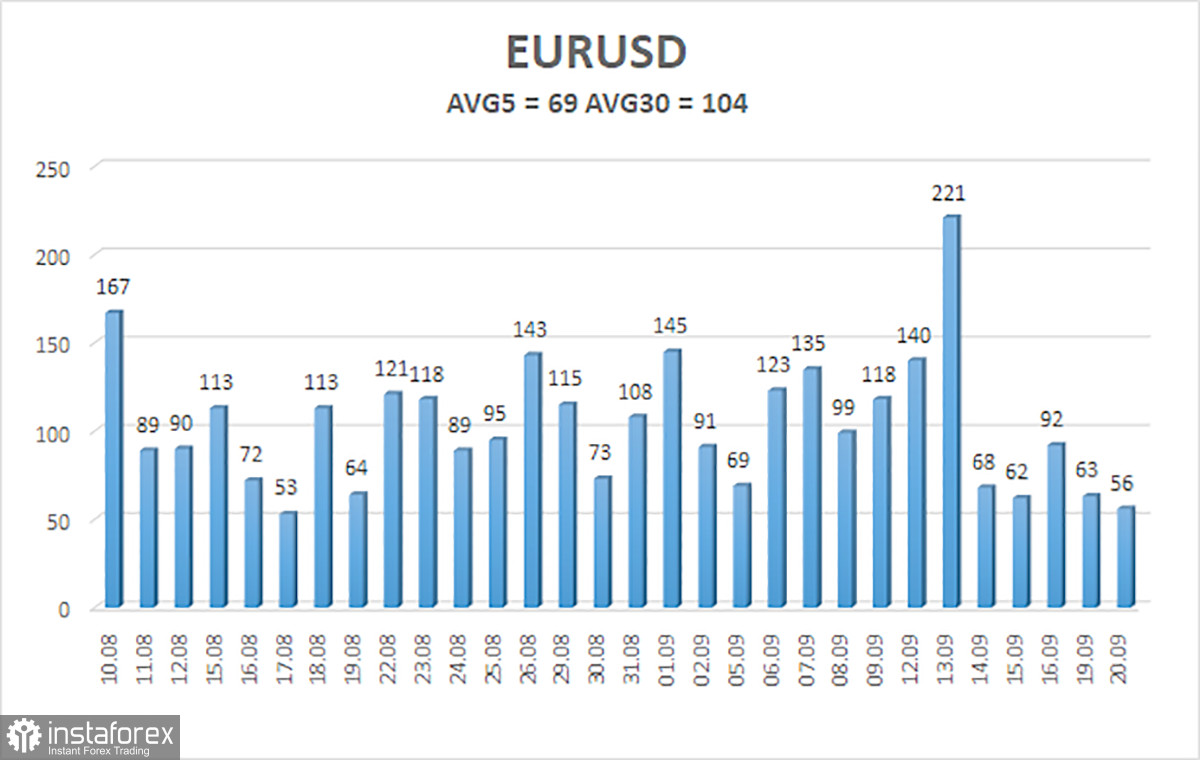

The average volatility of the euro/dollar currency pair over the last five trading days as of September 21 is 69 points, which is characterized as "average." Thus, we expect the pair to move today between 0.9925 and 1.0082. A reversal of the Heiken Ashi indicator back up will signal a round of upward movement within the next flat.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

S3 – 0.9827

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair is trying to continue the global downtrend, but it turns out that it is only inside the 0.9888-1.0072 side channel so far. Thus, you either need to wait for the flat to complete or trade for a rebound/overcoming its boundaries with appropriate goals.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.