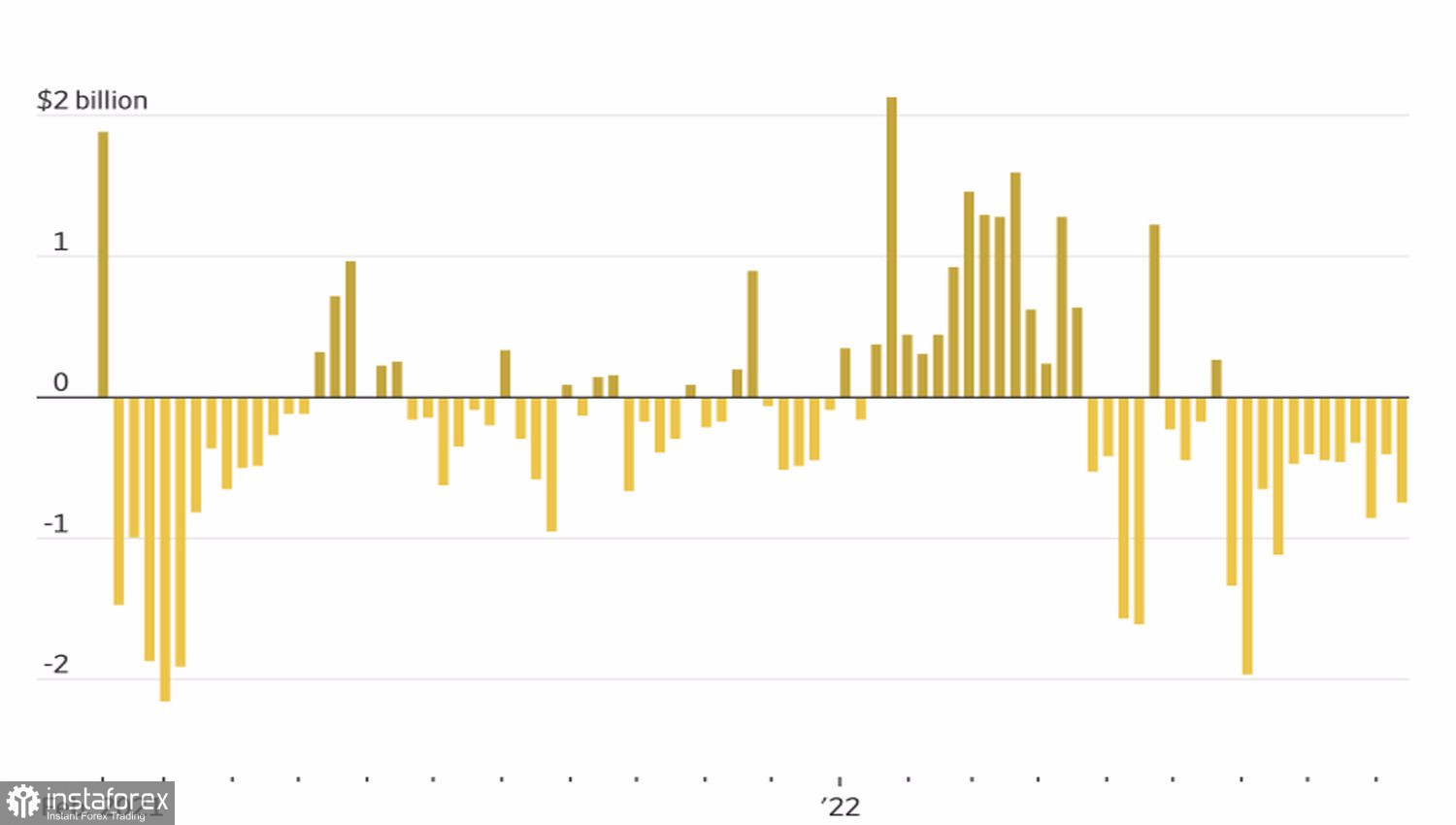

Gold has always been regarded as a tool against inflation. However, its continuous fall since the beginning of the year amid high consumer prices suggested the opposite. Quotes are clearly sensitive to the dynamics of real US Treasury yields, as well as to the fact that rates on 10-year inflation-protected debt have risen above 1%. Additional evidence of the bearish trend is the movement of gold futures, which, although separated from physical gold, is responsive to the dynamics of the global economy and monetary policy. Strong demand in China, accompanied by a 12-week ETF outflow, also contributed to the decline of ETFs to their lowest levels since January.

Capital flows to gold ETFs

The most serious headwind for gold is the increase of dollar recently. Since the metal is denominated in US currency (XAU/USD), the rally is negative for its rate.

Dollar has been rising because of the Treasury yields, which reached their best dynamics lately. This signals a likely increase in federal funds rate, and this is not a favorable environment for the metal.

But considering that investors are already expecting a 75 basis point rate hike this September, there is a chance that the volume of short positions will be little, which will result in a rebound in gold. After all, there are two inside bars in the daily chart, which allows pending orders to buy at $1680 and sell near $1659. The second option is preferable as the target price level is still $1,600. Another target is the 161.8% retracement level.