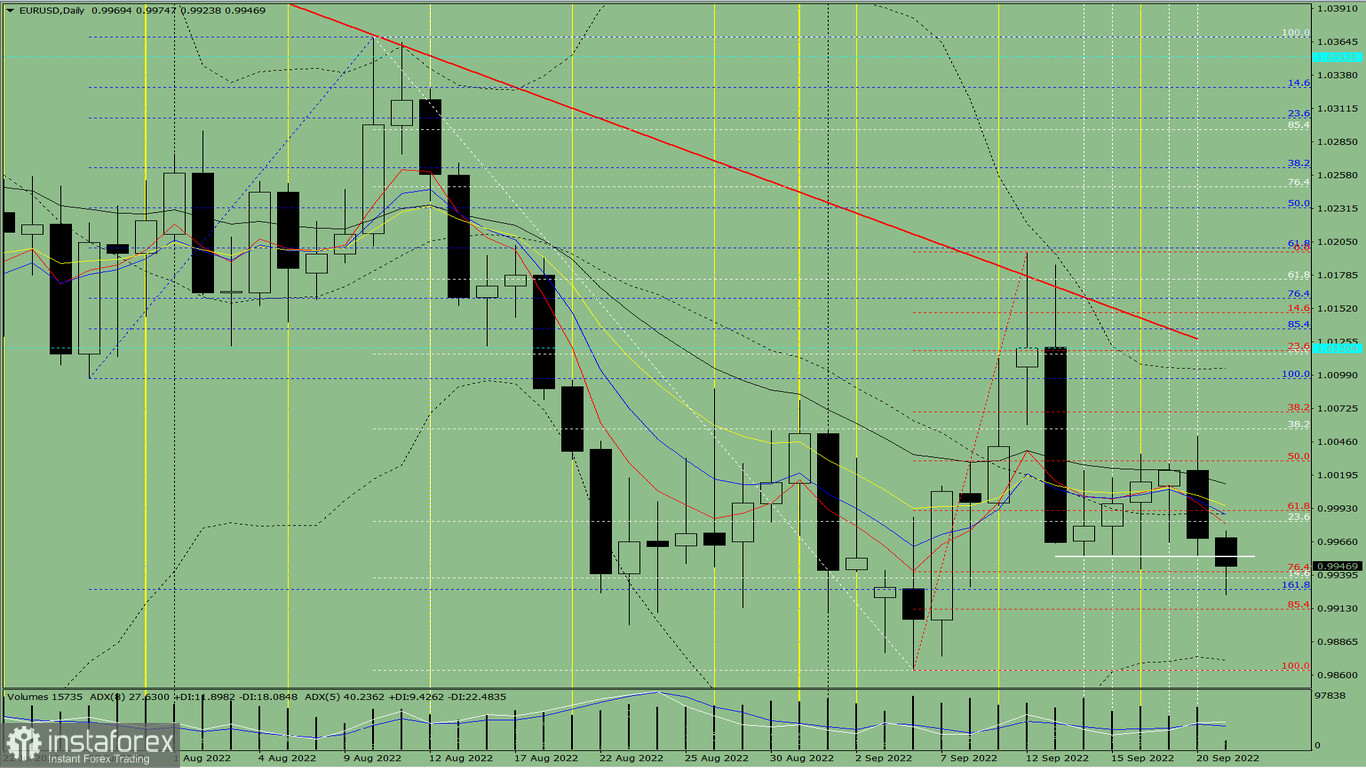

Trend analysis (Fig. 1)

EUR/USD may go down from 0.9969 (closing of yesterday's daily candle) to the 85.4% retracement level at 0.9912 (red dotted line), then bounce up to the 23.6% retracement level at 0.9982 (white dotted line) and to higher price levels. Much will depend on the reaction of the market over the increase in interest rates.

Fig. 1 (daily chart)

Comprehensive analysis:

Indicator analysis - downtrend

Fibonacci levels - downtrend

Volumes - downtrend

Candlestick analysis - downtrend

Trend analysis - downtrend

Bollinger bands - downtrend

Weekly chart - downtrend

Conclusion: EUR/USD will decline from 0.9969 (closing of yesterday's daily candle) to the 85.4% retracement level at 0.9912 (red dotted line), then bounce up to the 23.6% retracement level at 0.9982 (white dotted line) and to higher price levels. Much will depend on the reaction of the market over the increase in interest rates.

Alternatively, the pair could go down from 0.9969 (closing of yesterday's daily candle)to the 161.8% retracement level at 0.9928 (dashed blue line), then bounce up to the 23.6% retracement level at 0.9982 (white dotted line).