Analysis of Wednesday's deals:

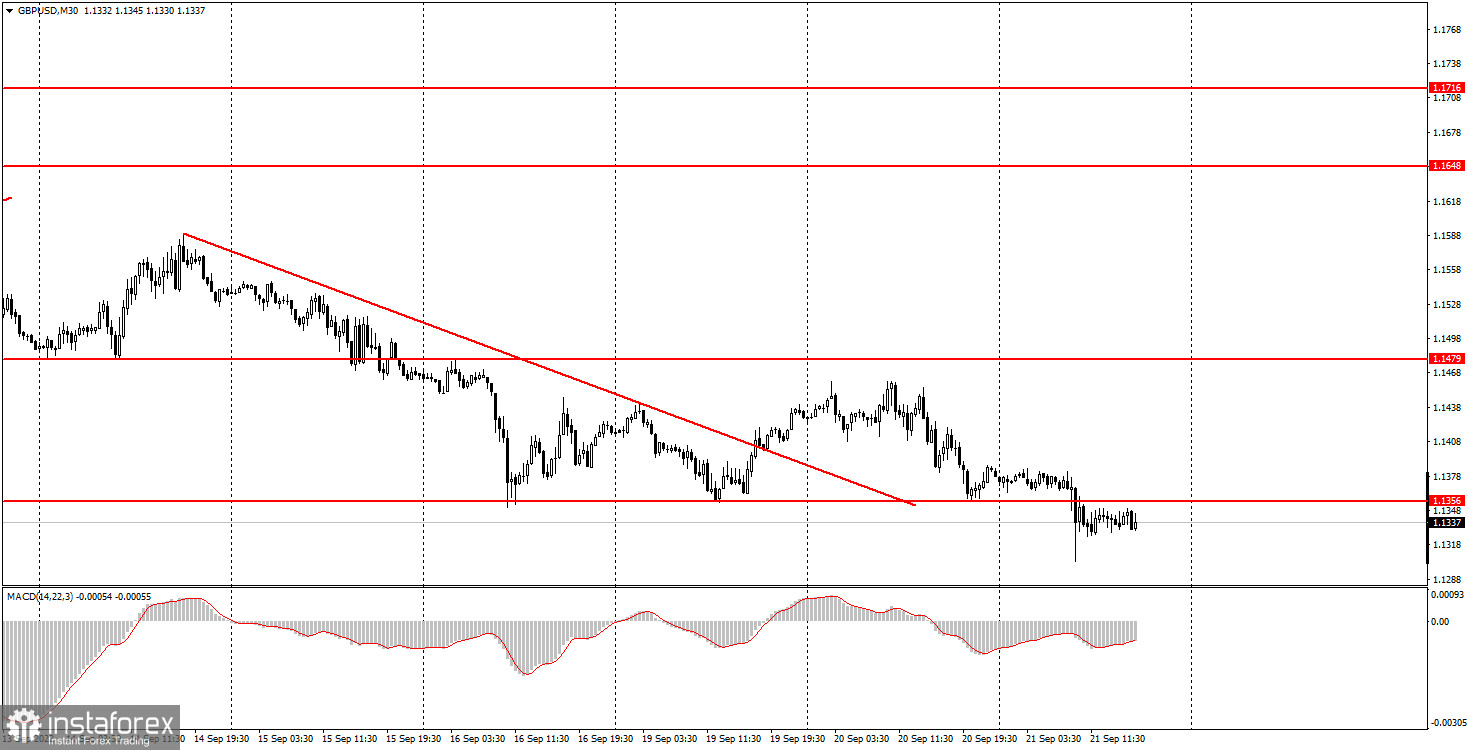

30M chart of the GBP/USD pair

The GBP/USD pair renewed its 37-year lows early on on Wednesday morning, without even waiting for the results of the Federal Reserve or Bank of England meetings, which are scheduled to be announced on Wednesday and Thursday. The news that Russian President Vladimir Putin announced a partial mobilization was perceived by the market as a signal for a new escalation of the conflict in Ukraine. And any geopolitical tension or its growth is a favorable factor for the US currency, which continues to be considered the world's reserve currency. Therefore, the dollar's growth on all fronts does not surprise us at all. The pound's collapse stalled during the day, but how can you say that right now if the currency is at its 37-year lows and cannot even begin an upward correction? The situation for the British pound may worsen. The Fed is likely to raise the key rate, which could trigger a new dollar growth. However, first of all, we would like to note that before the summing up starts, it is better for novice traders to leave the market. In principle, we do not recommend trading in the evenings and at night, and at this time there will also be ultra-important events that can provoke strong movements in different directions.

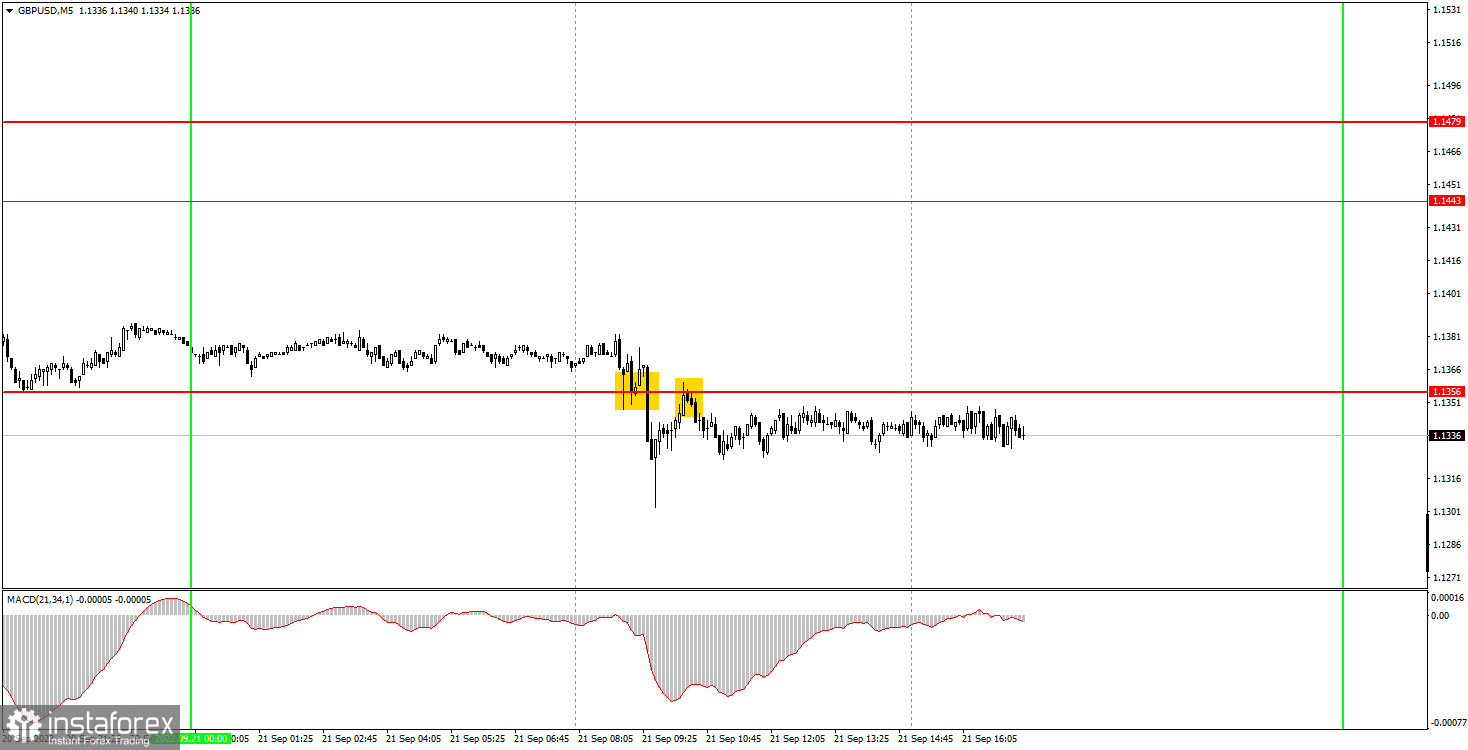

5M chart of the GBP/USD pair

In regards to Wednesday's trading signals on the 5-minute timeframe, the situation was rather weak, but not a failure. There were only two signals. First, the pound quotes settled below the previous local low of 1.1356, and a little later they rebounded from the same level from below. Therefore, beginners could open two short positions today. However, neither the first nor the second brought the desired profit. In the first case, the price went down only 30 points, which allowed us to set Stop Loss to breakeven, but no more. In the second case, the pair went down only 17 points, and at the moment this deal had to be closed manually. Thus, some 15 points could even be earned, despite the fact that most of the day there was an outright flat.

How to trade on Thursday:

The pound/dollar pair continues to fall on the 30-minute TF, which is visible even without a trend line. The geopolitical situation worsened on Wednesday morning, so the pound has new grounds for falling. It makes no sense to predict what will happen next and on Thursday. It is best to wait for the final reaction of the market and then sum up and draw conclusions. On the 5-minute time frame on Thursday, it is recommended to trade at the levels (Wednesday low), 1.1356, 1.1443, 1.1479, 1.1550, 1.1608. When the price passes after opening a position in the right direction for 20 points, Stop Loss should be set to breakeven. The results of the BoE meeting are scheduled for Wednesday in the UK. The market may still work out the results of the Fed meeting in the morning, so Thursday can be a very "fun" day. Movements are expected to be volatile, and the movements of the pair can change dramatically in their direction.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.