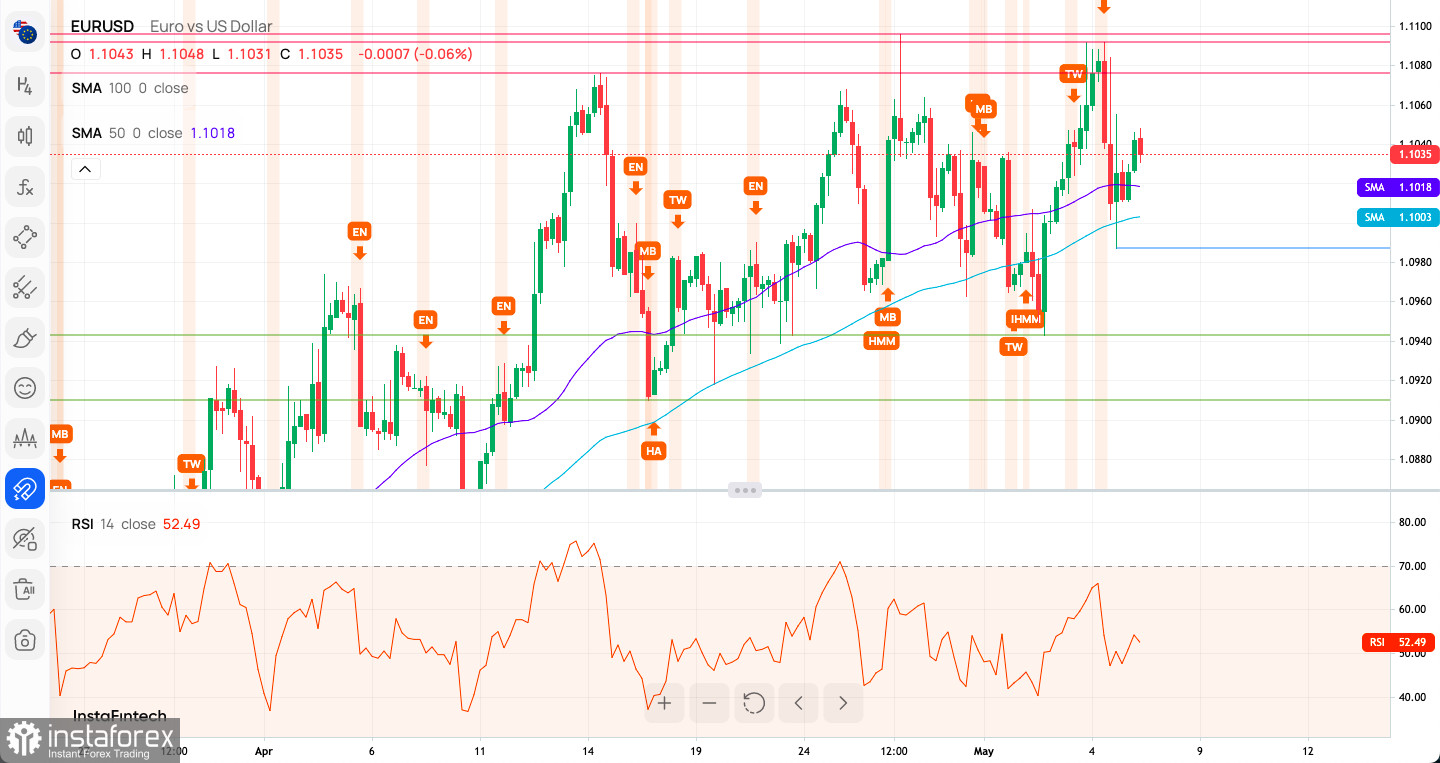

Technical Market Outlook:

The EUR/USD pair has been seen trading close to the last swing high located at 1.1096, so just ahead of the NFP-Payrolls data release the bulls are still in control of this market. The key short-term technical support is seen at the level of 1.0910 and any breakout below this level would be a bearish pressure indication. The momentum is strong and positive on the H4 time frame chart, so the market is ready yet to continue the up trend towards the level of 1.1185 (swing high from 31st March 2022) or even towards 1.1280, which is 61% Fibonacci retracement level of the whole, big wave down that started in January 2021. Please notice, that the short-term up trend is still intact and the key level for bulls is seen at 1.0910 (technical support).

Weekly Pivot Points:

WR3 - 1.13327

WR2 - 1.11829

WR1 - 1.11246

Weekly Pivot - 1.10331

WS1 - 1.09748

WS2 - 1.08833

WS3 - 1.07335

Trading Outlook:

Since the beginning of October 2022 the EUR/USD is in the corrective cycle to the upside, but the main, long-term trend remains bearish. This corrective cycle might had been terminated at the level of 1.2080 which is 61% Fibonacci retracement level. The EUR had made a new multi-decade low at the level of 0.9538, so as long as the USD is being bought all across the board, the down trend will continue towards the new lows.