Details of the economic calendar for September 21

Following the results of the Fed meeting, it was decided to raise the interest rate by 75 basis points, to 3.25%. The actual data coincided with the predicted estimate. The main lever of influence on the market was the speech of Fed Chairman Jerome Powell, during which he clearly pointed out that further tightening of monetary policy is a justified decision.

Key points from Jerome Powell's speech:

- Our goal is to reduce inflation to 2%.

- There is still a risk of further growth of inflation.

- We are determined to reduce the inflation rate and have all the tools for this.

- The labor market is strong. There are many vacancies.

- Since 2021, the country's economy has slowed down.

- The rate of interest rate increase depends on the incoming macroeconomic data.

- For some time, the Fed will still tighten monetary policy.

- At one point or another, it will be appropriate to slow down the pace of rate hikes, we will need a restrictive policy for a while.

The main points of Jerome Powell when communicating with journalists:

- We are still ready to tighten monetary policy due to high inflation.

- The Fed has raised the rate to a level that slows down the economy, there will be a pause sometime.

- I'm not sure there will be a recession.

- Nobody knows if there will be a recession in the United States.

- Commodity prices may have peaked.

- Median - for raising rates by 125 bps until the end of the year (0.75%+0.5%)

- Most Fed officials are in favor of a 100 bps rate hike until the end of the year (0.5%+0.5%).

- To the journalist's question, "Why didn't they immediately raise it by 100 bps now?" Powell replied, "Inflation fell in July, rose in August - we do not want to react to 1 report."

- When asked by a journalist, "Will the US economy withstand such rates?" Powell replied, "The US economy is very strong!".

- A slowdown in the economy could lead to an increase in the unemployment rate in the country.

- There is no painless solution to reduce inflation.

- When asked by a journalist, "How will you understand that you have gone too far with raising the interest rate?" Powell avoided a direct answer saying, "It's difficult ..."

- Commodity prices may have reached their peak.

- Our work will restore price stability. We are working on it.

The press conference ended ahead of schedule.

Conclusion

Based on the speech of the head of the Fed, a clear strategy is visible, in which the main task is to reduce the inflation rate at any cost. For this reason, the US stock market declined, while the US dollar has moved to a strong growth.

Analysis of trading charts from September 21

The EURUSD currency pair managed to stay below 0.9900 on the daily timeframe after 3.5 weeks of walking along this level. This difficult step led to prolonging the long-term downward trend, where the quote again found itself at the levels of 2002.

The GBPUSD currency pair completed a three-day stagnation in the range of 1.1350/1.1450 by breaking its lower border. As a result, a speculative inertial move took place, where the quote was firmly fixed at the levels of 1985.

Economic calendar for September 22

Today the focus is on the meeting of the Bank of England, which is expected to raise interest rates by 50 basis points. An event expected in financial markets, the reaction after raising the rate to 2.25% may well provoke a slight increase in the value of the British currency, but nothing more. If the rate is raised more than the forecast, for example, by 75 basis points, expect big speculation. The pound sterling in the moment can grow by 150–250 points.

At the end of the meeting, it is worth studying the comments and the minutes of the meeting of the Monetary Policy Committee, as it will indicate the future path of the regulator.

During the American trading session, weekly data on jobless claims in the United States will be published, which are assumed to reduce their total volume. This is a positive factor for the US labor market, but since we have the results of the meeting of the BoE, as well as the ongoing information flow, data on applications may be ignored by traders.

Statistics details:

The volume of continuing claims for benefits may come out at the level of 1.403 million.

The volume of initial claims for benefits may decline from 224,000 to 218,000.

Time targeting:

Bank of England Meeting Result – 11:00 UTC

US Jobless Claims – 12:30 UTC

Trading plan for EUR/USD on September 22

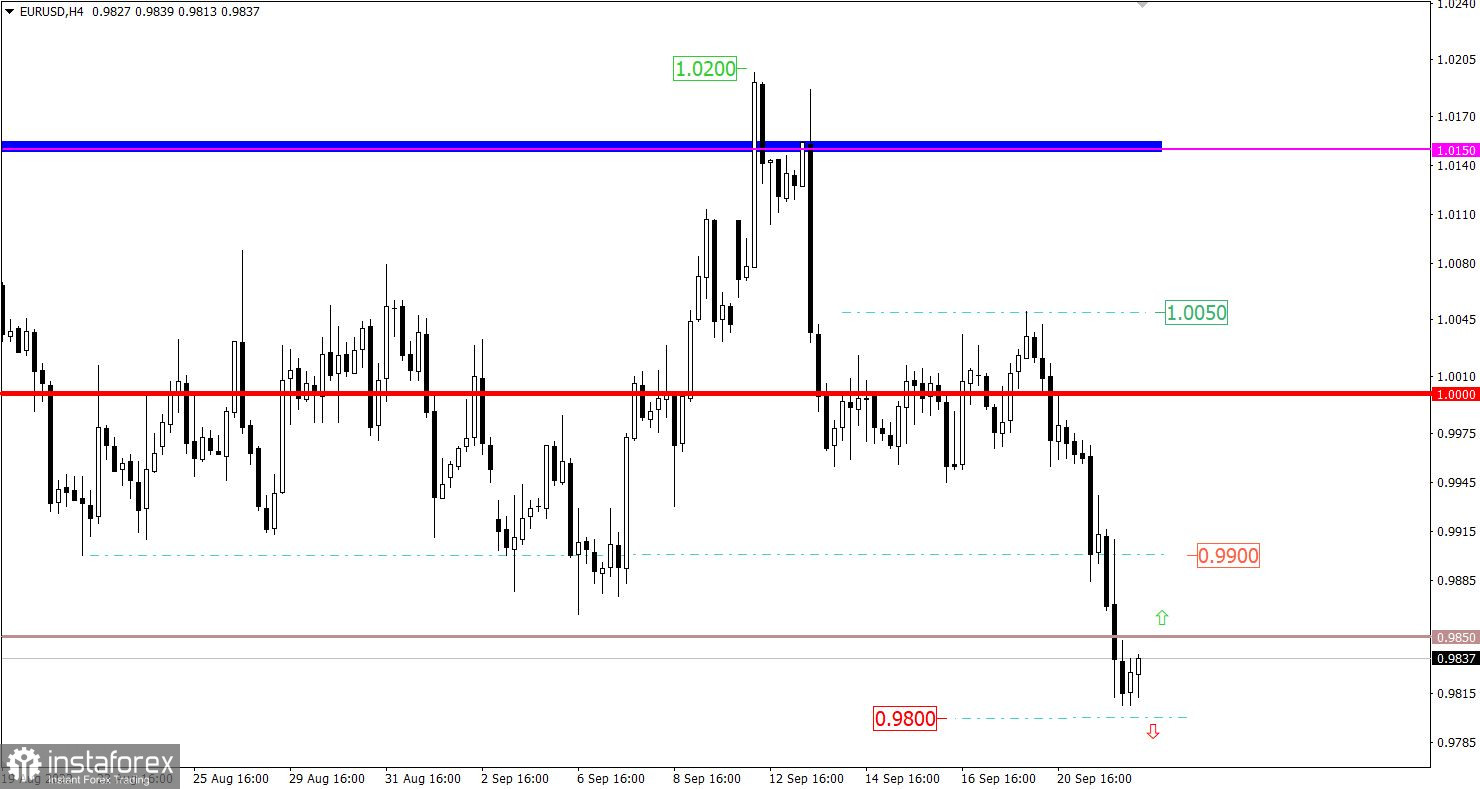

The euro loses more than 200 points in value in just 48 hours. This movement indicates an oversold technical signal, which can lead to a price pullback. If the quote stays above 0.9850, a pullback to the previously passed level of 0.9900 is allowed. An alternative scenario considers the persistence of the current inertial move in the market, where after a short stop with the subsequent holding of the price below 0.9800, further depreciation of the euro is possible.

Trading plan for GBP/USD on September 22

In this situation, there is already a technical signal on the market that the pound sterling is oversold, which in theory, allows the formation of a pullback on the market. From a technical analysis point of view, this is a rational price development scenario, but due to the high level of speculative interest, technical signals can be ignored. In this case, the current inertial move will continue its formation.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.