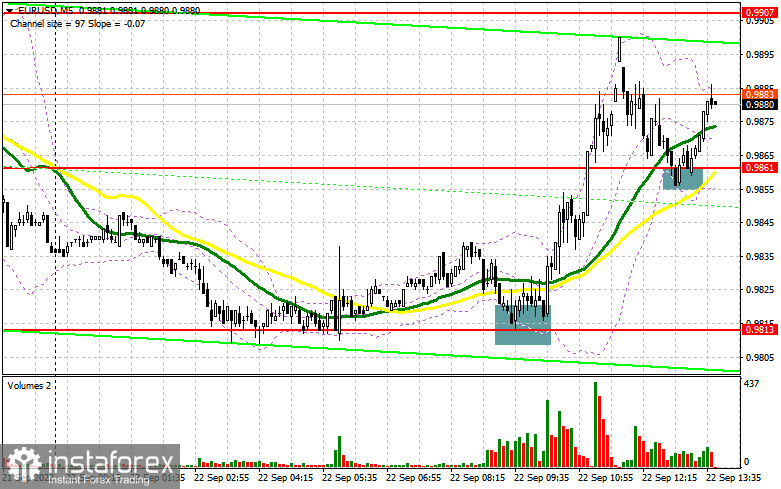

In my morning review, I pointed out two levels of 0.9813 and 0.9861 and recommended entering the market from there. Let's analyze the 5-minute chart and see what happened there. Another attempt by the bears to push the euro lower in the first half of the day had no success. A test and a false breakout of the 0.9813 level generated a buy signal. After that, the pair advanced by 40 pips to the area of 0.9861. Its breakout and a downward retest created an additional signal for opening long positions. At the time of writing, the pair has risen by already 20 pips. The technical picture has changed for the second half of the session.

For long positions on EUR/USD:

The euro buyers resisted the pressure and almost managed to bring the price back to the levels where a big sell-off started yesterday following the announcement of the Fed's rate decision. In the afternoon, traders will need to focus on the US weekly data on initial jobless claims and the current account balance. A weaker US labor market may allow the euro to repeat its upside movement and break above the new resistance of 0.9898. Yet, if you want to open log positions against the trend, it is better to wait for a false breakout of the 0.9847 support level formed in the first half of the day. This is a good moment to enter the market, keeping in mind a possible rise towards 0.9898 and consolidation above this range. Its downward test will generate an additional buy signal, thus paving the way towards 0.9952 where I recommend profit taking. The level of 0.9996 will serve as the highest target. If EUR/USD declines on an upbeat report on the US labor market and bulls stay idle at the level of 0.9847, the pair will rapidly fall to the yearly low of 0.9813. Buying at this level should be done only after a false breakout. In case of a rebound, it is advisable to go long on EUR/USD from the low of 0.9770 or 0.9723, bearing in mind an upside correction of 30-35 pips within the day.

For short positions on EUR/USD:

At the moment, bears are not in a rush to change the situation and are cautiously trading near the yearly lows. The best scenario for going short on the pair will be a false breakout around the nearest support of 0.9898. This will form a sell signal to the downward target of 0.984. At this point, the competition may intensify. A breakout and consolidation below 0.9847 in case of strong US data, as well as an upside retest of this range, will create an additional sell signal with triggered stop-loss orders set by the bulls. If so, the pair may test a yearly low of 0.9813. The price may also go beyond this range but only if there is a political or economic driver. If this happens, then the area of 0.9770 will serve as the next support where I recommend profit taking. If EUR/USD rises in the US session and bears are idle at 0.9898, the pair may perform a rapid jump to the upside. In this case, traders may consider selling the pair only after hitting the level of 0.9952. Its false breakout will act as a new point for opening short positions. Selling the pair right after a rebound is possible from the high of 0.9996 or 1.0040, bearing in mind a downside correction of 30-35 pips.

COT report:

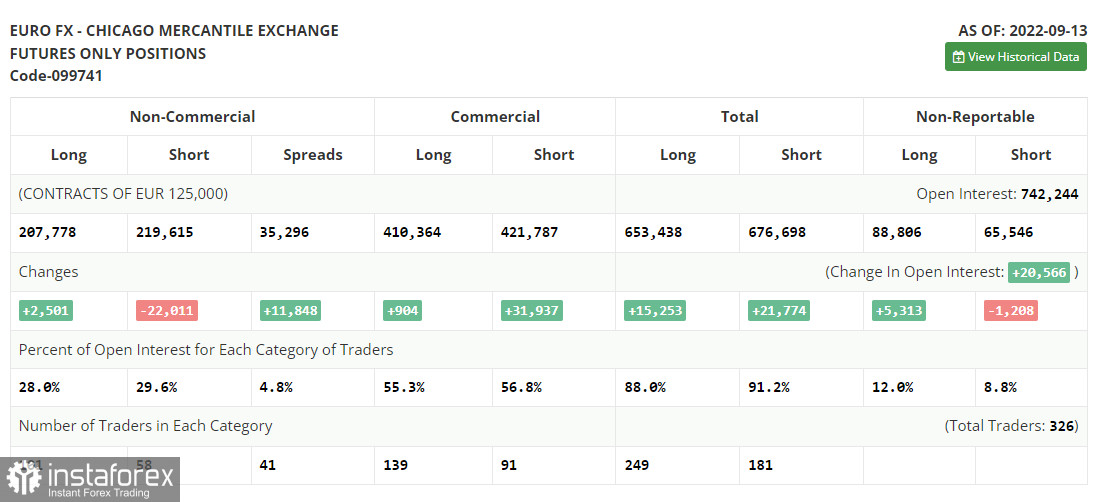

The Commitment of Traders report for September 13 recorded a drop in the short positions and a slight increase in the long ones. This means that the ECB meeting and a rate hike of 0.75% have influenced the market sentiment. Traders preferred to take profit at the current levels even despite the upcoming Fed meeting. The FOMC has raised the rate by another 0.75% this week. So, the speculations that the regulator would hike the rate by a full percentage point turned out to be false. Anyway, another rate hike will support the US dollar and lead to a rapid fall in the European currency. Given the recent inflation data for August, the Fed will continue to tighten its policy. At the same time, the European Central bank is no longer idle. The gap between the ECB's and the Fed's rate policies is gradually narrowing. This is a good factor for long-term investors in the euro who hope that demand for risk assets will soon recover. According to the COT report, long positions of the non-commercial group of traders went up by 2,501 to 207,778, while short positions decreased by 22,011 to 219,615. Last week, the net non-commercial position remained negative but rose slightly to -11,832 from -36,349, indicating the continuation of an upside correction and the fact that the pair has almost hit the bottom. The weekly closing price increased to 0.9980 from 0.9917.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 0.9810 will act as support. If the pair advances, the upper band of the indicator at 0.9900 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.