The US stock indices futures continue losing value after another massive sell-off, which took place on Wednesday. The sell-off was mainly caused by the Fed's announcement to remain stuck to its hawkish policy despite the recession. The S&P 500 futures opened with a decline, but then recouped losses, and now they are inching up. The current price is 20% lower compared to the high recorded in January. The Stoxx Europe 600 index declined by 0.8% amid losses on Wall Street and in Hong Kong.

Yesterday, the Fed gave the clearest signal that it was ready to face a recession to restore control over inflation. Officials signaled a further policy tightening by 1.25 percentage points until the end of the year. Forecasts for future interest rates have also been revised. Thus, interest rates are likely to be raised to 4.5% in the near future. Obviously, the Fed is planning to continue monetary policy tightening. Yesterday, Powell stated that economic growth would be below the trend for a certain period. This could be interpreted as a statement about recession. However, this fact will affect investors only some time later. There are still those who believe that demand for risky assets will rise in the near future. The US is expected to slip into recession next year. Until then, the upward correction in the market is hardly possible. It is likely to return to yearly lows and at the beginning of the next year, it may renew them.

Currencies of developing countries also declined amid the expectations that the Fed will remain stuck to its hawkish approach. Today, the Bank of England is expected to raise the key interest rate for the 7th time in an attempt to combat the highest inflation in several decades. What is more, the Swiss National Bank also raised interest rates by 75 basis points. Norges Bank, which was among the first banks that raised interest rates in September of 2021, once again hiked the key interest rate by 0.5%. However, it hinted that this could be the last hike.

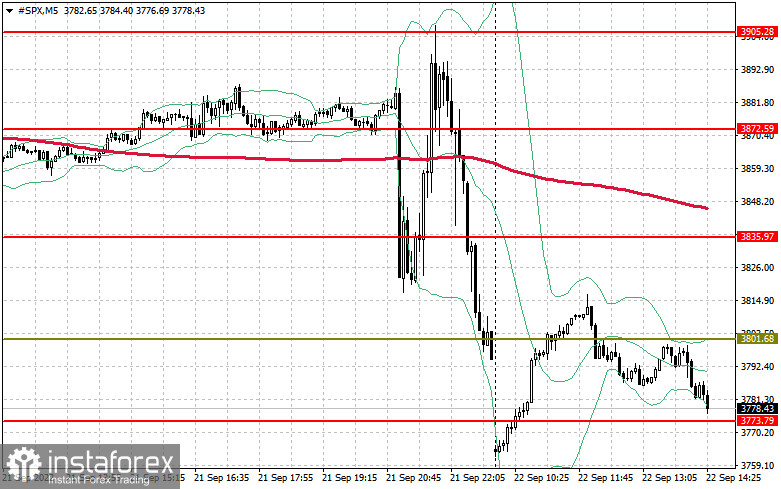

From the technical point of view, the S&P500, after yesterday's sharp collapse, the index will hardly rebound. To build an upward correction in an attempt to find the bottom, bulls need to protect $3,772. Only after that, they will have a chance to break the area of $3,800. The breakdown of this range will support a new upward momentum, which is aimed at the resistance of $3,835. The farthest target is $3,870. In case of a downward movement, a breakout of $3,772 will quickly push the trading instrument to $3,744 and open up the possibility to reach the support of $3,704. Below this range, traders may expect a larger sell-off of the index. In this case, the asset may slide to the lows of $3,677 and $3,643, where the pressure may ease slightly.