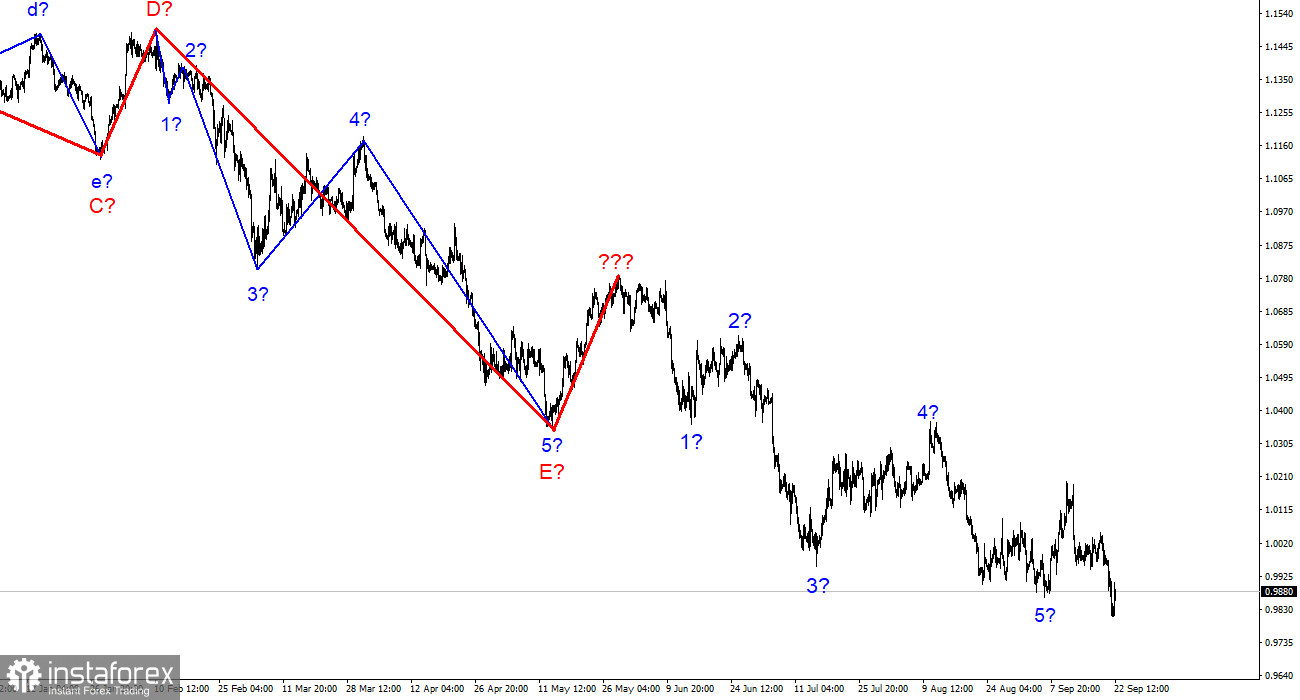

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. Given the rather strong increase in the quotes of the euro currency, it can be assumed that wave five has completed its construction since it is unlikely that the rising wave of the last week is part of wave 5. Thus, the working option is the end of a long downward trend and the beginning of a new, ascending, at least corrective, at least three waves. Since the European currency still does not show strong growth, I cannot say that there will be no more decline in demand for this currency in the near future. The option of constructing a correction section and further resuming the downward one is not excluded at all. The option of complicating the entire downward section of the trend is not excluded, which, in this case, will take an even more extended form. The news background for the markets remains one of the key factors, so if it gets worse, the demand for the euro may start to fall again. And it can be worse, which was perfectly shown to us last Tuesday and the current Wednesday. The wave marking indicates that the market is ready to build at least three waves.

The FOMC meeting only led to a new fall in the euro

The euro/dollar instrument fell by 135 basis points on Wednesday, and today it has increased by 50. Yesterday's decline in the European currency could have been avoided if not for the rhetoric of Jerome Powell after the Fed announced the results of the meeting. The interest rate increased by another 75 basis points, which did not surprise the market. However, the rhetoric of the Fed president, who said that new monetary policy tightening would be required in 2022 and hinted at an increase of another 125 points, did its job. As I said, the decision to raise the rate by another 75 points was already made by the markets, and, most likely, without Powell's new "hawkish" statements, the euro currency would have started to grow yesterday. However, Powell signaled to the market that inflation is falling too slowly, which means that the regulator will have to put additional pressure on this indicator and, simultaneously, the economy.

Markets are not too concerned about the state of the American economy yet. The recession in America has already begun. It will begin both in the European Union and in the UK. But the demand is growing only for the US dollar, so I can't say that the American recession is scaring the market. But the prospect of an even greater interest rate increase works for him like a red rag on a bull. The instrument dropped below the low of the expected wave five yesterday. Thus, there are already all the necessary grounds to believe that the downtrend will become even more complicated. However, there is still hope that the construction of a new upward wave will begin from the current positions, which may be 3 or c as part of the correction section of the trend.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is not completed with a probability of 100%. Sales should be abandoned for a while since we have five waves down now, and the tool can now build a corrective set of waves. You can try since the probability of building an upward wave is still high now. To do this, use the MACD signals "up" with targets near the 2 figures.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three-and five-wave standard structures from the overall picture and work on them. One of these five waves can be completed right now.